There isn’t any denying that Nvidia (NASDAQ: NVDA) has been on fireplace since early final 12 months. The inventory has soared greater than 750% as of this writing, pushed increased by the potential implications of generative synthetic intelligence (AI). The power to streamline time-consuming duties and automate routine processes guarantees to extend productiveness and will unleash a wave of better income for companies that undertake this cutting-edge know-how.

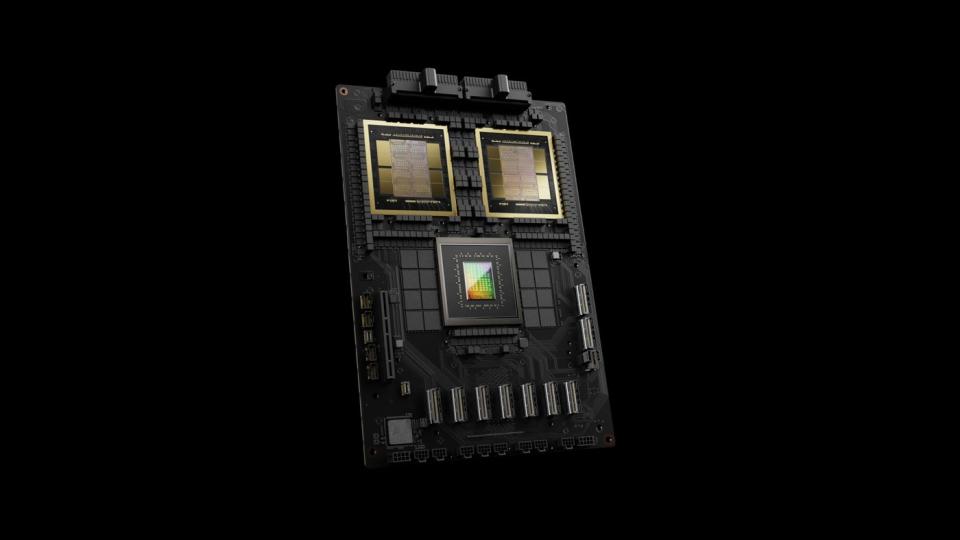

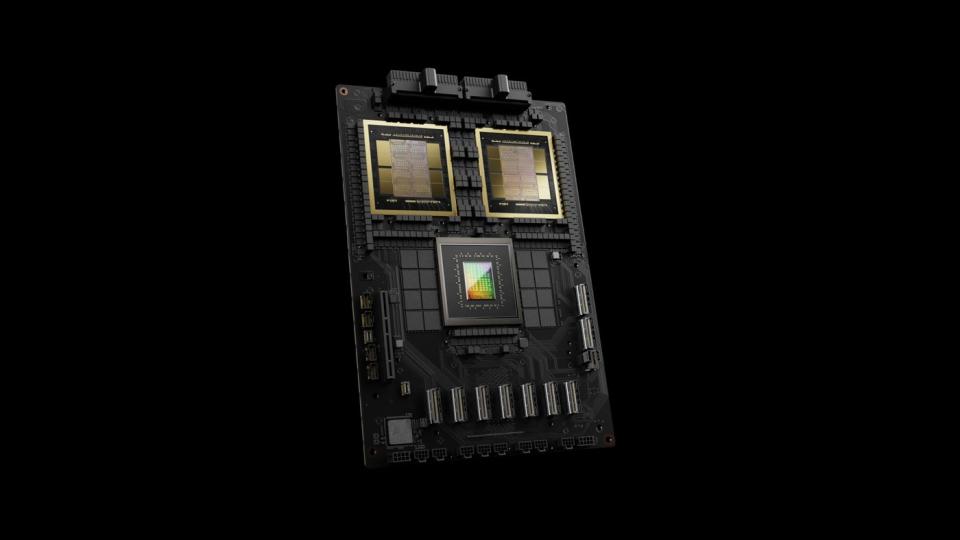

Nvidia’s graphics processing models (GPUs) are the gold normal and supply the computational horsepower needed for AI processing. This has let free a tidal wave of demand for the corporate’s high-end processors, sending its enterprise and monetary outcomes surging, leading to its current 10-for-1 inventory break up.

