Synthetic Intelligence (AI) prodigy Nvidia (NVDA), the world’s third-highest-valued inventory, skilled a cloth decline in market capitalization following its Q2 earnings in late August. Nonetheless, NVDA inventory has proven some vigor once more, rising 5% within the final week. After briefly surpassing the $3 trillion milestone earlier this yr, buyers are questioning what the long run will maintain. My thesis stays unchanged — I’m bullish on NVDA shares as an funding as a consequence of its clear AI supremacy and exponential progress potential.

NVDA’s Lengthy-Time period AI-Pushed Progress Trajectory Stays Intact

It’s well-known that NVDA is positioned for an extended runway of progress with top-notch purchasers like Microsoft (MSFT), Alphabet (GOOGL), Meta (META), and Amazon (AMZN) bulking up on their AI efforts. Nonetheless, past these main clients, Nvidia’s AI penetration remains to be rising throughout all industries, rising my optimism for NVDA inventory. Enterprises throughout industries and geographies are keen to include AI advantages into their operations. Likewise, NVDA continues to enter into collaborations with high companies.

There’s a cause enterprises are flocking to NVDA for his or her AI ambitions. Past being the chief in AI GPU processors, NVDA offers a whole end-to-end AI infrastructure that supercharges productiveness. That’s one thing that few, if any, of its international AI friends can ship.

NVDA Stays a One-Cease AI Powerhouse with Margin Progress

One more reason for my optimism about NVDA is CEO Jensen Huang‘s relentless focus. He’s dedicated to reworking NVDA into a completely AI-driven information heart powerhouse that covers all features of {hardware} and software program underneath the NVDA model.

This technique is a key cause why NVDA can keep premium pricing for its merchandise, contributing to regular progress in its revenue margins. Nonetheless, critics argue that NVDA’s distinctive income and margin progress is probably not sustainable. Some members of the funding neighborhood are frightened a couple of slowdown in income progress over the approaching years.

For context, NVDA reported a rare 217% enhance in its information heart revenues for fiscal 2024. Whereas that progress is anticipated to average to round 130% in 2025, this stays a formidable triple-digit determine, particularly contemplating the sturdy FY2024 baseline for comparability. Though decrease than at present’s tempo, these are nonetheless exceptional progress projections for the long run. I view bullish analyst estimates as a cause to stay assured on this AI chief, significantly because the disruptive potential of generative AI is simply starting to unfold.

Demand for NVDA’s chips is strong and can enhance future revenues within the coming quarters. Due to this fact, regardless of some investor considerations, I count on NVDA will proceed to take care of its clear AI dominance with an unbeatable aggressive moat and best-in-class AI services.

A Dialogue of Nvidia’s Spectacular Quarterly Earnings

Nvidia posted one more stellar Q2 outcome on August 28, 2024, pushed by accelerated computing and the continued momentum of generative AI. Adjusted earnings of $0.68 per share handily beat the consensus analyst estimate of $0.65 per share. The determine got here in a lot increased (+152%) than the Fiscal Q2-2023 determine of $0.27 per share.

The corporate posted a 122% year-over-year income progress, delivering $30.04 billion for the three months ending July 31 and surpassing analysts’ projections. Importantly, Knowledge Heart revenues, the corporate’s crown-jewel division, grew 154% year-over-year to $26.3 billion. Moreover NVDA’s adjusted gross margin expanded 5 proportion factors to 75.1% from 70.1% a yr in the past. Many buyers have been apparently hoping for even larger numbers, and subsequently the inventory dropped barely following the Q2 report. Shares then continued a downtrend till they bottomed out on September 6, simply above the $100 degree.

Nvidia’s steerage for the third quarter appeared much less promising to buyers, with revenues anticipated to achieve about $32.5 billion. Steerage got here in under expectations. Adjusted gross margins are forecast to degree off at about 75%, versus 75.15% delivered in Q2.

NVDA’s Insider Promoting Issues are Over

Insider promoting at Nvidia added downward strain on NVDA shares in current months. CEO Jensen Huang offered NVDA shares throughout a number of transactions from June to September, but it surely’s necessary to know that these gross sales have been a part of a predetermined buying and selling plan adopted in March. This plan allowed Huang to promote as much as six million NVDA shares by the top of Q1 2025.

Notably, Huang has accomplished gross sales of greater than $700 million value of NVDA inventory. Regardless of the importance of those gross sales, he stays the most important particular person shareholder of the corporate. Eventually report, Huang held 786 million shares via numerous trusts and partnerships, and 75.3 million shares instantly, based on firm filings. Mixed, Huang controls a ~3.5% stake within the firm, with an approximate whole of 859 million shares.

NVDA Valuation Isn’t Costly, Given Its Earnings Progress Prowess

Buyers could have been hesitant to purchase NVDA inventory at present ranges, pointing to the inventory’s extraordinary run in addition to as a consequence of considerations concerning the firm’s and slowing progress.

Quite the opposite, nonetheless, my competition is that NVDA inventory shouldn’t be as costly as it might appear. At present, it’s buying and selling at a ahead P/E ratio of about 43x (based mostly on FY2025 earnings expectations). That is really cheaper than some valuation multiples of its friends. For example, NVDA’s closest competitor and U.S.-based semiconductor firm, Superior Micro Units, carries a 46.8x ahead P/E. Apparently, NVDA’s present valuation nonetheless displays a ten% low cost to its five-year common ahead P/E of 47.3x.

