Markets transfer in cycles, some massive, some small. 2021 noticed a robust bullish pattern, the strongest in many years; it was adopted by a robust bearish pattern, the strongest in many years, in 2022. This yr opened with a flip again up that lasted by most of January. And in February, there was a pause. A short pause, probably, earlier than we begin the subsequent leg up, not less than in accordance with Oppenheimer chief technical strategist Ari Wald.

Wald notes that the S&P 500 has reversed final yr’s bear run, and that regardless of volatility to date this month that reversal stays intact above 3,950. The truth is, the S&P 500 index stands now at 4,137 and is pointing again upwards.

“Whereas we count on the bull market to proceed,” Wald says, “we reiterate it gained’t be a straight line greater, both. Nonetheless, the purpose is that buyers must be pondering when it comes to shopping for weak point relatively than promoting energy, in our view. With top-down headwinds easing, we additionally suggest inserting larger emphasis on figuring out rising relative energy, and fewer emphasis on market timing. With this in thoughts, we make the case that the Financials sector is positioned to steer the subsequent leg of the advance.”

Entering into particulars, Wald provides, “Capital Markets is our prime business concept for Financials sector publicity based mostly on its long-term pattern of upper relative lows since 2012. The business is supported by broader inside breadth and is nearer to a relative breakout too, by our evaluation.”

In opposition to this backdrop, we’ve used the TipRanks database to drag up particulars on two shares, from the Capital Markets business, that Oppenheimer has tapped as Prime Concepts for 2023. Are these the best shares on your portfolio? Let’s take a better look.

KKR & Co. Inc. (KKR)

The primary Oppenheimer choose we’re wanting at is KKR, a worldwide funding and asset administration agency, providing companies to a world-wide clientele. KKR follows a mannequin that brings third-party capital into reference to the capital markets enterprise, giving the assets to do all the things from taking firms by the method of going public to underwriting new market offers to investing in debt and fairness. The corporate mobilizes long-term capital into these functions, producing strong returns over time for fund buyers and stockholders.

As of the tip of 4Q22, the corporate had over $504 billion in whole belongings below administration, up from $470.6 billion a yr earlier than. The asset administration portfolio introduced in over $693 million in income, with one other $1.835 billion coming from the insurance coverage service section, for a complete GAAP income of $2.53 billion for the quarter. This was down from $4.05 billion in the identical quarter final yr, however topped Wall Road expectations of $1.41 billion. The corporate stays solidly worthwhile, as adj. EPS got here in at $0.92, trumping the Road’s name for $0.85.

Total, KKR completed 2022 with sound capital metrics. The corporate had $108 billion in uncalled commitments, representing capital accessible for deployment, and even thought final yr was a troublesome financial surroundings, KKR raised $16 billion in capital throughout 2022.

In his protection of this inventory for Oppenheimer, 5-star analyst Chris Kotowski continues to take an upbeat stance on KKR’s prospects regardless of the challenges forward. He writes, “We’re not out of the clear simply but as challenges stay from the 2022 backdrop; nevertheless, we discover ourselves with continued confidence within the KKR engine given its resilience on all fronts (fundraising, deployment, efficiency) and ongoing, balance-sheet bolstered versatile progress—each natural and strategic… We proceed to suppose KKR is a really compelling funding.”

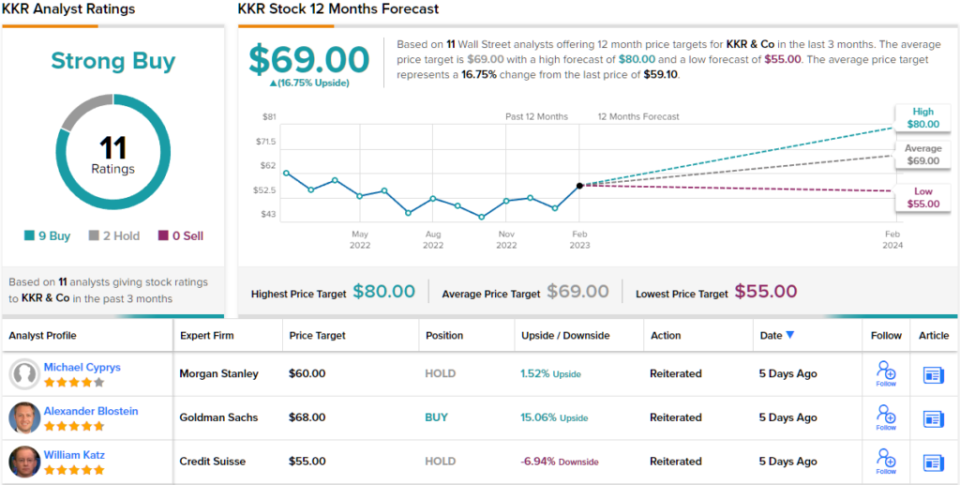

Kotowski goes on to reiterate his Outperform (i.e. Purchase) ranking on KKR shares, and his $80 value goal implies a one-year achieve of 35% ready within the wings. (To look at Kotowski’s monitor file, click on right here)