Whereas some traders worry the straightforward cash has been made, others consider the perfect is but to return. One analyst suggests Nvidia has a killer benefit that can assist it keep forward of the competitors and unleash a “money gusher” that can revenue shareholders.

Let’s examine if the analyst’s argument holds water and what it means for traders.

A protracted observe document of success

To grasp the supply of this “money gusher,” it helps to take a step again to see how Nvidia received to the place it’s at the moment.

Nvidia’s state-of-the-art processors have lengthy been the business normal for severe avid gamers. The corporate managed 88% of the discrete desktop GPU market within the first quarter, in keeping with information compiled by Jon Peddie Analysis.

Nonetheless, Nvidia tailored that very same know-how to zip information by the ether, changing into the go-to processor for information facilities. Estimates counsel the corporate controls as a lot as 92% of the info middle GPU market, in keeping with IoT Analytics. Nvidia can also be the undisputed chief in processing machine studying — a longtime department of AI — with an estimated 95% of that market, in keeping with information equipped by New Road Analysis.

Since a lot of generative AI processing happens within the cloud and information facilities, Nvidia has cemented its place because the chief. The corporate is ready to launch its Blackwell household of processors later this 12 months, and CEO Jensen Huang has stated, “The Blackwell Structure platform will possible be probably the most profitable product in our historical past.” If that is the case, and I consider that it’s, the perfect might be but to return.

Moreover, whereas the favored narrative says the competitors is coming for Nvidia, so far — regardless of years of alternative — no severe competitor has emerged.

A “money gusher”

Melius Analysis analyst Ben Reitzes believes Nvidia has one killer benefit that some traders could also be overlooking, one that can preserve the corporate on the forefront of know-how. Nvidia offers not solely the chips which might be tailored for AI but in addition the built-in software program that eeks each final ounce of efficiency from these AI-centric processors. This “full stack” strategy, or the marrying of {hardware} and software program, offers Nvidia with a key benefit that might be laborious for rivals to match, significantly given the corporate’s lengthy observe document of management within the discipline.

“What they did is that they constructed a computing language and an ecosystem that lets you monetize AI, and clearly, they’re killing it,” Reitzes stated.

The analyst goes on to notice that the cadence of Nvidia’s analysis and improvement (R&D) makes it laborious for opponents to maintain up. The corporate not too long ago elevated its already relentless tempo of innovation, as CEO Jensen Huang stated the corporate is now “on a one-year rhythm,” releasing new processors yearly as a substitute of each two years. “They’re operating 150 miles an hour whereas everybody else is operating 100. It will be laborious to catch these guys,” Reitzes stated.

Because of the accelerating adoption of AI and Nvidia’s dominant place, it is estimated the corporate will generate $270 billion in money within the coming three years, which might unleash a wave of returns to shareholders within the type of inventory buybacks and better dividend funds.

The analyst notes that even with increased R&D spending, the inflow of money will far outweigh any potential makes use of, suggesting the bulk might be returned to shareholders.

Traders are already seeing proof of that shift. Late final 12 months, Nvidia introduced a brand new $25 billion share repurchase plan. Moreover, along side its inventory break up announcement in Could, the corporate elevated its dividend cost by 150%. That stated, Nvidia is presently utilizing lower than 1% of income to fund the dividend, and even at its increased price, the yield is a paltry 0.03%.

This illustrates that there is nonetheless ample alternative for Nvidia to return money to shareholders, and with the continuing tsunami of AI adoption, the corporate may have an rising quantity of assets to just do that. Moreover, given its killer benefit, its unlikely a rival will take Nvidia’s crown, no less than not anytime quickly.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $757,001!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 24, 2024

Danny Vena has positions in Nvidia. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.

Nvidia’s 1 Killer Benefit Will Produce a “Money Gusher” for Shareholders within the Wake of Its 10-for-1 Inventory Cut up, In line with 1 Wall Road Analyst. was initially revealed by The Motley Idiot