On Aug. 28, Wall Avenue held its breath because the world’s most vital synthetic intelligence (AI) firm reported second-quarter earnings. I am speaking about Nvidia (NASDAQ: NVDA), in fact. Whereas every member of the “Magnificent Seven” is seen as an indicator for the course of all issues AI, Nvidia has emerged as maybe the trade’s end-all-be-all barometer.

However worry not! As soon as once more, Nvidia silenced the doubters after posting one more spectacular earnings report. Nonetheless, whereas combing by means of the monetary and working metrics, I found one announcement that left me a bit of perplexed.

Particularly, Nvidia’s board of administrators accredited an extra $50 billion in share repurchases (this comes on high of a remaining $7.5 billion from a previous buyback program). There is a common notion that inventory buybacks could be fairly favorable for traders. However within the case of Nvidia, I simply do not get it.

Under, I will break down some the explanation why I believe Nvidia introduced the buyback and why I don’t see this transfer as a purpose to purchase the inventory proper now.

Is Nvidia’s buyback a distraction?

One of many greater bulletins from Nvidia this yr was the corporate’s 10-for-1 inventory break up, which occurred again in June. Since early September 2022, shares of Nvidia have risen over 750%. Because the inventory value eclipsed $1,000 per share, constructing a place in Nvidia turned extra of a hurdle for some traders.

Typically, an organization will select to separate its inventory following these vital rises within the share value. Though a inventory break up doesn’t inherently change an organization’s market capitalization, the decrease split-adjusted value is usually perceived as inexpensive and will encourage traders to purchase. In consequence, a inventory may truly change into extra costly following a break up as a bigger physique of traders begins to pour in.

This is not precisely the case with Nvidia inventory, although. Since shares started buying and selling on a split-adjusted foundation on June 10, Nvidia inventory has declined by about 2% (as of market shut on Sept. 2). I will concede {that a} 2% drop shouldn’t be a purpose to panic. However with that stated, I’m a bit of shocked that the break up didn’t encourage a noticeable uptick in shopping for exercise and subsequently propel Nvidia’s valuation to new highs.

To be candid, I see the announcement of the buyback as considerably of a PR stunt and an effort to reinspire traders.

Does Nvidia’s buyback make strategic sense?

Think about watching a business wherein a celeb you admire endorses a product, however later, you be taught that the celeb has by no means used the product and easily promoted it as a result of they had been paid a price to take action. In a means, that is type of what is going on on with Nvidia proper now.

Whereas including to the prevailing buyback initiative may give the impression that administration views the inventory as a very good shopping for alternative and even undervalued, needless to say insider promoting has change into all the fashion at Nvidia over the past couple of months. Executives, together with Nvidia’s CEO, Jensen Huang; government vice chairman of operations, Debora Shoquist; and board members Mark Stevens and Tench Coxe had been all promoting inventory when Nvidia shares had been using excessive earlier in the summertime.

Why must you purchase Nvidia inventory when these chargeable for producing shareholder worth are cashing out? Maybe it is a harsh criticism, as Nvidia’s executives nonetheless personal massive chunks of inventory — making their web value intently tied to the efficiency of the enterprise. Nonetheless, I’ve another considerations relating to the buyback.

Whereas Nvidia is greatest identified for its graphics processing models (GPUs), not too way back, I wrote a chunk on how the corporate is deploying its report earnings into development initiatives outdoors its core semiconductor and knowledge heart companies. Furthermore, contemplating Nvidia’s closest competitor, Superior Micro Gadgets (AMD), has made a number of notable acquisitions over simply the final couple of years, I might assume administration could be motivated to double down on analysis and growth, advertising, and different endeavors amid intensifying competitors. I might see these as extra prudent choices, contemplating Nvidia did should delay orders on its latest Blackwell GPUs attributable to a design flaw.

