Earlier than turning into the proprietor of the NFL’s Carolina Panthers and MLS’s Charlotte FC, David Tepper made his identify (and cash) by way of Appaloosa Administration, a world hedge fund he based. Tepper, whose web value is round $20 billion, is among the prime 100 richest individuals on this planet. Evidently, he is had success within the investing world.

Given Tepper’s success, it is sensible that buyers would look to his and his hedge fund’s investments to realize ideas. Whereas the common investor and billionaire hedge fund managers do not have the identical danger tolerance or funding objectives, there’s nothing incorrect with seeking to them for inspiration.

Tepper’s portfolio is pretty concentrated, with virtually a 3rd being held in three “Magnificent Seven” shares. If buyers need strong companies with long-term sustainability, they want look no additional.

1. Amazon

Amazon (NASDAQ: AMZN) turned a family identify due to its e-commerce enterprise, nevertheless it has since branched out and change into a significant participant in a handful of industries.

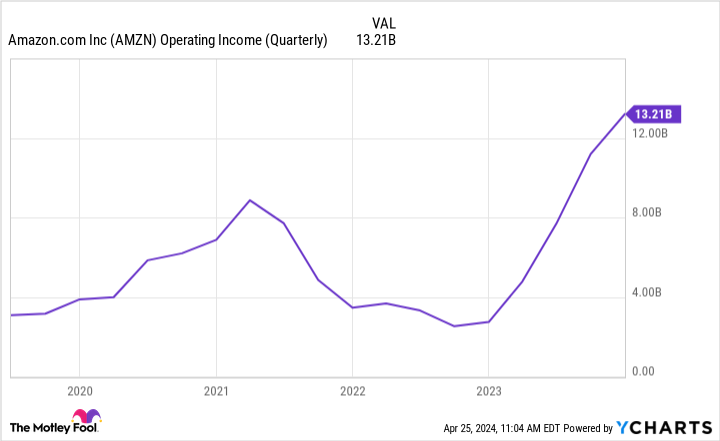

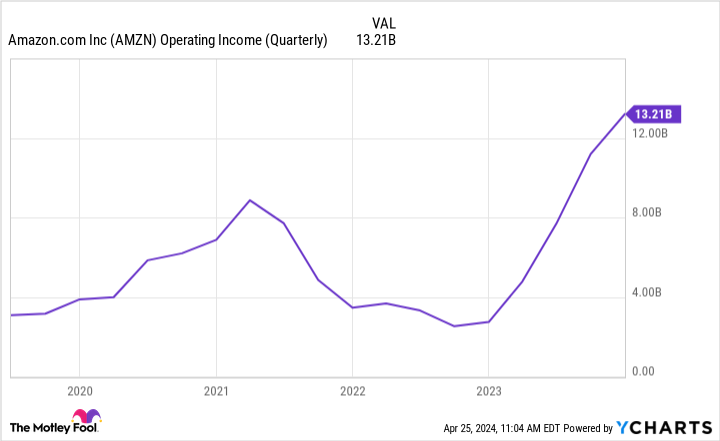

For some time, Amazon’s e-commerce enterprise was unprofitable and used primarily as a income generator. It is nonetheless Amazon’s greatest income supply, nevertheless it has lately change into worthwhile. Within the fourth quarter, Amazon’s North American section made round $6.5 billion in working earnings, a powerful turnaround from the $240 million it misplaced in This autumn 2022. Its worldwide section misplaced $419 million, which is not splendid, nevertheless it nonetheless leaves Amazon worthwhile in its non-Amazon Net Companies (AWS) companies.

There’s nonetheless room for progress in e-commerce, however a lot of Amazon’s progress will depend on its cloud service, AWS. Though AWS progress slowed lately, 13% year-over-year (YOY) progress is not too shabby for Amazon’s greatest profit-maker. AWS has a commanding market share in international cloud companies however has misplaced just a little floor over the previous yr. Nonetheless, its market share is 31%, which leads Microsoft‘s (NASDAQ: MSFT) Azure (a 24% share) and Alphabet’s Google Cloud (11%).

In the long run, Amazon stands to profit from the natural progress of cloud companies and e-commerce. Nevertheless, the corporate has additionally proven that it is keen to make investments in new industries. Take its $13.7 billion Complete Meals buy and healthcare ambitions, for instance. Traders can rely on the corporate not getting complacent.

2. Microsoft

There are numerous tech companies, after which there’s Microsoft, the poster youngster for casting a large web of companies.

