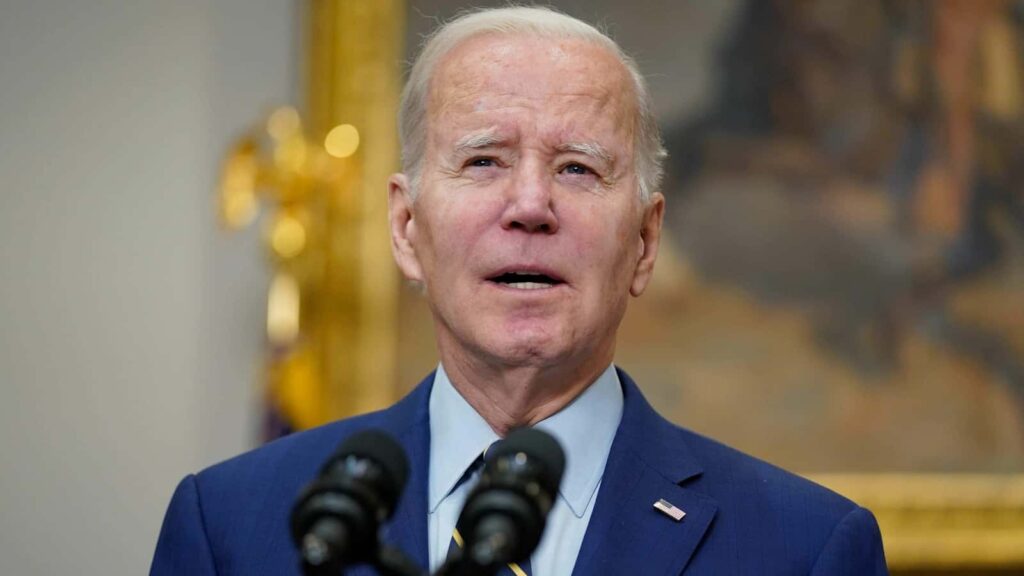

President Joe Biden on Monday reassured People that their banking system is safe within the wake of the collapse of SVB and mentioned he needs more durable rules to forestall future crises.

“People can believe that the banking system is protected. Your deposits can be there while you want them,” Biden mentioned in televised remarks from the White Home after Silicon Valley Financial institution’s failure and the federal takeover of a second financial institution.

Additionally Learn | ‘…for this mess’: Joe Biden reacts as Signature Financial institution closed after Silicon Valley Financial institution failure

Whereas the federal government is guaranteeing that SVB depositors get their a refund, “no losses can be borne by the taxpayers,” Biden mentioned.

“The cash will come from the charges that banks pay into the deposit insurance coverage.”

Biden challenged Congress to enact extra stringent rules, saying that “robust” safeguards introduced in after the 2008 monetary collapse had been undone beneath his Republican predecessor Donald Trump.

Additionally Learn | Biden speaks with California’s governor on Silicon Valley Financial institution, says White Home

“I’ll ask Congress and the banking regulators to strengthen the principles for banks to make it much less doubtless this type of financial institution failure would occur once more,” Biden mentioned.

He made clear he expects the results to fall on the shoulders of these accountable and that the federal government’s speedy response over the weekend was not a financial institution bailout, as occurred in 2008.

“We should get the total accounting of what occurred and why, (so) these accountable will be held accountable,” he mentioned.

Not solely will taxpayers not be responsible for masking the deposits, however “the administration of those banks can be fired,” he mentioned.

As soon as a financial institution is taken over by the federal government, “the folks working the financial institution shouldn’t work there anymore.”

Biden pressured that buyers who purchased into SVB weren’t getting bailed out.

“They knowingly took a danger and when the dangers did not repay, buyers lose their cash. That is how capitalism works,” he mentioned.