(Bloomberg) — Worldwide oil demand is racing towards an all-time excessive and among the smartest minds within the trade are forecasting $100-a-barrel crude in a matter of months, however US producers are taking part in the quick recreation and seeking to flip over as a lot money as attainable to traders.

Most Learn from Bloomberg

Shareholders in US oil corporations reaped a $128 billion windfall in 2022 due to a mix of world provide disruptions equivalent to Russia’s warfare in Ukraine and intensifying Wall Avenue strain to prioritize returns over discovering untapped crude reserves. Oil executives who in years previous had been rewarded for investing in gigantic, long-term power tasks at the moment are below the gun to funnel money to traders who’re more and more satisfied that the sundown of the fossil-fuel period is nigh.

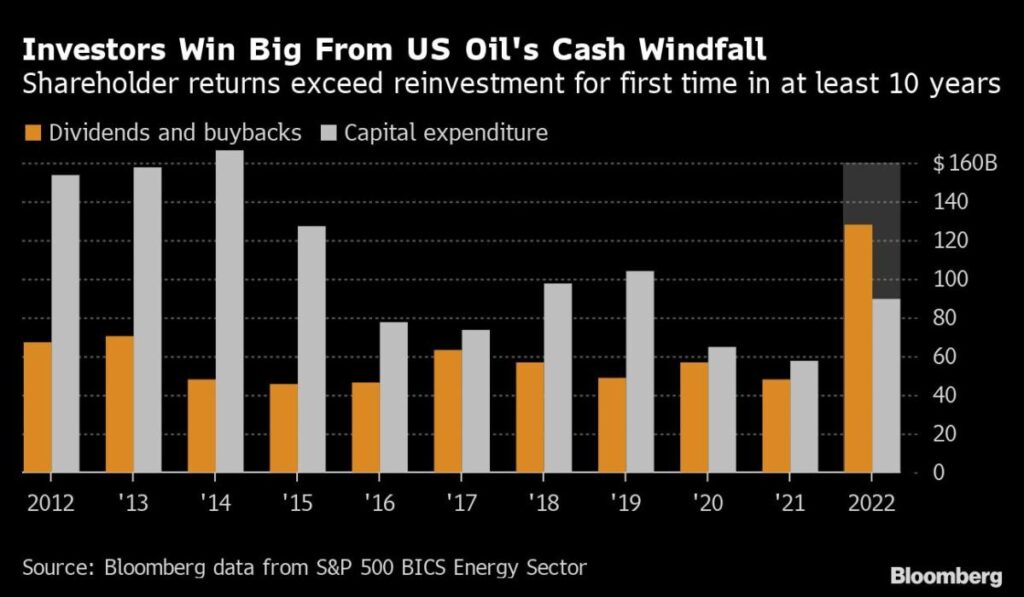

For the primary time in a minimum of a decade, US drillers final 12 months spent extra on share buybacks and dividends than on capital tasks, in response to Bloomberg calculations. The $128 billion in mixed payouts throughout 26 corporations is also essentially the most since a minimum of 2012, and so they occurred in a 12 months when US President Joe Biden unsuccessfully appealed to the trade to raise manufacturing and relieve surging gas costs. For Large Oil, rejecting the direct requests of the US authorities might by no means have been extra worthwhile.

On the coronary heart of the divergence is rising concern amongst traders that demand for fossil fuels will peak as quickly as 2030, obviating the necessity for mutlibillion-dollar megaprojects that take a long time to yield full returns. In different phrases, oil refineries and natural-gas fired energy crops — together with the wells that feed them — threat turning into so-called stranded property if and when they’re displaced by electrical automobiles and battery farms.

“The funding neighborhood is skeptical of what property and power costs can be,” John Arnold, the billionaire philanthropist and former commodities dealer, mentioned throughout a Bloomberg Information interview in Houston. “They’d fairly have the cash via buybacks and dividends to take a position somewhere else. The businesses have to reply to what the funding neighborhood is telling them to do in any other case they don’t seem to be going to be in cost very lengthy.”

The upsurge in oil buybacks helps drive a broader US company spending spree that noticed share-repurchase bulletins greater than triple in the course of the first month of 2023 to $132 billion, the very best ever to start a 12 months. Chevron Corp. alone accounted for greater than half that whole with a $75 billion, open-ended pledge. The White Home lashed out and mentioned that cash can be higher spent on increasing power provides. A 1% US tax on buybacks takes impact later this 12 months.

