The U.S. inventory market, as measured by the S&P 500 Index

SPX,

has struggled this week general, throughout what is usually a seasonally bullish interval. That’s what Yale Hirsch termed “the Santa Claus rally” 60 years in the past. It covers the time interval of the final 5 buying and selling days of 1 yr and the primary two buying and selling days of the following yr.

Usually, SPX rallies slightly over 1% throughout that point interval. Aside from Thursday’s robust session, Santa is lacking in motion, however there’s nonetheless time. One of many uncomfortable side effects of this technique is that, if the market fails to register a achieve over that seven-day interval, it is a adverse indicator going ahead. Or as Hirsch so eloquently put it: “If Santa Claus ought to fail to name, bears might come to Broad and Wall.”

The SPX chart itself has resistance at 3900-3940, after the breakdown beneath 3900 in mid-December. Thus far, there was assist within the 3760-3800 space. Thus, the market is range-bound over the quick time period. Don’t anticipate that to final too lengthy. From a barely longer-term perspective, there’s heavy resistance as much as 4100, which is the place the inventory market rally failed in early December. On the draw back, there must be some assist at 3700, after which on the yearly lows at 3500. And, after all, the most important image remains to be that of a bear market, with the pattern traces sloping downward (blue traces within the accompanying graph of SPX).

We do not have a McMillan Volatility Band (MVB) sign in place right now. SPX wants to maneuver exterior of the +/-4σ “modified Bollinger Bands” so as to produce such a sign.

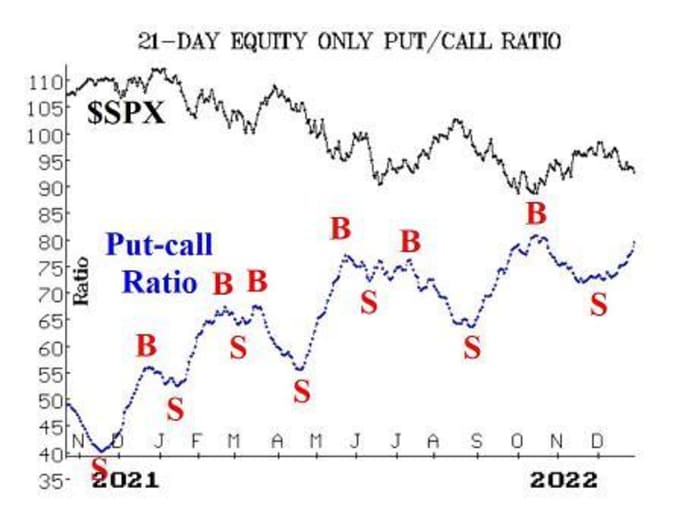

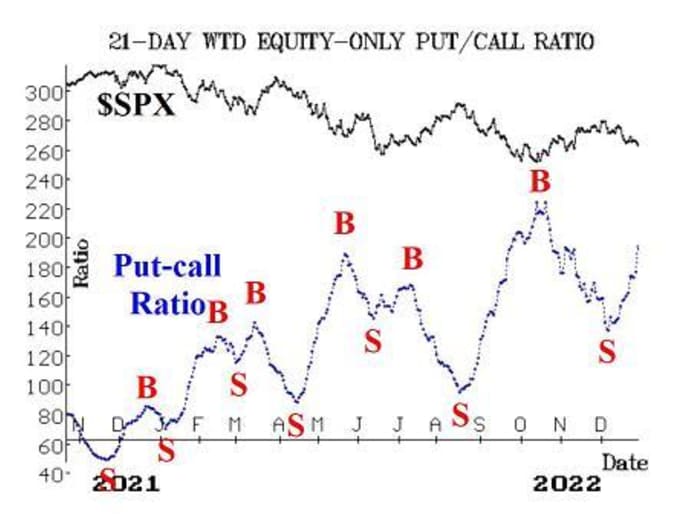

There was heavy put-buying not too long ago, and the put-call ratios have moved steadily increased due to it. These ratios have been on promote indicators for a few weeks now, and so long as they’re trending increased, these promote indicators will stay in place. That is true of the entire put-call ratios we comply with, particularly the 2 equity-only ratios (accompanying charts) and the overall put-call ratio. The CBOE equity-only put-call ratio registered an enormous quantity on December 28, however there are some arbitrage implications there, in order that quantity could also be over-stated. The normal ratio is nearing its yearly highs, which implies it’s positively in oversold territory, and the weighted ratio is starting to method oversold ranges as nicely. Nonetheless, “oversold doesn’t imply purchase.”