Microsoft did not change into the world’s most beneficial public firm by chance; it is taken years of spectacular enterprise progress and a lift from AI mania. The latter can also carry the corporate by way of its subsequent phases of progress.

Microsoft’s strategic partnership with OpenAI — which provides it unique licenses to OpenAI’s massive language fashions (LLMs) — could possibly be precisely what it must additional strengthen its maintain on workplace software program. From Workplace (Excel, Phrase, PowerPoint, and many others.) to Azure to Groups, Microsoft is nearly unavoidable within the company world.

Microsoft’s abundance of company purchasers offers it an edge in making certain its longevity and shielding towards financial and market downturns. When occasions get arduous, customers can simply forego the latest smartphones or on-line purchasing, and companies can in the reduction of on their promoting. It is a lot tougher for corporations to cease utilizing Workplace software program, migrate their information off the cloud, or leap ship from established communication platforms like Groups.

With Microsoft, buyers might be assured they’re investing in an organization constructed for sustained progress over the lengthy haul.

3. Meta Platforms

Fb creator Meta Platforms (NASDAQ: META) continues to be one of many premier money cow companies, incomes round $36.5 billion in income in Q1, up 27% YOY.

Averaging 3.24 billion household each day lively individuals in March 2024 (up 7% YOY), Fb reveals why it continues to be a go-to for lots of the prime advertisers globally. Meta has capitalized on this, rising its household common income per particular person from $9.47 in Q1 2023 to $11.20 in Q1 2024.

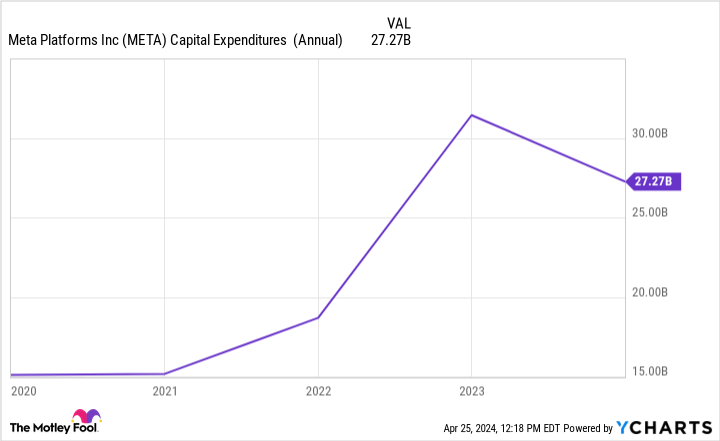

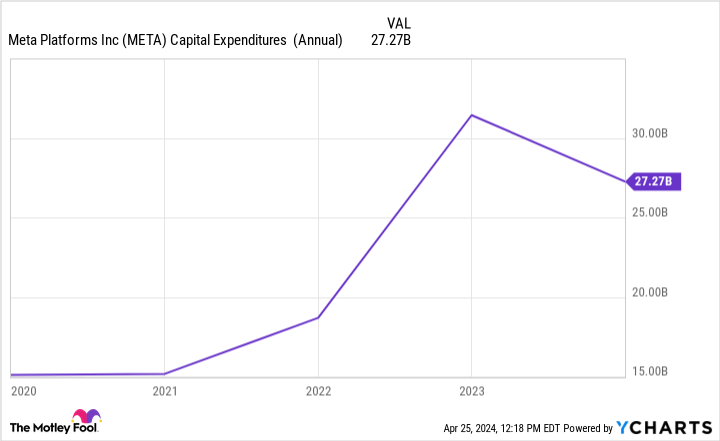

Regardless of the expansion in key metrics, Meta’s inventory plummeted after releasing its newest earnings, dropping as a lot as 15% on the identical day. A lot of that is due to the corporate’s spending plan going ahead, which largely surrounds its AI infrastructure. Meta stated it plans to spend $35 billion to $40 billion this yr, up from the prior $30 billion to $37 billion estimate.

Traders might not agree with the spending plan, however their response appears overreactive. The excellent news, although, is that its decrease valuation makes it a extra compelling entry level.

Traders must also recognize Meta’s new dividend of $0.50 per share. The dividend yield is not sufficient to please most income-seeking buyers, nevertheless it’s an incentive that may encourage buyers’ persistence as Meta works on its AI plans.

Must you make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Amazon wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $537,557!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of April 22, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Stefon Walters has positions in Microsoft. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

One Third of Billionaire David Tepper’s Portfolio Is Made Up of These 3 Magnificent Seven Shares was initially printed by The Motley Idiot