World funding in new oil and fuel provides already is anticipated to fall in need of the minimal wanted to maintain up with demand by $140 billion this 12 months, in response to Evercore ISI. In the meantime, crude provides are seen rising at such an anemic tempo that the margin between consumption and output will slim to simply 350,000 barrels a day subsequent 12 months from 630,000 in 2023, in response to the US Vitality Info Administration.

“The businesses have to reply to what the funding neighborhood is telling them to do in any other case they don’t seem to be going to be in cost very lengthy.” — Billionaire John Arnold

Administration groups from the largest US oil corporations recommitted to the investor-returns mantra as they unveiled fourth-quarter ends in latest week and the 36% stoop in home oil costs since mid-summer has solely strengthened these convictions. Executives throughout the board now insist that funding dividends and buybacks takes precedence over pumping further crude to quell client discontent over greater pump costs. This may occasionally pose an issue in a matter of months as Chinese language demand accelerates and international gas consumption hits an all-time excessive.

“5 years in the past, you’ll have seen very vital year-on-year oil-supply development, however you’re not seeing that at this time,” Arnold mentioned. “It’s one of many bull tales for oil — that the provision development that had come out of the US has now stopped.”

The US is essential to international crude provide not simply because it’s the world’s greatest oil producer. Its shale sources will be tapped rather more shortly than conventional reservoirs, that means that the sector is uniquely positioned to reply to worth spikes. However with buybacks and dividends swallowing up an increasing number of money move, shale is not the worldwide oil system’s ace within the gap.

Within the waning weeks of 2022, shale specialists reinvested simply 35% of their money move in drilling and different endeavors aimed toward boosting provides, down from greater than 100% within the 2011-2017 interval, in response to information compiled by Bloomberg. An analogous development is clear among the many majors, with Exxon Mobil Corp. and Chevron aggressively ramping buybacks whereas restraining capital spending to lower than pre-Covid ranges.

Buyers are driving this habits, as evidenced by clear messages despatched to home producers up to now two weeks. EOG Sources Inc., ConocoPhillips and Devon Vitality Corp. dropped after asserting higher-than-expected 2023 budgets whereas Diamondback Vitality Inc., Permian Sources Corp. and Civitas Sources Inc. all rose as they saved spending in test.

On prime of shareholder calls for for money, oil explorers are also grappling with greater prices, decrease effectively productiveness and shrinking portfolios of top-notch drilling places. Chevron and Pioneer Pure Sources Co. are two high-profile producers reorganizing drilling plans after weaker-than-expected effectively outcomes. Labor prices are also rising, in response to Janette Marx, CEO of Airswift, one of many world’s greatest oil recruiters.

US oil manufacturing is anticipated to develop simply 5% this 12 months to 12.5 million barrels a day, in response to the Vitality Info Administration. Subsequent 12 months, the enlargement is anticipated to sluggish to simply 1.3%, the company says. Whereas the US is including extra provide than a lot of the remainder of the world, it’s a marked distinction to the heady days of shale within the earlier decade when the US was including greater than 1 million barrels of each day output annually, competing with OPEC and influencing international costs.

Demand, fairly than supply-side actors just like the American shale sector or OPEC, would be the major driver of costs this 12 months, Dan Yergin, Pulitzer Value-winning oil historian and vice chairman of S&P World, mentioned throughout an inteview.

“Oil costs can be decided by, metaphorically talking, Jerome Powell and Xi Jinping,” Yergin mentioned, referring to the Federal Reserve’s rate-hike path and China’s post-pandemic restoration. S&P World expects international oil demand to achieve an all-time excessive of 102 million barrels per day.

With the case for greater oil costs constructing, US President Joe Biden has fewer instruments at his disposal with which to counteract the blow to customers. The president already has tapped the Strategic Petroleum Reserve to the tune of 180 million barrels in a bid to ease gasoline costs as they had been spiking in 2022. Vitality Secretary Jennifer Granholm is more likely to get a frosty reception on the CERAWeek by S&P World occasion in Houston staring March 6 if she follows Biden’s lead and assaults the trade for giving an excessive amount of again to traders. That enterprise mannequin is “right here to remain,” mentioned Dan Pickering, chief funding officer of Pickering Vitality Companions.

“There’s going to be a degree at which the US wants to provide extra as a result of the market goes to demand it,” Pickering mentioned. “That’s most likely when investor sentiment shifts to development. Till then, returning capital looks as if the perfect thought.”

–With help from Lu Wang and Tom Contiliano.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.