One factor is definite nowadays, and that’s uncertainty. Markets stay risky, as a collection of knowledge releases have buyers considerably uncertain whether or not excessive inflation, rising rates of interest, or a doable recession – or maybe all three without delay – will come to dominate the forecasts. The consequence: day-to-day value swings and sharp modifications that make predictions a dangerous enterprise.

Not each economist, nonetheless, is prepared to throw within the towel, and the tough market surroundings hasn’t put the scare on John Stoltzfus. The chief funding strategist from Oppenheimer stays bullish on shares, and in his month-to-month report on market technique, he lays out why.

“Our longer-term outlook for the US financial system and the inventory market stays decidedly bullish. We imagine US financial fundamentals stay on strong footing. As soon as inflation begins to average, US development ought to start to get well, supported by shopper demand and enterprise funding,” Stoltzfus opined.

Acknowledging the present volatility, and the excessive threat of a harmful financial recession, Stoltzfus goes on to say, “We are able to’t say that the market has bottomed at these ranges or that the bear market won’t grind on for a while to come back, however with a lot dangerous information already priced in, the potential rewards of investing at these ranges are trying extra engaging relative to the dangers.”

Taking Stoltzfus’ outlook into consideration, we wished to take a more in-depth take a look at three shares incomes a spherical of applause from Oppenheimer, with the agency’s 5-star analysts forecasting over 30% upside potential for every. Utilizing TipRanks’ database, we realized that the remainder of the Avenue is in settlement, as all three boast a “Sturdy Purchase” analyst consensus.

CSG Techniques Worldwide (CSGS)

The primary Oppenheimer decide is CSG Techniques Worldwide, a software program and companies firm within the enterprise assist methods (BSS) area of interest. CSG’s platforms, accessible on the SaaS mannequin, supply a variety of capabilities, together with income administration and monetization, wholesale and accomplice administration, and cost and service provider companies. The corporate has a worldwide attain, and works with well-known manufacturers as Bell, Comcast, and Dish.

CSG has introduced regular efficiency over the previous a number of years, with the latest 3Q22 outcomes being thought of pretty typical. On the high line, whole income was reported at 273.3 million, up 3.8% year-over-year. On the backside line, the corporate’s outcomes have been cut up; GAAP EPS was down 20% y/y, from 50 cents to 40 cents, whereas non-GAAP EPS was up 20.5%, from 88 cents to $1.06.

On the steadiness sheet, CSG’s money flows have been down y/y. Money from operations declined from $46.1 million to $22.8 million, whereas free money movement fell from $38.7 million to $10.9 million. The corporate attributed the decline to ‘unfavorable modifications in working capital.’

Despite the fact that the money flows have been down CSGS maintained its common share dividend cost, as a part of a $91 million year-to-date capital return to shareholders. The Q3 dividend was set at 26.5 cents per frequent share, and totaled $8 million paid out within the quarter. Annualized, the dividend is $1.06 and yields 1.9%, about common for the broader markets. The corporate has been regularly elevating the dividend cost over the previous 9 years.

In his protection of CSG Techniques for Oppenheimer, 5-star analyst Timothy Horan provides a number of causes to imagine that this firm will convey long-term features for buyers. Horan writes, “The corporate has traditionally been a constant money cow serving MSOs (née ‘Cable Providers Group’), however the base enterprise is accelerating from: 1) digital, 5G, and cloud, 2) CSG’s taking share from much less centered rivals, and three) new administration’s reorienting its modular SaaS-and cloud-native buyer engagement choices to faster-growing geographies and verticals outdoors the communications service suppliers (CSPs). The method will take time, however ought to increase development and valuation.”

Horan interprets his upbeat view of CSG’s ahead prospects into numbers with a $75 value goal – which means an upside of ~36%. It is not stunning, then, why he charges the inventory an Outperform (i.e. Purchase). (To observe Horan’s observe file, click on right here)

Total, there are 3 latest analyst critiques on file for CSGS, they usually all agree that it’s a inventory to purchase – making the Sturdy Purchase analyst consensus unanimous. The inventory has a mean value goal of $74, implying ~34% one-year upside from the present buying and selling value of $55.26. (See CSGS inventory forecast on TipRanks)

Wag! Group Co. (PET)

The subsequent inventory we’ll take a look at is Wag! Group, an up-and-coming on-line app providing customers entry to a full vary of pet care companies, together with canine strolling, pet sitting, recommendation, and even pet coaching. The corporate boasts a web-based group of greater than 400,000 pet caregivers, and has accomplished transactions for greater than 12 million pet care companies since its 2015 founding.

This inventory is a brand new one on the general public markets, having entered the NASDAQ alternate earlier this 12 months by way of a enterprise mixture merger – a SPAC transaction. The merger was with CHW Company, and was authorised on July 28. The PET ticker began buying and selling on August 10. At its closing, the transaction internet Wag! Group roughly $350 million in gross capital.

Final month, Wag! launched monetary outcomes for 3Q22, exhibiting high line income of $15.4 million, for a 161% year-over-year achieve. The corporate’s income achieve was pushed by a powerful improve in gross bookings over the interval, from $13.7 million one 12 months in the past to $25.3 million in latest report – or y/y development of 85%.

On the similar time, throughout this era, the corporate’s internet earnings fell sharply, from $1.6 million in 3Q21 to a 3Q22 internet lack of $40.9 million. Wag! attributed that shift to one-time inclusion of COVID-era PPP mortgage forgiveness. Excluding that issue, the corporate noticed a $1.4 million loss within the 3Q22.

Throughout 3Q22, Wag! reported vital features on buyer metrics. The corporate reached a complete of 473,000 platform individuals throughout the quarter, up 22% y/y and elevated its Pet Father or mother Wag! Premium program penetration to 53%, beating the corporate aim of fifty%.