Total, KKR shares have a Robust Purchase ranking from the analyst consensus, displaying that Wall Road agrees with Kotowski’s evaluation. The ranking relies on 9 Buys and a couple of Holds set previously 3 months. (See KKR inventory forecast)

Goldman Sachs Group (GS)

The subsequent inventory we’re is among the main names in banking, the Goldman Sachs Group. GS is a world financial institution holding firm, one in all listed companies on the Dow Jones Industrial Common, and a big-name participant in buying and selling and investments, asset administration, and securities companies. Goldman primarily serves different establishments, equivalent to banks, companies, and governments, however has been recognized to tackle small numbers of particular person purchasers with ultra-high internet price.

In final month’s monetary launch for This fall and full yr 2022, the financial institution reported year-over-year drops in each revenues and earnings. Beginning on the prime line, Goldman had $10.59 billion in income, down 16% from the prior yr quarter. On the backside line, earnings plunged 66% from a yr earlier to $1.33 billion, or $3.32 per share. Each figures missed Road expectations.

Widespread shareholders, nevertheless, haven’t performed too badly. Goldman maintained an ROE of 10.2% for all of 2022 and 4.4% for This fall; these numbers may be in comparison with 11% and 4.8% from the prior yr. All in all, in a yr buffeted by excessive inflation and rising rates of interest, GS shares introduced a sound return to buyers.

Oppenheimer’s Chris Kotowski sees returns on fairness has a key level right here, writing: “Even when a gradual funding banking surroundings persists, we’d count on GS to take care of a double-digit ROTCE and suppose the inventory is oversold at simply 1.2x tangible ebook… Goldman’s comparatively new senior administration group has launched into a sequence of initiatives to boost ROTE, which has averaged roughly 11% in recent times, to not less than 15%. We predict this effort has a robust risk of success as a result of the corporate has a robust franchise and there are a number of income, value, and capital optimization methods that may be applied, however the market continues to be valuing the inventory as if the returns will stay unchanged indefinitely.”

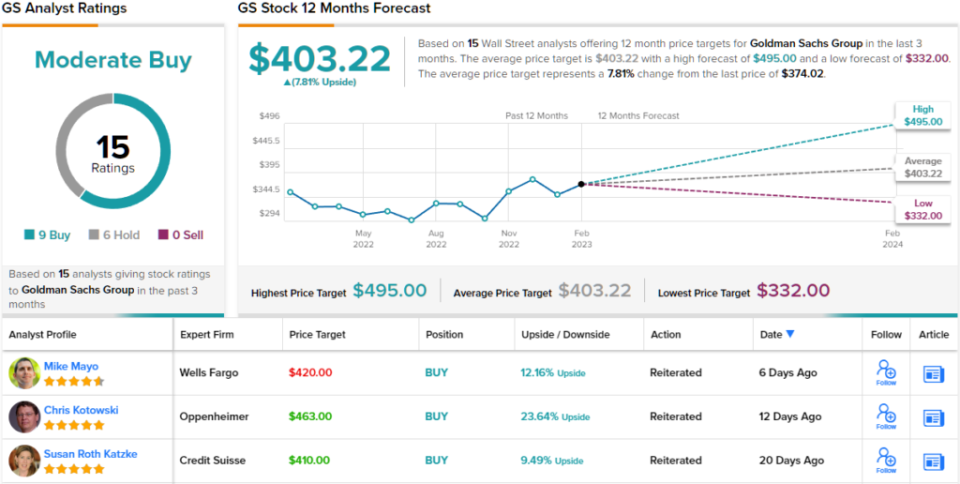

Wanting forward, Kotowski units an Outperform (i.e. Purchase) ranking on GS shares, together with a $441 value goal that implies a one-year upside potential of ~24%.

So we now have one 5-star analyst popping out for the bulls on this one – however what does the remainder of the Road make of GS’s prospects? The inventory has picked up 15 current analyst critiques, and so they embody 9 Buys and 6 Holds, for a Average Purchase consensus view. (See Goldman Sachs inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely essential to do your individual evaluation earlier than making any funding.