Whereas synthetic intelligence (AI) is broadly thought of a software program program, it requires {hardware} to develop and energy it. This results in traders on the lookout for “pick-and-shovel” model investments, as these firms promote the instruments wanted to energy these processes (just like what number of companies bought picks and shovels to gold miners throughout the varied gold rushes all through U.S. historical past).

Two of the highest “pick-and-shovel” performs within the AI market are Nvidia (NASDAQ: NVDA) and Tremendous Micro Pc (NASDAQ: SMCI). Each shares have been rocket ships because the begin of 2023, with Nvidia and Tremendous Micro Pc’s (usually known as Supermicro) shares up 437% and 1,000%, respectively.

However which one is the higher purchase now? Let’s discover out.

Nvidia and Tremendous Micro Pc are complementary companies

Whereas each firms could possibly be thought of “pick-and-shovel” investments, in actuality, Nvidia makes the shovel and decide heads, whereas Supermicro assembles the instruments and sells them to finish customers.

Nvidia makes the graphics processing models (GPUs) to deal with the advanced workloads that AI fashions require. These {hardware} items have been round for a very long time and had been initially used to course of gaming graphics, however have since expanded their utilization to engineering simulations, drug discovery, and AI mannequin coaching.

When firms need to construct a supercomputer to harness the facility of knowledge via AI, they do not simply purchase one or two GPUs; they purchase a whole lot or hundreds. To get essentially the most use out of them, they have to even be strategically positioned and related to a server, which is the place Supermicro is available in.

Supermicro builds these servers for shoppers and presents extremely configurable fashions that may be tailor-made to end-use and computing energy expectations. They work carefully with Nvidia to make sure they’re squeezing each ounce of efficiency out of their servers, which advantages customers in the long term.

However as to which makes extra sense to put money into, there is a clear alternative.

Nvidia is the superior funding at these costs

Supermicro is closely depending on Nvidia for enterprise. If Nvidia chooses to satisfy GPU orders to different shoppers or the connection sours, Supermicro’s enterprise can be crushed. These two firms have been companions for some time, so I do not see this taking place, however it’s one thing to remember.

Moreover, Supermicro has fierce competitors from different server builders like Hewlett-Packard and IBM, whereas Nvidia’s AI GPUs are in a category of their very own.

This closely skews the bias towards Nvidia, however one other issue can be at play.