Given NVDA’s constant outperformance and robust progress potential, the present valuation seems affordable and justified. Any future dip within the inventory worth might symbolize a strong shopping for alternative, in my view, particularly contemplating Nvidia’s immense potential within the quickly increasing AI market.

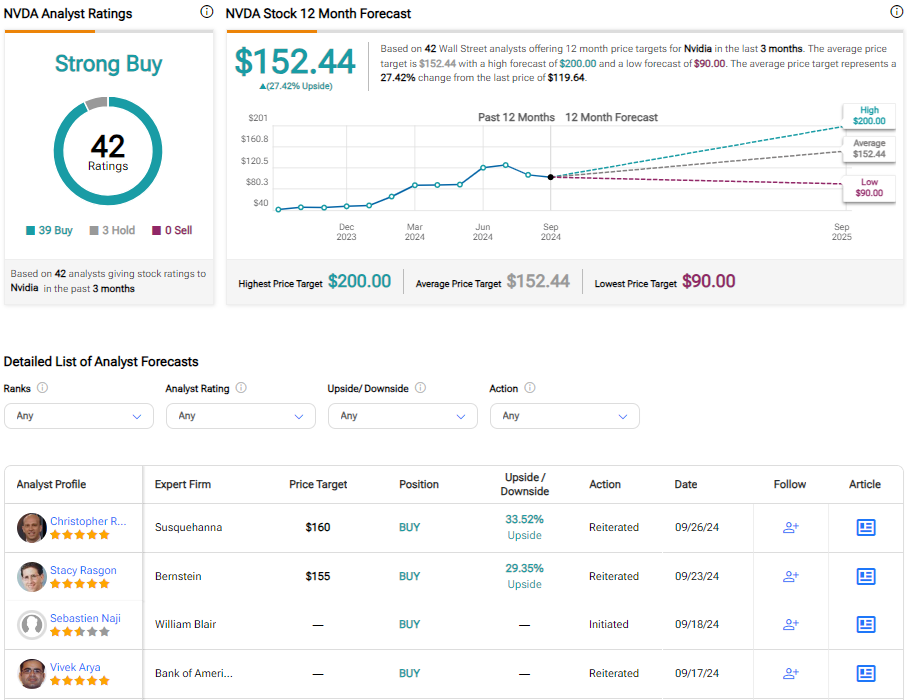

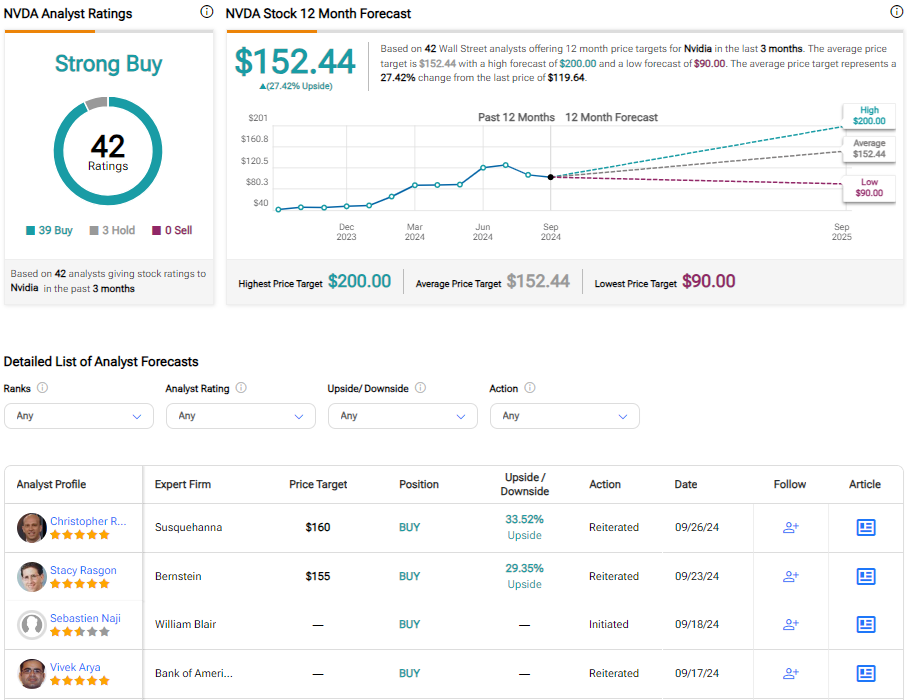

Is NVDA Inventory a Purchase or Promote, In response to Analysts?

With 39 Buys and three Maintain rankings from analysts within the final three months, the consensus TipRanks score is a Sturdy Purchase. The common Nvidia inventory goal worth of $152.44 implies potential upside of about 26% for the following yr.

Conclusion: Contemplate NVDA Inventory for Its Lengthy-Time period AI Potential

Regardless of current weak spot, NVDA shares have almost tripled over the previous yr in comparison with an increase of about 37% for the Nasdaq 100. The post-earnings sell-off for NVDA inventory, for my part, was largely pushed by profit-taking. After bottoming close to $100, the inventory seems to be in restoration mode now.

Within the close to time period, I consider ongoing financial and political uncertainties could preserve the inventory range-bound. Nonetheless, I view any dips as shopping for alternatives. I see NVDA as a powerful long-term funding given the numerous continued potential of AI.

Learn full Disclosure