For the reason that creation of the web roughly three a long time in the past, traders have just about all the time had a buzzy development or innovation to captivate their consideration. Nevertheless, none of those different next-big-thing developments got here wherever near rivaling what the web did for company America.

However after an extended wait, the substitute intelligence (AI) revolution has left skilled and on a regular basis traders wide-eyed with its potential.

Though estimates range, as you’d anticipate from a game-changing expertise, the analysts at PwC see AI including $15.7 trillion (sure, with a “t”) to the worldwide economic system by way of varied consumption-side advantages and productiveness features by the flip of the last decade.

No firm has benefited extra straight from the hype surrounding AI and its seemingly limitless ceiling than Nvidia (NASDAQ: NVDA).

Nvidia’s ascension is in contrast to something we have ever witnessed

When the web page turned to 2023, Nvidia was a $360 billion firm that was on the perimeter of being one in all America’s most-important tech shares. However as of the closing bell on Aug. 28, 2024, it was price $3.09 trillion. In June, it briefly turned essentially the most worthwhile publicly traded firm, shortly after finishing its historic 10-for-1 inventory cut up.

No deep digging is required to flesh out why Nvidia added, at one level, nicely over $3 trillion in market worth in lower than 18 months. In brief order, the corporate’s H100 graphics processing unit (GPU) turned the popular chip in AI-accelerated information facilities. It is successfully the mind that powers generative AI options, facilitates the coaching of huge language fashions (LLMs), and fuels split-second decision-making by AI-driven software program and methods.

Demand for Nvidia’s {hardware} has utterly overwhelmed provide. Producing the must-have AI-GPU has afforded Nvidia a jaw-dropping quantity of pricing energy. Whereas Superior Micro Gadgets (NASDAQ: AMD) is promoting its MI300X AI-GPU for between $10,000 and $15,000, Nvidia’s H100 usually prices between $30,000 and $40,000.

Nvidia’s CUDA software program platform has performed a key function in its success, too. CUDA is the toolkit builders use to construct LLMs in addition to get as a lot computing capability out of their GPUs as potential. CUDA has been an indispensable instrument that is helped hold Nvidia’s clients loyal to its ecosystem of services and products.

The tip results of this seemingly textbook enlargement has been six consecutive quarters the place the corporate’s reported gross sales and earnings utterly trounced the consensus of Wall Avenue analysts.

However despite this success, one under-the-radar efficiency metric seems to all however verify that Nvidia’s finest days are within the rearview mirror.

The primary sequential decline in two years for this working metric spells bother

As I acknowledged earlier this week, I wasn’t going to be shocked one bit if Nvidia blew previous Wall Avenue’s consensus income and earnings per share (EPS) estimates for the fiscal second quarter (ended July 28) — which is exactly what it did. It isn’t unusual for analysts to be conservative with their estimates and supply a low sufficient bar for corporations to clear.

However headline figures, similar to income and internet earnings, solely seize a part of the story.

