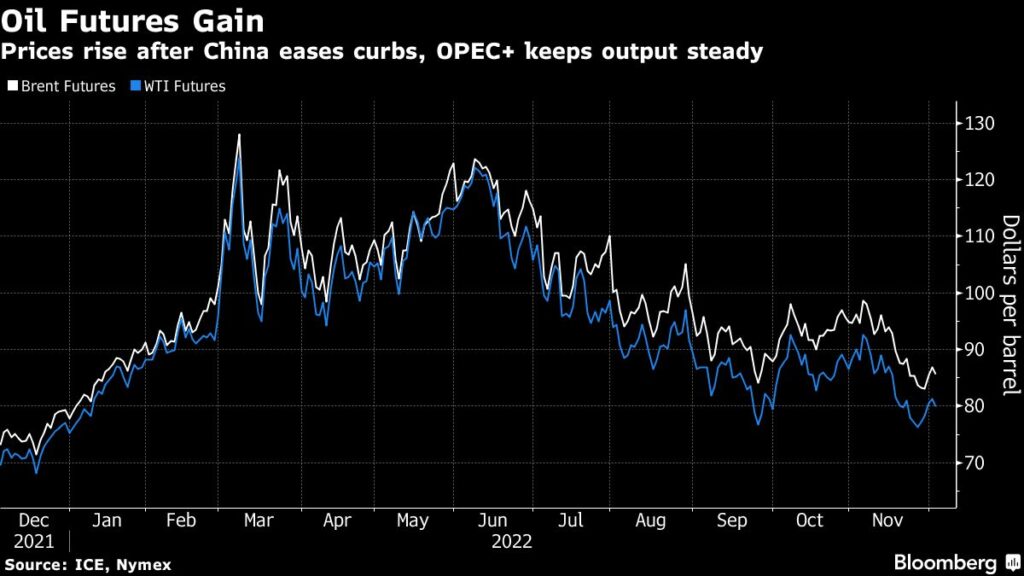

(Bloomberg) — Oil climbed after OPEC+ stored oil output regular, sanctions on Russian crude kicked in, and China made additional progress towards reopening.

Most Learn from Bloomberg

West Texas Intermediate rose above $80 a barrel after rallying nearly 5% final week as Beijing loosened strict virus curbs which have stymied vitality consumption. The Group of Petroleum Exporting International locations and its allies together with Russia agreed to keep up manufacturing at present ranges on Sunday, pausing to take inventory of the worldwide market in a state of flux.

To additional punish Moscow for the invasion of Ukraine, the European Union, in tandem with the Group of Seven, agreed to impose a cap at $60 a barrel on Russian crude, whereas banning most seaborne imports from Monday. The initiative is supposed to penalize Russia financially, whereas preserving that nation’s oil flowing to different states. Russian Deputy Prime Minister Alexander Novak once more rejected the cap, saying the nation was prepared to chop output if wanted.

Oil’s achieve is the newest twist in what’s been an awfully unstable 12 months for the world’s most necessary commodity, with markets roiled by Europe’s largest land battle since World Warfare II and an aggressive spherical of central financial institution tightening to struggle runaway inflation. After hitting the bottom degree since December early final week, US benchmark costs have since rebounded.

“It stays unsure whether or not the plan will guarantee the graceful circulate of Russian barrels to Asian markets or if there shall be a cloth disruption due to deliberate provide motion from Moscow or threat aversion by worldwide compliance departments,” RBC Capital Markets analysts together with Helima Croft mentioned in a observe.

Oil merchants have been fixated in current weeks on China’s rapidly-shifting method to dealing with Covid-19. Following a uncommon spherical of protests, authorities are shifting to ease restrictions, aiding the outlook for vitality demand in addition to different commodities. Main cities together with Shanghai, Shenzhen and Guangzhou have relaxed curbs in current days, accelerating the shift towards reopening.

OPEC+’s settlement got here after a web based gathering, which changed what was initially meant to be an in-person assembly on the group’s Vienna headquarters. The Joint Ministerial Monitoring Committee, which oversees implementation of manufacturing cuts, will meet once more on Feb. 1, in keeping with delegates. Most analysts had anticipated no change in provide coverage on the weekend’s session.

The value-cap deal for Russian crude was months within the making because the US expressed concern that the EU’s bar on Russia’s oil and associated insurance coverage and financing companies would result in a dangerous value spike. Nonetheless, the extent now agreed upon is about $10 above the Russia’s key Urals grade, suggesting its affect on these flows could also be restricted. In Asia, nevertheless, the ceiling is beneath the worth for ESPO crude, which is loaded from Russia’s far east.

Components, Bloomberg’s day by day vitality and commodities publication, is now out there. Join right here.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.