One final level I would prefer to make pertains to competitors outdoors of AMD. Nvidia can be dealing with surging competitors from its personal prospects — significantly among the Magnificent Seven members. Electrical car (EV) producer Tesla depends closely on Nvidia chips to develop autonomous driving software program. However latest remarks from Elon Musk counsel Tesla is trying to migrate away from Nvidia and maybe compete with the chip large sooner or later. Furthermore, each Amazon and Meta are rising investments in capital expenditures (capex), particularly in some tasks revolving round designing their very own in-house semiconductor chips.

Is Nvidia inventory a very good purchase proper now?

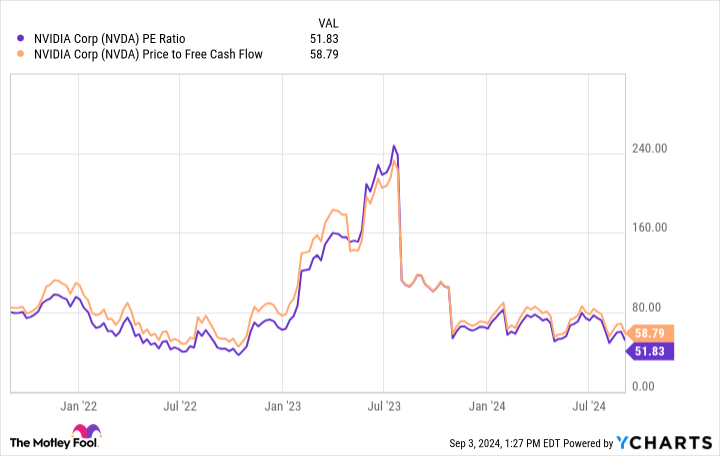

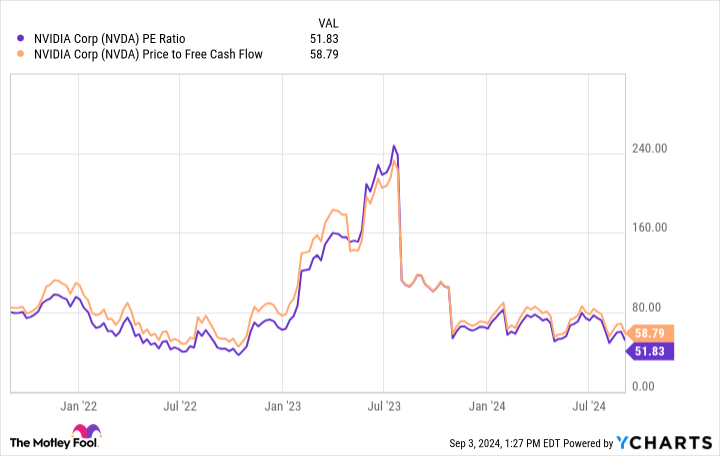

In case you take a look at Nvidia purely from a valuation perspective, there’s an argument to be made that the inventory is a cut price proper now. On price-to-earnings (P/E) and price-to-free money stream (P/FCF) bases, Nvidia inventory is definitely inexpensive at this time than it was even only a few years in the past — and that is with all of this newfound income and revenue development.

However I am starting to have some considerations that Nvidia is hard-pressed to determine alternatives to allocate capital amid a interval of rising competitors. I am not going to place forth the notion that investing in Nvidia is a disastrous selection. I will save the doomsday-speak for one more time.

Nonetheless, traders ought to understand that Nvidia’s report development throughout the highest and backside strains won’t final without end. Ultimately, development will normalize and take a toll on Nvidia’s earnings. For that purpose, I discover the $50 billion buyback questionable and never purpose alone to scoop up shares of Nvidia in the mean time.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $630,099!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 3, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Idiot has a disclosure coverage.

Opinion: Nvidia’s $50 Billion Buyback Is Not a Cause to Purchase the Inventory Hand Over Fist. This is What I am Involved About. was initially printed by The Motley Idiot