Nvidia (NVDA) is a big in information facilities and gaming, however semiconductor firms are bracing for a bumpy 2023. Is Nvidia inventory a purchase proper now?

X

Semiconductor Information

Chipmakers broadly face a number of challenges, from excessive inflation, weak international development and the Russia-Ukraine struggle to more and more fraught U.S.-China relations.

Lately, World Semiconductor Commerce Statistics predicted that chip gross sales will decline 4.1% in 2023. Chip gross sales rose 26.2% in 2021 and 4.4% in 2022.

For these on the lookout for high large-cap shares to purchase now, this is a deep dive into NVDA inventory.

Nvidia Inventory Technical Evaluation

Shares of Nvidia popped 6.4% to 178.39 on Jan. 20, extending a latest rally above the 50- and 200-day shifting averages. NVDA inventory has surged 20.7% thus far in 2023, one of many Nasdaq 100’s high performers.

NVDA inventory has shaped a cup base inside a bigger consolidation with a purchase level of 188. The chip inventory crashed in 2022 and stays greater than 38% beneath its 52-week excessive. Nevertheless, Nvidia inventory is properly off October 2022 lows.

NVDA earns an IBD Composite Score of 69. In different phrases, Nvidia inventory has outperformed 69% of all different shares in IBD’s database by way of mixed technical and elementary metrics.

Buyers usually ought to concentrate on shares with Comp Rankings of 90 and even 95 and above. Although it falls wanting that threshold now, NVDA can typically be discovered on the IBD Leaderboard, IBD 50, Huge Cap 20 and Sector Leaders lists.

The relative power line for NVDA inventory is enhancing after a plunge in 2022, already proper at consolidation highs, a bullish signal.

The RS line indicator rallied strongly from mid-2019 to late 2021, IBD MarketSmith charts present. A rising RS line signifies that a inventory is outperforming the S&P 500 index. It’s the blue line within the chart proven.

The IBD Inventory Checkup instrument exhibits that Nvidia inventory carries a Relative Energy Score of 81, which means it has outperformed 81% of all shares in IBD’s database over the previous yr.

The iShares PHLX Semiconductor ETF (SOXX) holds each Nvidia and AMD inventory.

IBD Stay: A New Device For Every day Inventory Market Evaluation

Nvidia Earnings

Nvidia’s EPS Score is 60 out of 99 and its SMR Score is a B, on a scale of A to a worst E. The EPS score compares an organization’s earnings development to different shares. Its SMR Score gauges gross sales development, revenue margins and return on fairness.

In November 2022, Nvidia missed Wall Road’s earnings goal on higher-than-expected gross sales for its fiscal third quarter, ended Oct. 30.

The Santa Clara, Calif.-based firm earned 58 cents a share, down 50% vs. a yr earlier. Gross sales slid 17% to $5.93 billion. It marked the second straight quarter of earnings declines.

Nvidia is about to report fiscal fourth-quarter earnings on Feb. 22. Analysts polled by FactSet count on Nvidia earnings to slip 39% for the quarter. They venture count on NVDA earnings will fall 26% for the total yr on principally flat gross sales.

In fiscal 2024 beginning Feb. 1, Wall Road count on Nvidia earnings to rebound almost 33% per share, however nonetheless barely beneath the fiscal 2022 peak. It is also far beneath the scorching tempo of earnings development seen in 2021 and 2022.

Out of 42 analysts overlaying NVDA inventory, 28 fee it a purchase. Twelve have a maintain and two have a promote, in line with FactSet.

The early 2020 coronavirus pandemic fueled demand for chips utilized in computer systems, video video games and information facilities. That, in flip, led to a chip scarcity for a lot of the final couple of years.

The chip scarcity may now develop into an oversupply drawback in 2023, some business specialists say.

