Crude oil costs have been on fireplace this 12 months. WTI, the first U.S. oil value benchmark, has surged from round $70 a barrel at first of the 12 months to almost $90 a barrel just lately. Increased oil costs will likely be a boon for oil firms, which ought to produce much more free money move this 12 months.

The rising tide of upper oil costs ought to carry all boats within the oil patch. Nevertheless, Chevron (NYSE: CVX), Devon Vitality (NYSE: DVN), and Diamondback Vitality (NASDAQ: FANG) stand out to a couple Idiot.com contributors for his or her capacity to money in on greater oil costs. Here is why they assume that traders ought to take a look at these oil shares.

Chevron is not benefiting as a lot; that is good for you

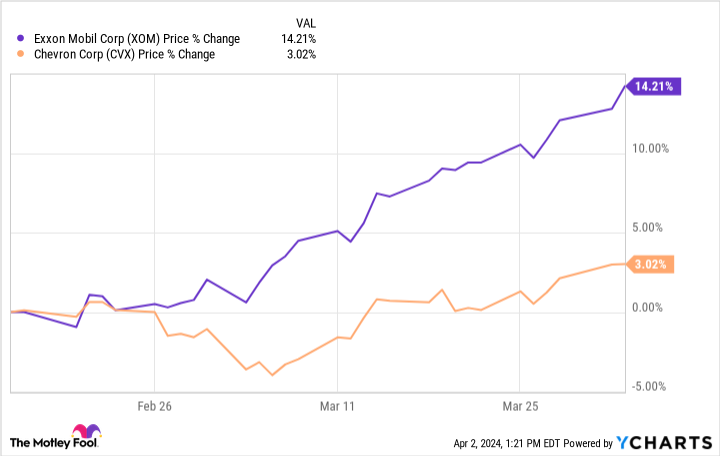

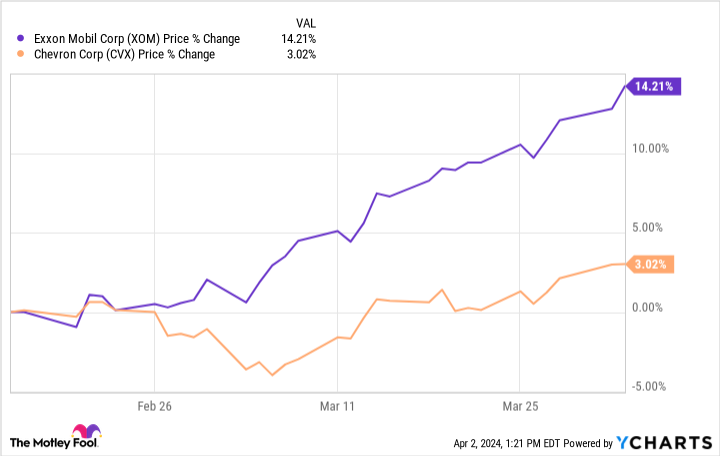

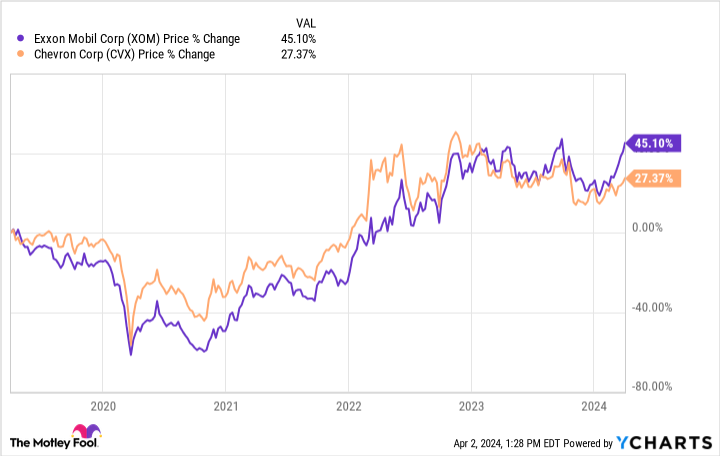

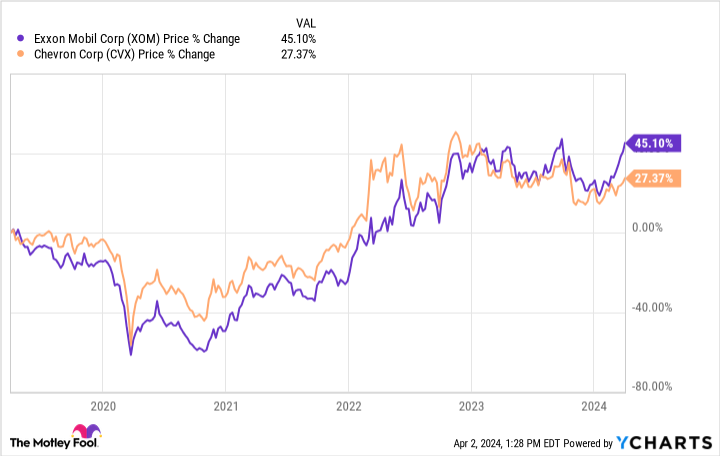

Reuben Gregg Brewer (Chevron): Chevron and ExxonMobil (NYSE: XOM) are related in some ways. However the shares of those two built-in vitality giants have diverged of late, as Wall Road is apprehensive that Chevron’s acquisition of Hess (NYSE: HES) may crumble. The issue is that Exxon does not need Chevron to realize a toehold in an Exxon-operated mission situated in Guyana. To place a quantity on that divergence, Chevron’s inventory is up simply a few proportion factors since mid-February, when rumors of hassle began to flow into, whereas Exxon’s inventory has gained 14%.