Market breadth has been poor, and thus our breadth oscillators stay on promote indicators, albeit in oversold territory. The NYSE breadth oscillator has tried to generate purchase indicators on two latest events, however in the end failed. The “shares solely” breadth oscillator has not generated a purchase sign. We additionally watch the differential of those two oscillators, and it’s oversold territory as nicely — after having had a not too long ago failed purchase sign.

One space that’s enhancing slightly is that of recent 52-week highs on the NYSE. For the final couple of days, the variety of new highs has exceeded 60. That won’t sound like a lot, and it isn’t, actually — but it surely’s an enchancment. Nonetheless, for this indicator to generate a purchase sign, the variety of new highs must exceed 100 for 2 consecutive days. That could be a tall order proper now.

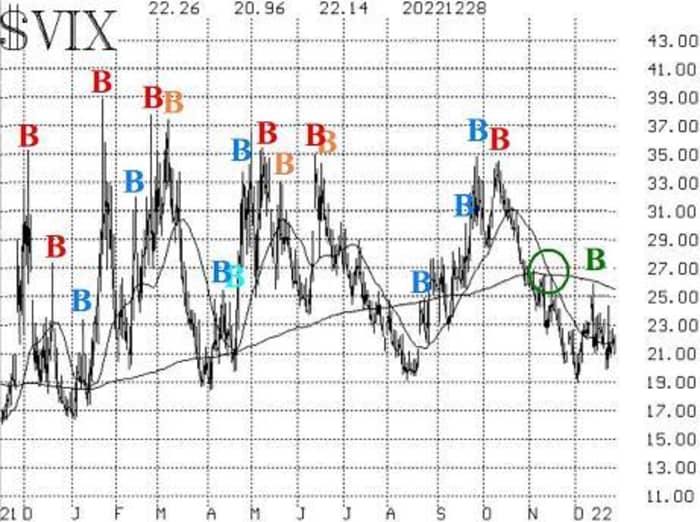

The world of most optimism is that of volatility (VIX, particularly). VIX

VIX,

continues to be in its personal world. Sure, it has risen barely over the previous two days, in what appears to be a concession to sharply declining inventory costs, however general, the technical indicators from VIX are nonetheless bullish for shares. There’s a “spike peak” purchase sign in place, and the pattern of VIX purchase sign can be nonetheless energetic. VIX must shut above its 200-day transferring common (at the moment at 25.50 and declining) to cancel out the pattern of VIX purchase sign, and it must shut above 25.84 (the spike peak of mid-December) to cancel out the “spike peak” purchase sign.

The assemble of volatility derivatives stays bullish in its outlook for shares, as nicely. The time period constructions of each the VIX futures and of the CBOE Volatility Indices slope upward. Furthermore, the VIX futures are all buying and selling at wholesome premiums to VIX. These are optimistic indicators for shares.

In abstract, we proceed to take care of a “core” bearish place, due to the downtrend on the SPX chart and due to the latest breakdown beneath 3900. There are additionally adverse indicators from put-call ratios and breadth (though each are in oversold territory). The one present purchase indicators are emanating from the volatility advanced. So, we are going to proceed to commerce confirmed indicators round that “core” place.

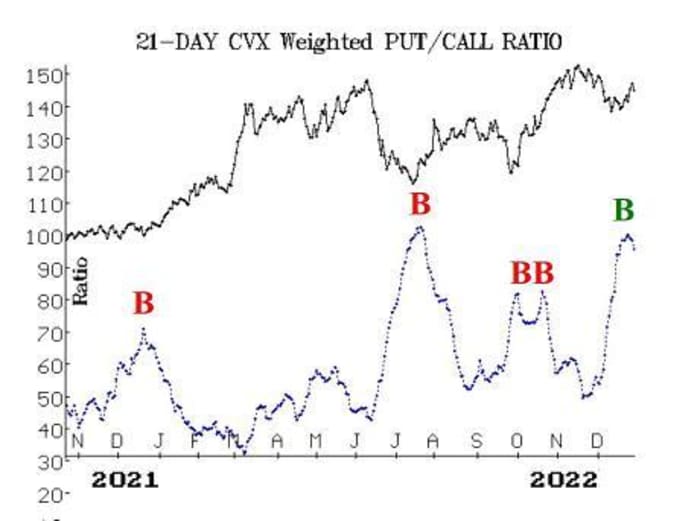

New suggestion: Chevron (CVX)