Trying For The Subsequent Huge Inventory Market Winners? Begin With These 3 Steps

NVDA Backstory, Rivals

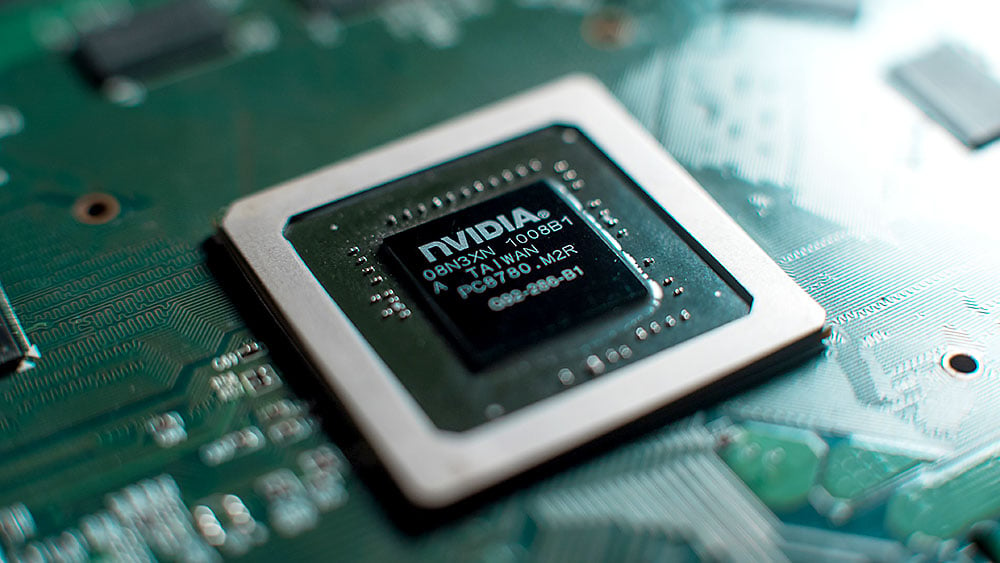

The fabless chipmaker pioneered graphics processing models, or GPUs, to make video video games extra sensible. It is increasing in AI chips, utilized in supercomputers, information facilities and drug growth.

Nvidia’s GPUs act as accelerators for central processing models, or CPUs, made by different firms.

As well as, Nvidia chips are used for Bitcoin mining and self-driving electrical automobiles.

Nvidia has made a large push into metaverse purposes.

Apart from NVDA, fabless chip shares embrace Qualcomm (QCOM), Broadcom (AVGO) and Monolithic Energy Techniques (MPWR).

Amid business headwinds, the fabless group ranks No. 48 out of 197 business teams.

For the very best returns, buyers ought to concentrate on firms which might be main the market and their very own business group.

Is Nvidia Inventory A Purchase Or Promote?

On a elementary stage, Nvidia earnings and gross sales are anticipated to return to development in 2023.

The chipmaker is increasing in development areas, equivalent to information facilities, automated electrical automobiles, and cloud gaming. The adoption of metaverses and cryptocurrencies may additional stoke demand for Nvidia chips.

Nevertheless, macroeconomic uncertainties and danger of world recession proceed to develop. Amid headwinds, semiconductor gross sales are anticipated to shrink this yr.

NVDA inventory has rallied in January to regain key technical ranges after tumbling prior to now yr. However the chip inventory continues to be beneath a purchase level from a cup base.

Backside line: Nvidia inventory isn’t a purchase. As a number one chipmaker with publicity to high finish markets in information facilities and gaming, Nvidia is at all times one to observe.

Try IBD Inventory Lists and different IBD content material to search out dozens of the finest shares to purchase or watch.

YOU MAY ALSO LIKE:

Is AMD Inventory A Purchase?

See The Greatest Shares To Purchase And Watch

Catch The Subsequent Huge Successful Inventory With MarketSmith

Be part of IBD Stay And Study High Chart-Studying And Buying and selling Methods From The Professionals