EVEN AS inter-ministerial consultations for 2022-23 revised estimates of Union funds start Monday, October 10, inside discussions inside the Prime Minister’s Workplace and the Ministry of Finance appear to recommend that the cascading impression of a worse-than-anticipated world downturn could dent the funds arithmetic within the second half of the present monetary yr.

Thus far, the political management has been considerably sanguine with the upsides – an uptick in GDP development throughout April-June; regular tax revenues, together with month-to-month Items and Providers Tax (GST) collections averaging round Rs 1.48 lakh crore; and extra leeway for the Indian rupee to depreciate on the REER (Actual Efficient Trade Fee) foundation vis-à-vis different nations.

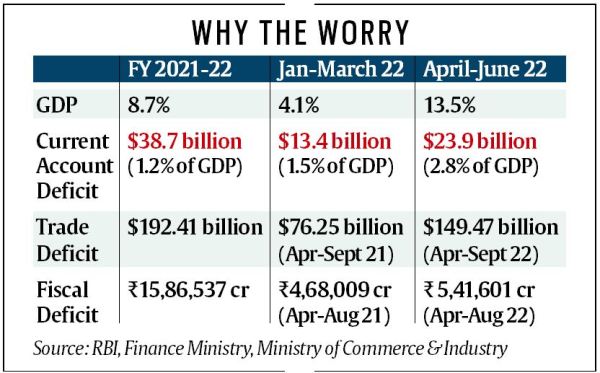

However coverage makers at the moment are pointing to a number of headwinds: stress on the dual deficits (fiscal deficit and the present account deficit), considerations over personal funding and job creation, and the persevering with misery within the MSME (Micro, Small and Medium Enterprises) sector. All this, along with a hike in coverage charges by the RBI – 190 foundation factors since March – is predicted to dampen the nascent consumption-led home restoration, even because the concern of a worldwide recession looms massive.

Whereas tax revenues have posted sturdy development, it’s being felt that the income development should flip higher throughout October-March, since non-tax revenues will not be anticipated to be substantial. “(In a slowing financial system) this is not going to be straightforward. We’ve got to assume what may be completed to handle this. Receipts ought to improve. In the event that they don’t, we might want to lower expenditure. The opposite possibility is to borrow extra, however then we’d wish to keep a good diploma of predictability. So, the area to manoeuvre shrinks,” an official concerned within the discussions stated.

The extra spending on account of inflated subsidies invoice and any additional extension to the free foodgrains scheme is seen as including to the fiscal burden, which can necessitate decreasing authorities expenditure. Some indicators of rationalisation in spending are already seen. Whereas capex development throughout April-August jumped 46.81 per cent, the Centre’s non-interest income expenditure development has contracted 3.31 per cent throughout the identical interval. “This (contraction) is a bit perplexing as to why the Union authorities is restraining its budgeted expenditure when there isn’t any shortfall on the tax income entrance,” stated Sunil Sinha, Principal Economist, India Scores.

The Funds had pegged the fiscal deficit at 6.4 per cent of the GDP for 2022-23, which it expects to keep up given the upside in GDP in nominal phrases because of excessive inflation. Within the overview conferences starting Monday, it’s anticipated that schemes which haven’t seen substantial offtake might get discontinued.

One other large fear is on the exterior entrance, with fears of additional aggressive charge hikes by the Federal Reserve leading to FII outflows. India’s present account funding wants proceed to be massive, with the deficit for the present monetary yr anticipated to widen to ranges final seen in 2013. Increased, costly imports and flagging exports because of a worldwide slowdown has resulted in increased commerce deficit. It has widened to $26.72 billion, with exports shrinking by 3.52 per cent to $32.62 billion in September.

The spill-over results of the persevering with aggressive financial tightening in america, the Chinese language slowdown because of a tough Covid-19 coverage, and the unpredictability of crude oil costs given a risky geo-political state of affairs, have solely difficult the administration of the exterior sector. The central financial institution’s intervention within the foreign money market to stop the rupee from depreciating extra sharply towards the US greenback has already resulted in a pointy dip within the nation’s foreign exchange reserves.

There may be some consolation to be drawn from an additional moderation in commodity costs because of demand dissipation within the world financial system. Crude stays a lingering fear although and with oil costs remaining on the boil, what’s of specific concern to policymakers is the restricted wriggle room obtainable to go on the advantages throughout brief home windows of low costs. The consequence being inflation could stay excessive for longer than anticipated as a result of fiscal intervention via increased subsidy might not be prudent.

On the expansion entrance, one main concern is that personal funding is just not exhibiting significant indicators of revival. Union Finance Minister Nirmala Sitharaman needed to not too long ago prod the trade to step up investments throughout a current interplay. The federal government’s guess on crowding in personal investments has not yielded a lot success “regardless of a number of interventions on the coverage aspect”, a authorities official stated.

Given the complexities, a relentless chorus amongst policymakers as of late is that fiscal and financial insurance policies should be in consonance. “The indicators will not be too brilliant globally. So, one has to maintain the armour on. We have to train most prudence. It will be significant that fiscal and financial insurance policies must be backing up one another quite than working at cross functions,” one other official concerned within the deliberations stated.