Oppenheimer’s Jason Helfstein, a high analyst with a 5-star ranking from TipRanks, sees loads of causes for buyers to purchase up shares of this newly public inventory. Stepping into some specifics, and his outlook for the corporate’s longer-term prospects, Helfstein writes: “We imagine the corporate is nicely positioned to develop as pet companies shift on-line… We imagine the overall addressable market (TAM) for on-line pet care can be a $24B alternative by 2028, pushed by the secular shift of shoppers buying companies/merchandise through on-line platforms. We estimate the US On-line Pet Care business grew 98% y/y in 2021, as ~20M households adopted a pet throughout the pandemic lockdown.”

“Our 2026 service estimate would suggest 190K households utilizing the platform 2.0x weekly. That is 3% of our estimated 7.4M households which may shift to on-line dog-walking and pet service bookings. Presently modeling constructive EBITDA profitability in FY24 and no want for extra funding,” Helfstein added.

Maintaining his optimistic view, Helfstein charges PET an Outperform (i.e. Purchase), and his $5 value goal implies a one-year upside potential of a powerful 132%. (To observe Helfstein’s observe file, click on right here)

Total, all three of the latest analyst critiques on PET are constructive, making the consensus ranking right here a unanimous Sturdy Purchase. The inventory is promoting for $2.15, and its $5.50 common value goal suggests a bullish 156% upside potential by the top of 2023. (See PET inventory forecast on TipRanks)

Datadog, Inc. (DDOG)

Final up is Datadog, a cloud software program agency providing observability instruments, the instruments wanted to watch, observe, and safe cloud-based web sites in actual time. Datadog’s package deal of cloud-based software program instruments contains automation, supply management, bug monitoring, troubleshooting, optimization, and fundamental monitoring instrumentation. Prospects can use Datadog’s software program and repair to look and navigate web site logs, comply with key metrics and web site traces, and make proactive administration decisions based mostly on high-quality datasets.

The corporate gives investor a historical past of constant EPS beats. Datadog’s final reported quarter, 3Q22, confirmed a backside line of 23 cents per diluted share, in comparison with the 16-cent forecast, for a 43% beat. Income in the identical quarter was up 61% y/y, reaching $436.5 million.

The highest and backside traces weren’t the one constructive metrics. Datadog additionally noticed $83.6 million in whole money from operations, which included $67.1 million in free money movement. As of the top of Q3, September 30, Datadog had $1.8 billion in money and liquid belongings accessible.

Wanting forward, there may be motive for continued optimism. Datadog’s ‘high-yield’ prospects, outlined as prospects with at the very least $100K in annual recurring income (ARR), reached 2,600 on the finish of Q3, up from 1,800 one 12 months earlier, for a 44% y/y improve.

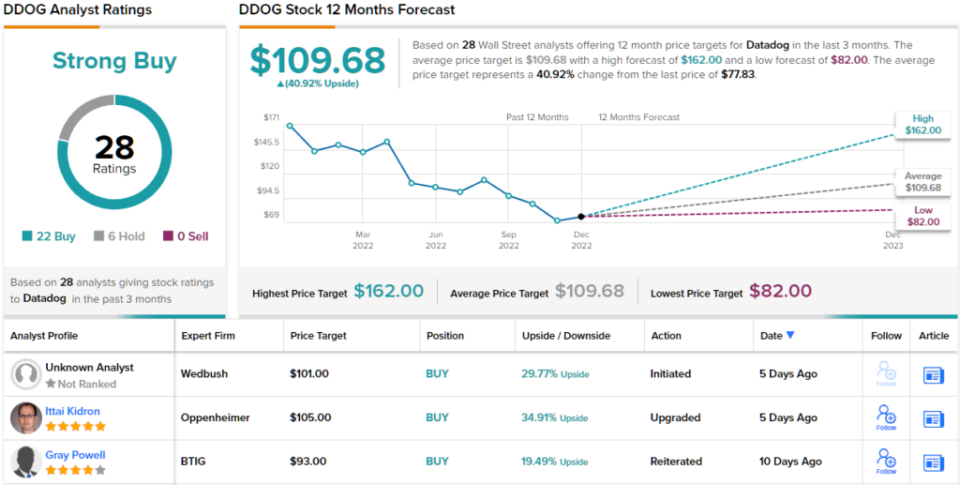

All of this exhibits that Datadog has a strong basis to maneuver ahead, and Ittai Kidron, one other of Oppenheimer’s 5-star analysts, would agree. The analyst says of Datadog, “The corporate has a powerful historical past of outperforming expectations, by no means lacking consensus expectations, and sometimes guiding above the Avenue… Whereas not recession-proof, the mission-critical nature of its options provides Datadog relative resiliency in occasions of spending constraints. The corporate has additionally expanded into safety, capitalizing on ‘shift-left’ efforts in safety and its sturdy standing with builders, providing massive TAM growth and a protracted tail of development.”

On the backside line, Kidron describes this firm as ‘a core long-term holding.’ Befitting this upbeat view of Datadog’s total excellence as an funding, Kidron charges DDOG an Outperform (i.e. Purchase), with a $105 value goal suggesting ~35% one-year achieve within the offing. (To observe Kidron’s observe file, click on right here)

With 28 latest analyst critiques on file, together with 22 Buys towards 6 Holds, Datadog shares get a Sturdy Purchase consensus from the Avenue’s execs. The inventory is promoting for $77.83 and its common value goal of $109.68 implies ~41% upside over the following 12 months. (See DDOG inventory forecast on TipRanks)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather vital to do your personal evaluation earlier than making any funding.