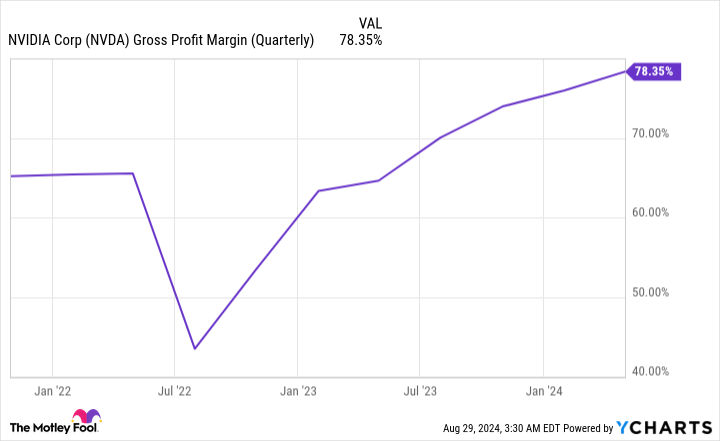

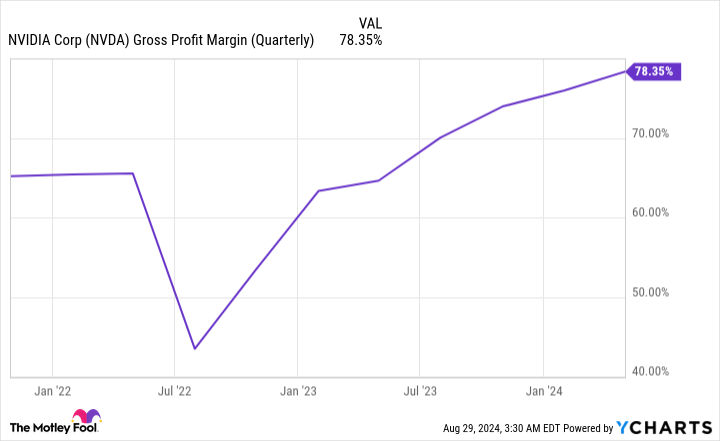

With Nvidia, the one efficiency metric that tells a extra thorough story about the place it is headed is its gross margin. Personally, I favor to make use of adjusted gross margin, which removes acquisition-related bills and stock-based compensation; however both gross margin or adjusted gross margin works superb for this dialogue.

Through the fiscal first quarter (ended April 28), Nvidia’s adjusted gross margin expanded to an nearly unthinkable 78.35%. In a span of 5 quarters, it is risen by near 14 proportion factors, which is a mirrored image of the corporate commanding such excessive worth factors for its AI-GPUs.

Nevertheless, Nvidia additionally guided to an adjusted gross margin of 75.5% (+/- 50 foundation factors) for the fiscal second quarter in its first-quarter report. If it had been to hit this vary, it might mark the primary sequential quarterly decline in adjusted gross margin in two years.

After the closing bell on Wednesday, Aug. 28, Nvidia delivered its much-anticipated fiscal second-quarter working outcomes, with adjusted gross margin falling by 320 foundation factors to 75.15%. Whereas that is inside vary of what the corporate forecast three months prior, it is on the decrease finish of what was anticipated.

What’s extra, Nvidia’s fiscal third-quarter outlook requires the potential of further gross margin contraction, with an adjusted gross margin forecast of 75% (+/- 50 foundation factors).

Though its adjusted gross margin remains to be up considerably from the place issues stood 18 months in the past, there seems to be no query that the tide is popping — and never for the higher.

Aggressive pressures and historical past are working in opposition to Nvidia

Although Nvidia is promoting extra of its H100 chips, and CEO Jensen Huang has famous that demand stays sturdy for its next-generation Blackwell GPU structure, the lion’s share of its adjusted gross margin enlargement has been the results of AI-GPU shortage and its otherworldly pricing energy.

The primary downside is that AI-GPU shortage shall be abating over time. AMD has been growing manufacturing of its MI300X, and it does not have the identical provide constraints that Nvidia has contended with from main chip fabricator Taiwan Semiconductor Manufacturing (NYSE: TSM). As exterior rivals enter the area and ramp their output, Nvidia’s pricing energy shall be steadily whittled away.

It is also extremely possible that suppliers are going to desire a greater piece of the pie. Taiwan Semiconductor is within the means of meaningfully increasing its chip-on-wafer-on-substrate (CoWoS) capability, which is a necessity for packaging the high-bandwidth reminiscence wanted in AI-accelerated information facilities. Rising its CoWoS capability is more likely to translate into greater prices on Nvidia’s finish to spice up manufacturing.

And it isn’t simply exterior competitors that this main AI juggernaut wants to fret about. Nvidia’s 4 largest clients by internet gross sales (all members of the “Magnificent Seven”) are growing in-house AI-GPUs to be used of their high-compute information facilities. The H100 and Blackwell GPUs sustaining their computing capability benefits will not to be sufficient to dissuade these high clients from utilizing their in-house chips and denying Nvidia worthwhile information middle “actual property.”

The opposite main difficulty working in opposition to Nvidia is historical past. At no level over the past 30 years has there been a next-big-thing expertise, innovation, or development that is averted an early-innings bubble. All applied sciences want time to mature, and synthetic intelligence does not look like the exception to this unwritten rule.

Though Nvidia has loved giant orders from its high clients, the overwhelming majority of companies investing in AI lack a transparent sport plan. Even Meta Platforms, which is one in all Nvidia’s high 4 clients by internet gross sales, has no intention of meaningfully monetizing its AI investments anytime quickly.

This clear lack of path, coupled with the corporate’s adjusted gross margin forecast, successfully confirms that Nvidia’s inventory has peaked.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $769,685!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 26, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Sean Williams has positions in Meta Platforms. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot has a disclosure coverage.

Nvidia’s Inventory Has Peaked, and 1 Underneath-the-Radar Efficiency Metric Proves It was initially revealed by The Motley Idiot