-

Financial institution of America analysts raised their value goal for Nvidia inventory to $190 a share this week.

-

They see the AI market rising to $400 billion, giving Nvidia a “generational alternative.”

-

They level to Nvidia’s sturdy lead amongst rivals, helped by its enterprise partnerships.

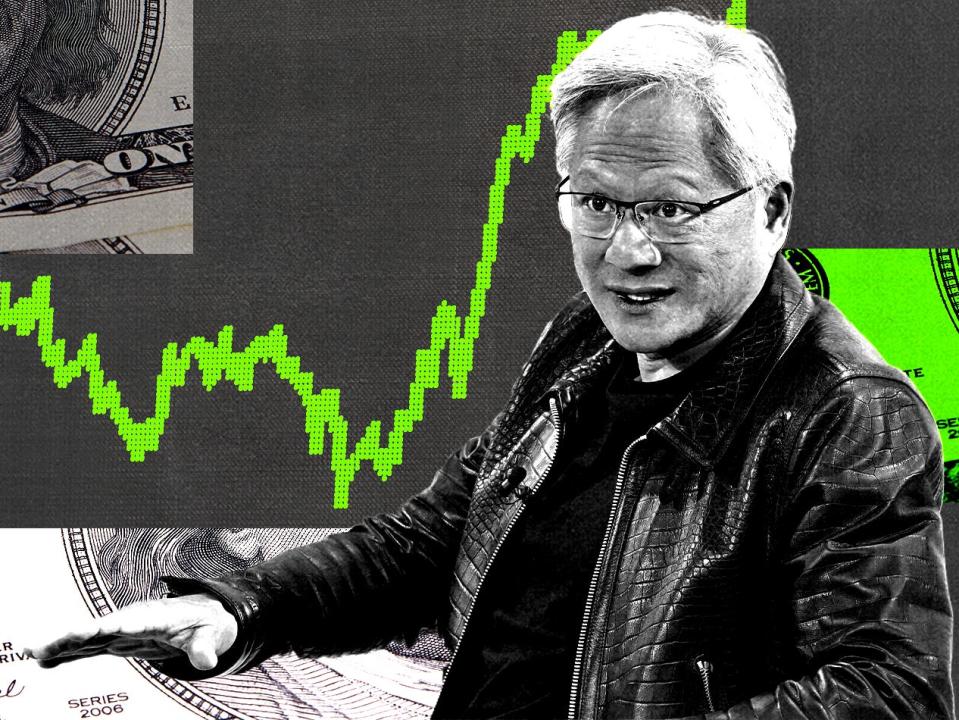

Nvidia inventory has been on a tear all 12 months, however buyers can brace for much more good points forward, Financial institution of America analysts say.

In a Thursday observe, the analysts raised their value goal on the inventory from $165 to $190. That means a 38% upside from its value of about $138 a share at noon on Friday.

The analysts level to exponential development within the AI market within the coming years, which they are saying will give Nvidia a “generational alternative” because the chip titan continues to strengthen its lead available in the market.

The analysts see the AI accelerator market rising to $280 billion by 2027, and towards upwards of $400 billion over time — marking large development from $45 billion in 2023.

As AI fashions proceed to develop quickly—with builders like OpenAI, Google, and Meta launching new giant language fashions a number of occasions per 12 months—the necessity for computing will solely develop, the analysts predict.

Every new main LLM technology, particularly these developed for bigger measurement and higher reasoning capabilities, would require higher coaching depth, they add.

“We proceed to see the tempo of recent mannequin improvement improve. LLMs particularly are being developed for each bigger measurement and higher reasoning capabilities, which each require higher coaching depth,” the analysts mentioned.

In addition they level to Nvidia’s sturdy partnerships with enterprise clients like Accenture, ServiceNow, Oracle, and others, which present the rising presence of AI at huge corporations and Nvidia’s position as accomplice of selection.

“NVDA’s engagements span a number of verticals (e.g., Accenture, ServiceNow, Microsoft), and choices comparable to AI Foundry, AI Hubs, NIMs are key levers to its AI management, not solely on the {hardware} facet but in addition on techniques/ecosystems facet,” the analysts mentioned.

The analysts additionally mentioned Nvidia’s financials are arrange nicely for future good points. Given its free money move technology at 45%-50% margins, which is sort of double that of different Magnificent 7 shares, Nvidia will have the ability to generate $200 billion in free money move over the following two years, they wrote.

Nvidia’s inventory has skyrocketed this 12 months, up 187% as AI continues to growth after a quick sell-off over the summer time. The sector has since recovered, with chip shares like Nvidia and TSMC buying and selling at or close to all-time highs in latest weeks.

Learn the unique article on Enterprise Insider