However due to this concern it seems that Exxon’s inventory is benefiting extra from oil’s latest value strikes than Chevron. To be honest, the Hess deal is sizable and the Guyana mission is vital. However in the long term, this is not a make-or-break concern. Chevron is massive sufficient and financially sturdy sufficient to do exactly advantageous with out Hess.

What’s notable about this divergence is that the inventory costs of Chevron and Exxon usually observe pretty carefully with one another over time. And divergences like this usually get resolved with the laggard merely catching as much as the chief. An extra rise in vitality costs might be simply what’s wanted to get traders enthusiastic about Chevron once more. And even when that does not occur within the close to time period, the efficiency hole remains to be prone to shut over the long run. You should purchase Chevron whereas it appears comparatively low cost and accumulate its beneficiant 4.1% dividend yield whilst you look ahead to higher days.

Devon’s variable dividends may surge with oil costs

Neha Chamaria (Devon Vitality): Whereas many oil and gasoline shares pay a dividend, proudly owning Devon Vitality inventory might be significantly rewarding when oil costs are going up, due to its flexible-plus-variable dividend coverage.

The factor is, other than paying a set dividend each quarter, Devon Vitality additionally pays a variable dividend equal to as much as 50% of the surplus free money move (FCF) it generates within the quarter. Since its money flows rise alongside oil costs, traders in Devon Vitality can usually anticipate to earn massive dividends when oil costs rise. To provide you an instance of how Devon’s dividends can develop alongside oil costs, contemplate that the corporate’s whole dividend payout (fixed-plus-variable dividend) per share jumped 57% sequentially within the third quarter of 2023 as its common realized value of oil rose practically 11%.

After all, Devon is an fascinating dividend inventory to personal when oil is up as a result of it additionally has the monetary fortitude to help greater dividends. The corporate plans to extend oil manufacturing solely reasonably within the close to time period to keep away from oil value shocks and is concentrated on FCF technology whereas holding debt at manageable ranges. It additionally goals to return capital to shareholders constantly within the type of dividends in addition to share repurchases. The truth that Devon additionally elevated its fastened dividend payout by 10% final quarter underscores its monetary energy and dedication to paying regular and common dividends no matter the place oil costs are. With oil costs inching greater proper now, you’ve gotten a stable purpose to contemplate this 4.6%-yielding inventory.

Poised to provide an excellent greater free-cash-flow gusher

Matt DiLallo (Diamondback Vitality): Diamondback Vitality spent years constructing a premier place within the Permian Basin. That technique has paid massive dividends lately. Its rising scale has enabled it to provide an rising quantity of free money move.

The corporate can produce over $2.8 billion in free money move this 12 months at $70-a-barrel oil. That quantity will rise to $3.4 billion at $80 oil and over $4.1 billion if crude averages $90 a barrel. With oil costs rising this 12 months (from round $70 firstly to almost $90 just lately), it is on observe to provide much more free money move this 12 months.

Diamondback Vitality may produce much more free money move this 12 months if it closes its needle-moving acquisition of Endeavor Vitality Assets. It is shopping for its rival in a $26 billion deal to create a premier pure-play unbiased producer within the Permian. Diamondback estimates that the deal will improve its free money move per share by greater than 10% subsequent 12 months.

The corporate plans to return half of this 12 months’s free money move to traders through dividends and share repurchases. That is down from a goal of not less than 75% final 12 months as a result of the corporate desires to retain extra money to repay debt following its acquisition of Endeavor. As soon as it reaches its focused leverage ratio, Diamondback may enhance its capital return goal. With oil costs surging this 12 months, the corporate may obtain its leverage goal even sooner. In the meantime, even on the present 50% degree, Diamondback will produce additional cash to return to traders this 12 months.

Diamondback Vitality’s rising money move and money returns may assist give it the gasoline to provide sturdy whole returns from right here.

Must you make investments $1,000 in Chevron proper now?

Before you purchase inventory in Chevron, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Chevron wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $526,345!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of April 4, 2024

Matt DiLallo has positions in Chevron. Neha Chamaria has no place in any of the shares talked about. Reuben Gregg Brewer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Chevron. The Motley Idiot has a disclosure coverage.

Oil Is Up, These 3 Vitality Shares Are Set to Reward Buyers was initially printed by The Motley Idiot