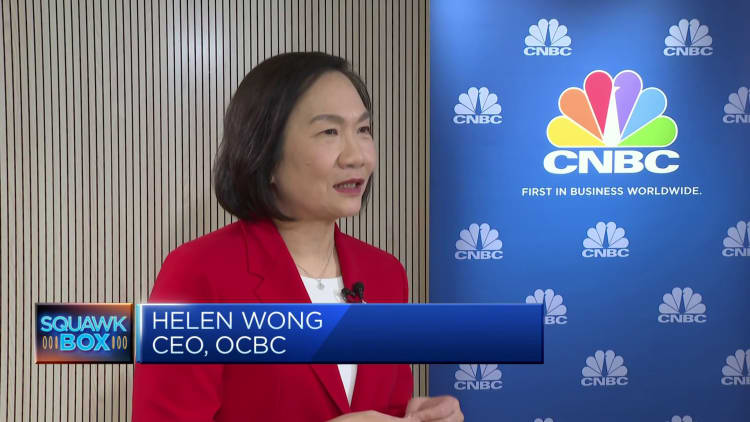

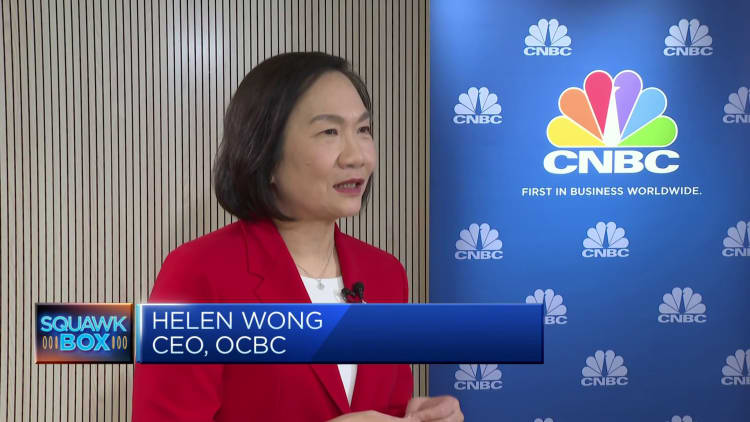

Singapore’s Oversea-Chinese language Banking Company has set its sights on “long run alternatives” in Better China and Southeast Asia and expects the technique to deliver a further income of $2.2 billion by 2025, CEO Helen Wong advised CNBC on Monday.

Southeast Asia’s second largest financial institution introduced Monday that it is going to be unifying its model throughout its core markets in Better China — which incorporates Hong Kong and Macao — in addition to Southeast Asia.

“For those who have a look at macro developments, Better China and ASEAN collectively goes to proceed to contribute extra to the world’s GDP development,” Wong advised CNBC, referring to the 10-nation Affiliation of South East Asian Nations bloc.

“For those who have a look at the commerce numbers for the final 4 years, China and ASEAN — they’re rising at a CAGR of 13%,” she added. Compound annual development price is a measure of annualized returns for an funding over a time frame, assuming income are reinvested on the finish of every 12 months.

In a media launch, Wong stated “the results of China’s reopening post-pandemic, the rise of ASEAN for the China plus one technique and different geopolitical components” have amplified the potential enterprise flows between the 2 areas.

As such, whereas the OCBC has seen slowing financial development in some nations within the area, Wong stated she’s assured it is going to be capable of seize development because it “places our act collectively.”

The signage of Oversea-Chinese language Banking Corp. (OCBC) at OCBC Centre in Singapore, on Wednesday, Aug. 3, 2022.

Edwin Koo | Bloomberg | Getty Photographs

This might be carried out by bettering the way it offers with clients digitally, in addition to bettering the best way the financial institution captures clients and companies, she stated with out providing extra particulars.

She additionally identified that OCBC and its subsidiaries service the highest seven markets in ASEAN, and may depend on a presence in 17 cities within the Better China area, together with Hong Kong, Macao and Taiwan, in addition to its partnership with the Financial institution of Ningbo.

Outlook for 2023

Requested concerning the financial institution’s outlook for the following half of 2023, Wong stated it should “in all probability might be fairly steady.”

She stated the excessive rate of interest setting has helped its curiosity revenue, at the same time as revenue from charges has fallen as traders maintain again on investing as a result of unsure financial setting.

However OCBC has different income streams that would contribute to development, reminiscent of insurance coverage revenue, Wong stated.

Nonetheless, she additionally acknowledged there could also be uncertainty as rates of interest may probably stay at present ranges or be “somewhat bit greater.”

Because of this, OCBC should take note of whether or not its credit score portfolio could also be impacted by extended excessive rates of interest. Additionally, if charges proceed to be excessive, clients are more likely to be “somewhat bit on the sidelines as to their funding actions,” Wong identified.

As a regional financial institution — Southeast Asia’s second largest — OCBC additionally noticed some cash are available in from the collapse of regional banks within the U.S. earlier this 12 months.

“At any time when there are some adjustments, some weak spot in sure elements of the trade, there’s a flight to high quality. So being a extremely rated financial institution, sitting in Asia, we do see a few of that new cash coming in,” she stated.

Nonetheless, the target isn’t solely to have the cash are available in, however holding the cash with OCBC.

To that, Wong highlighted that the financial institution has to ask itself: “Is there any lesson realized? How does that really affect clients? Are we outfitted to serve the purchasers as cash is available in as properly?”

OCBC shares are greater by practically 9% within the final 12 months, and closed at 12.30 Singapore {dollars} on Monday.