-

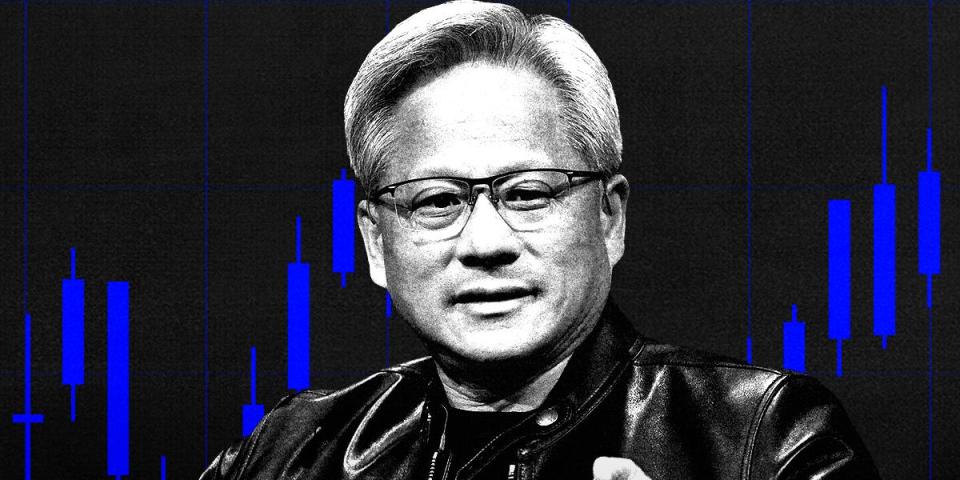

Buyers continued to promote Nvidia inventory, sending the chipmaker 4% decrease on Friday.

-

Shares are on monitor to finish the week 14% decrease amid information of an antitrust probe.

-

The inventory is flirting with $100 a share, a key technical threshold watched by analysts.

Nvidia inventory prolonged its post-earnings decline on Friday, with shares of the chip maker flirting with a key technical stage amid a wider tech sell-off within the session.

Nvidia shares slid over 4.5% on Friday, buying and selling round $102.15 a share. That places the inventory near a key psychological threshold of $100 a share and its 200-day shifting common just under $90.

Merchants are eyeing these ranges for indicators that the chip titan’s blistering rally could also be fading, analysts informed Enterprise Insider this week. Wall Avenue, although, typically stays bullish on the outlook for the inventory, of which analysts have projected a mean worth goal of $153 a share, based on Nasdaq information.

Buyers have been cautious on Nvidia inventory because the firm posted second-quarter financials that beat earnings estimates however not fairly sufficient to fulfill the loftiest expectations.

The inventory staged a small restoration earlier this week, however continued its steep sell-off after a report from Bloomberg that mentioned the Division of Justice was probing the corporate over antitrust considerations.

“Whereas each case is totally different, we additionally spotlight the plethora of govt. instances ongoing towards different giant US tech corporations during the last a number of years. Till we’ve extra particulars, we assume no particular materials affect on NVDA’s elementary alternative,” Financial institution of America strategists mentioned in a word, reiterating their “purchase” score on the inventory.

Nvidia has misplaced round $500 million in market worth from ranges in early June, with the agency being valued at $2.53 trillion on Friday. The inventory is on monitor to finish the week 14% decrease, although shares are nonetheless up 111% from ranges initially of the 12 months.

The slide on Friday got here amid a bigger decline in tech, with the Nasdaq Composite down 2.5% at 2:00 p.m. ET. Buyers have been fleeing high-flying development names after the August jobs report was weaker than anticipated, sparking new fears about an financial slowdown.

Learn the unique article on Enterprise Insider