There’s a new put-call ratio purchase sign in Chevron

CVX,

coming from an excessive oversold situation. So, we’re going to take an extended place right here:

Purchase 1 CVX Feb (17th) 180 name

At a worth of seven.20 or much less.

CVX: 177.35 Feb (17th) 180 name: 7.00 bid, provided at 7.20

We are going to maintain this place so long as the put-call ratio of CVX stays on a purchase sign.

Observe-Up Motion:

All stops are psychological closing stops until in any other case famous.

We’re utilizing a “normal” rolling process for our

SPY,

spreads: in any vertical bull or bear unfold, if the underlying hits the quick strike, then roll all the unfold. That may be roll up within the case of a name bull unfold, or roll down within the case of a bear put unfold. Keep in the identical expiration, and maintain the space between the strikes the identical until in any other case instructed.

Lengthy 2 SPY Jan (20th) 375 places and Brief 2 Jan (20th) 355 places: that is our “core” bearish place. So long as SPX stays in a downtrend, we need to preserve a place right here.

Lengthy 2 KMB Jan (20th) 135 calls: relies on the put-call ratio in Kimberly-Clark

KMB,

That ratio has now rolled over to a promote sign, so promote these calls to shut the place.

Lengthy 2 IWM Jan (20th) 185 at-the-money calls and Brief 2 IWM Jan (20th) 205 calls: That is our place primarily based on the bullish seasonality between Thanksgiving and the second buying and selling day of the brand new yr. Exit this iShares Russell 2000 ETF

IWM,

place on the shut of buying and selling on Wednesday, January 4, the second buying and selling day of the brand new yr.

Lengthy 1 SPY Jan (20th) 402 name and Brief 1 SPY Jan (20th) 417 calls: this unfold was purchased on the shut on December 13th, when the newest VIX “spike peak” purchase sign was generated. Cease your self out if VIX subsequently closes above 25.84. In any other case, we are going to maintain for 22 buying and selling days.

Lengthy 1 SPY Jan (20th) 389 put and Brief 1 SPY Jan (20th) 364 put: this was an addition to our “core” bearish place, established when SPX closed beneath 3900 on December 15th. Cease your self out of this unfold if SPX closes above 3940.

Lengthy 2 PCAR Feb (17th) 97.20 places: These places on Paccar

PCAR,

had been purchased on December 20th, once they lastly traded at our purchase restrict. We are going to proceed to carry these places so long as the weighted put-call ratio is on a promote sign.

Lengthy 2 SPY Jan (13th) 386 calls and Brief 2 SPY Jan (13th) 391 calls: that is the commerce primarily based on the seasonally optimistic “Santa Claus rally” time interval. There is no such thing as a cease for this commerce, aside from time. If SPY trades at 391, then roll all the unfold up 15 factors on both sides. In any case, exit your spreads on the shut of buying and selling on Wednesday, January 4 (the second buying and selling day of the brand new yr).

All stops are psychological closing stops until in any other case famous.

Lawrence G. McMillan is president of McMillan Evaluation, a registered funding and commodity buying and selling advisor. McMillan might maintain positions in securities advisable on this report, each personally and in consumer accounts. He’s an skilled dealer and cash supervisor and is the creator of the best-selling e book, Choices as a Strategic Funding. www.optionstrategist.com

Ship inquiries to: lmcmillan@optionstrategist.com.

Disclaimer: ©McMillan Evaluation Company is registered with the SEC as an funding advisor and with the CFTC as a commodity buying and selling advisor. The knowledge on this publication has been rigorously compiled from sources believed to be dependable, however accuracy and completeness are usually not assured. The officers or administrators of McMillan Evaluation Company, or accounts managed by such individuals might have positions within the securities advisable within the advisory.