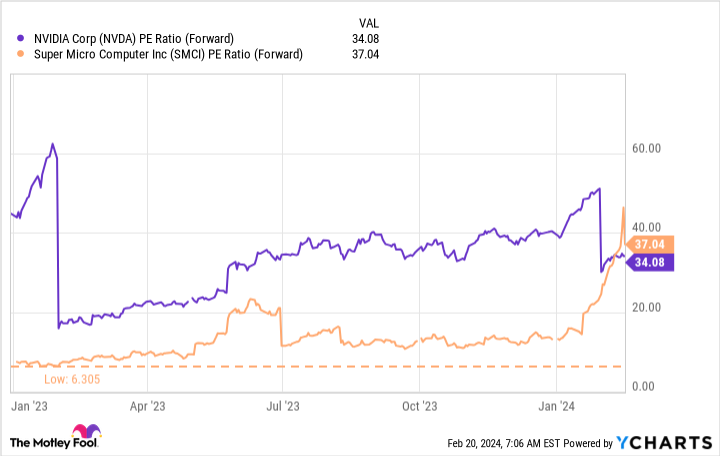

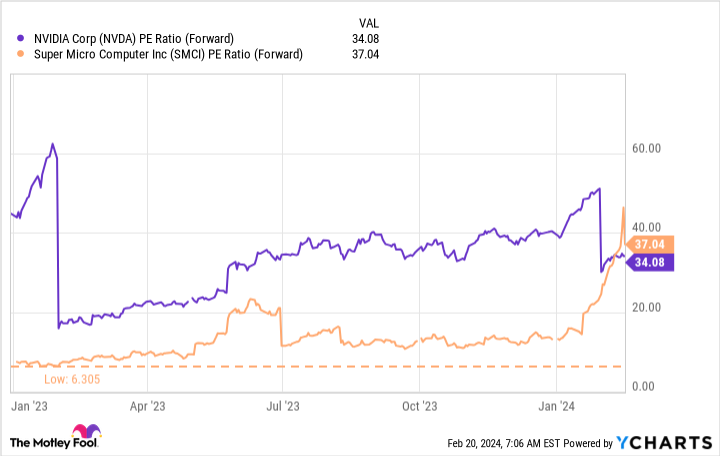

Each shares had been undervalued coming into 2023, however Supermicro’s inventory was unbelievably low-cost at simply over six occasions ahead earnings.

That is why Supermicro has outperformed Nvidia’s inventory over the previous yr, however that may probably cease quickly. Now that Supermicro is costlier than Nvidia, shopping for it would not make a ton of sense, particularly in the event that they’re rising on the identical tempo.

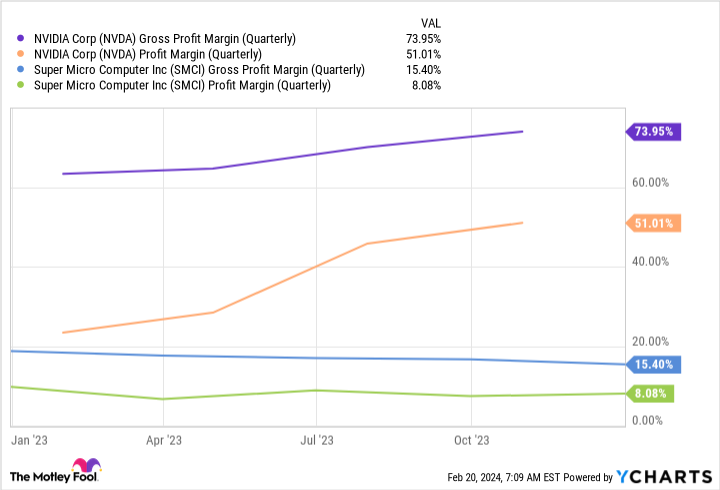

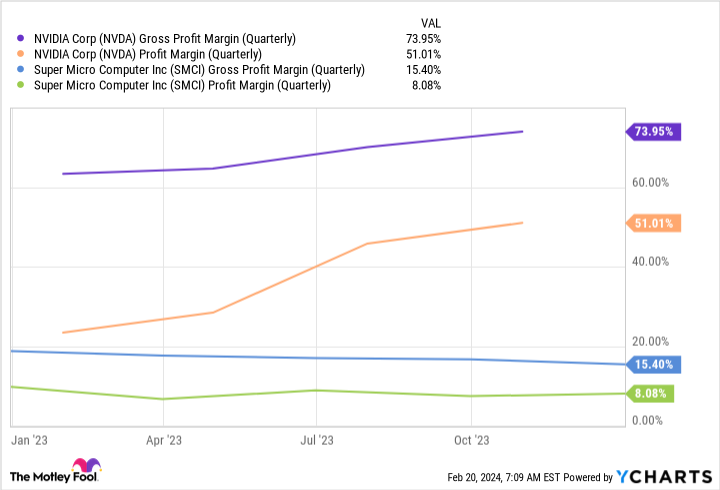

Nvidia’s enterprise mannequin is way superior as a result of it controls the first product, giving it a bonus when assessing revenue margins.

Nvidia is way extra worthwhile than Supermicro, and if you happen to give me a alternative between two shares which can be evenly priced and rising across the identical tempo, then I will select the extra worthwhile one each single time.

Whereas each firms will succeed because the AI buildout continues, I am extra enthusiastic about Nvidia as a consequence of its superior margins and management over the first product. Tremendous Micro Pc could also be a stable firm to put money into, however you are higher off choosing Nvidia at these costs.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 finest shares for traders to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 20, 2024

Keithen Drury has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot recommends Tremendous Micro Pc. The Motley Idiot has a disclosure coverage.

Higher AI Inventory: Nvidia or Tremendous Micro Pc? was initially printed by The Motley Idiot