-

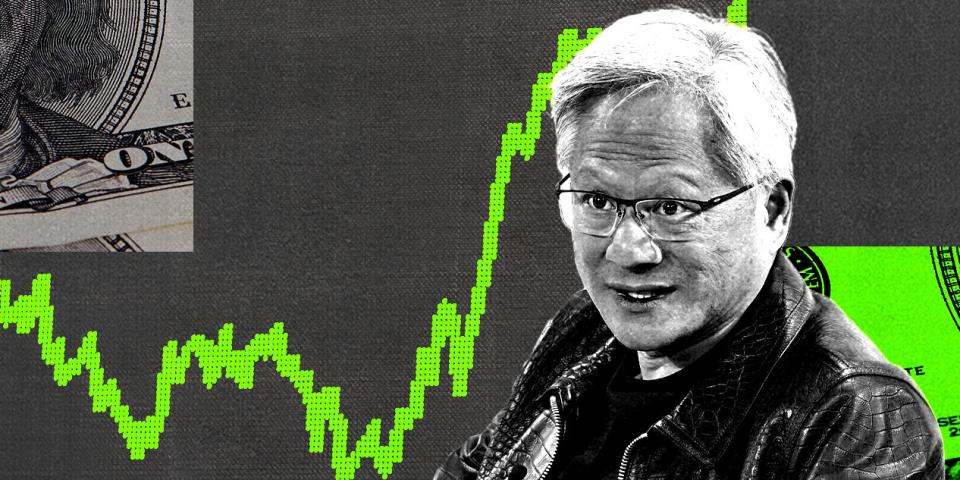

Nvidia’s monster rally will not final because the chipmaker faces long-term challenges, in accordance with Gil Luria.

-

The DA Davidson analyst has predicted as a lot as a 20% decline in Nvidia inventory by the top of the yr.

-

Nvidia’s largest clients might flip into competitors as they develop their very own AI chips, Luria warned.

Nvidia inventory cannot preserve hovering ceaselessly, and the chip behemoth will ultimately endure as demand for its GPUs softens, in accordance with DA Davidson analyst Gil Luria.

Luria advised BNN Bloomberg on Tuesday that Nvidia in all probability will not see a significant decline over the brief time period. Income during the last quarter will probably be “incredible,” he stated, predicting the corporate would report over $25 billion in income.

Nonetheless, the chipmaker’s decline over the long term is inevitable, as the corporate will battle extra competitors over the approaching years, even from its personal clients, he warned.

“The explanation we’re not fairly as bullish as everyone else is we’re trying on the horizon. What is going on to occur subsequent yr? What is going on to occur in 2026? We predict there’s accumulating increasingly proof this could’t proceed,” Luria stated. “At any time when one firm extracts this a lot revenue out of the market, competitors does are available in, and in Nvidia’s case, it is coming in from its clients.

Most of Nvidia’s enterprise comes from its 5 largest clients, Luria stated, which embody Amazon, Meta, Microsoft, Alphabet, and Tesla. These corporations are additionally large opponents within the AI race, and firms like Apple and Microsoft are reportedly creating their very own AI chips.

And whereas a few of Nvidia’s clients are stockpiling its GPUs, demand is sure to expire ultimately, Luria beforehand advised Bloomberg, as corporations can solely accumulate so many chips.

“Since our expectations are significantly decrease than consensus expectations for these out years, our perspective is that there will probably be a day the place income begins declining, and if no one is anticipating that, the inventory would have a major draw back if that had been to occur,” Luria warned.

Nvidia has loved a meteoric rally during the last 18 months, with the inventory practically doubling over the previous 5 months alone because the AI hype continues to grip Wall Avenue. That is led some analysts to develop involved over the corporate’s lofty valuation, which is now larger than different tech titans like Alphabet and Amazon.

Luria has amongst few forecasters who’re bearish on Nvidia inventory. Beforehand, he known as for as a lot as a 20% drop within the firm inventory by the top of the yr, as the corporate was unlikely to maintain up its fast tempo of development.

Learn the unique article on Enterprise Insider