-

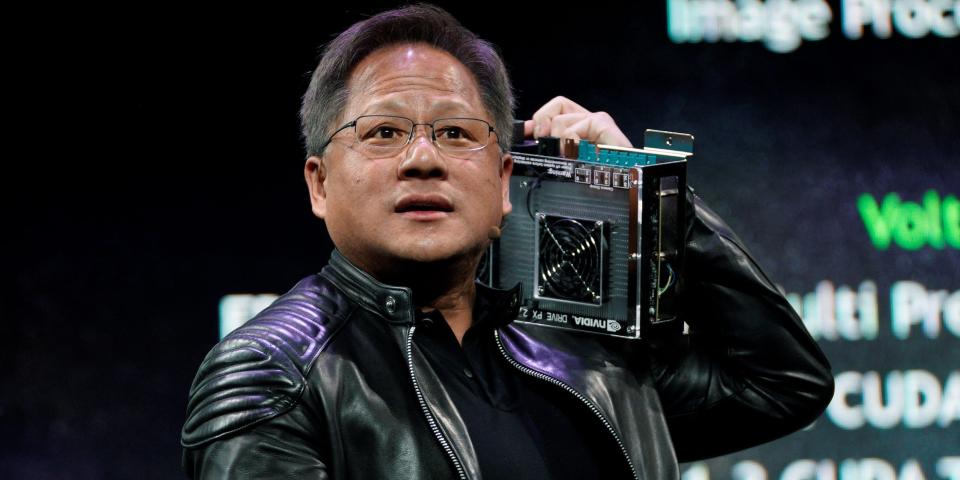

Nvidia is among the largest beneficiaries of the AI race that’s beginning to warmth up, in response to Financial institution of America.

-

The financial institution stated Nvidia gives buyers publicity to the AI market like picks and shovels did in the course of the gold rush.

-

Nvidia gives a turnkey mannequin “which is what we consider can allow NVDA to take care of and presumably broaden its AI market share,” BofA stated.

As an alternative of attempting to choose a winner within the synthetic intelligence race, why not simply purchase the corporate that might be supplying all AI rivals with the mandatory {hardware}?

That is the concept behind a latest notice from Financial institution of America, which stated Nvidia is properly positioned to monetize the AI race that is heating up between Microsoft and Alphabet — regardless of which firm finally reigns supreme.

Nvidia is the “picks and shovels chief within the AI gold rush,” BofA stated, referencing the concept retailers who bought provides in the course of the 1850s gold rush did higher than the precise gold miners.

Nvidia sells AI accelerator graphics processing items, which assist energy the massive language fashions which can be behind the conversational AI chatbots like ChatGPT and Bard.

In response to the notice, the overall addressable marketplace for these chips might develop to $60 billion by 2027, and Nvidia at present dominates about 75% of the market.

The semiconductor firm’s H100 accelerator has surged in demand in latest months, a lot so that they are at present promoting on eBay for upwards of $45,000 per chip.

And whereas the shortage of Nvidia’s extremely wanted H100 chip is sure to convey extra rivals to the market, Nvidia is properly positioned to fend off potential market share grabbers.

“We remind buyers that success in AI requires full-stack computing and scale/expertise throughout silicon, software program, utility libraries, builders plus enterprise and public cloud incumbency. In different phrases, it is a 10+ yr well-honed turnkey mannequin versus piecemeal silicon-only options from many rivals,” BofA stated.

That is why the financial institution believes Nvidia can “preserve and presumably broaden its AI market share.”

BofA referred to as Nvidia a “prime decide” and really useful buyers purchase the inventory, reiterating its $340 value goal, which represents potential upside of 19% from present ranges.

Learn the unique article on Enterprise Insider