(Bloomberg) — There wasn’t a lot sunshine within the stack of Wall Avenue forecasts that predicted 2023 would convey a worldwide financial contraction and tough going for danger property. However as January buying and selling picks up steam, a small cadre of optimists is breaking away from consensus and betting a tender touchdown can ship market features.

Most Learn from Bloomberg

David Kelly, chief international strategist at JPMorgan Asset Administration, is betting that inflation will proceed to ease in 2023, serving to the US economic system to narrowly escape a recession. Ed Yardeni, the longtime inventory strategist and founding father of his namesake analysis agency, is placing the percentages of a tender touchdown at 60% primarily based on sturdy financial knowledge, resilient shoppers and indicators of tumbling value pressures.

“In the event you speak to folks, they are saying it’s the worst of all potential worlds,” Kelly stated in an interview. “It’s not — inflation is coming down, unemployment is low, we’re transferring previous the pandemic. The possibilities are danger property are going to do very nicely.”

An virtually 20% hunch in international shares final 12 months has most analysts and traders erring on the facet of warning, with the bulk predicting that traditionally excessive inflation is right here to remain and a recession is inevitable. Kelly, who thinks the Federal Reserve will wrap up its historic climbing cycle after the March assembly and begin slicing charges within the fourth quarter, says the pessimism could present good alternatives to purchase US worth shares and funding grade credit score at discounted costs.

Yardeni, who doesn’t rule out the potential of a tough touchdown, sees alternatives in monetary, industrial, vitality and expertise shares that he says now look less expensive than they did final 12 months. The bonds of such corporations may additionally carry out nicely in 2023, he stated.

“Optimists and pessimists agree that 2022 was a horrible 12 months for shares and bonds nevertheless it doesn’t go on endlessly,” Yardeni stated in an interview. “The market has responded to the truth that inflation has turned out to be extra persistent and the Fed to be extra aggressive.”

Financial knowledge revealed Friday bolstered the case for optimism. One other sturdy US jobs report confirmed hiring development exceeded expectations as wage features slowed greater than anticipated. Euro-area inflation returned to single digits for the primary time since August, fueling hopes that the bloc’s worst-ever spike in shopper costs has peaked.

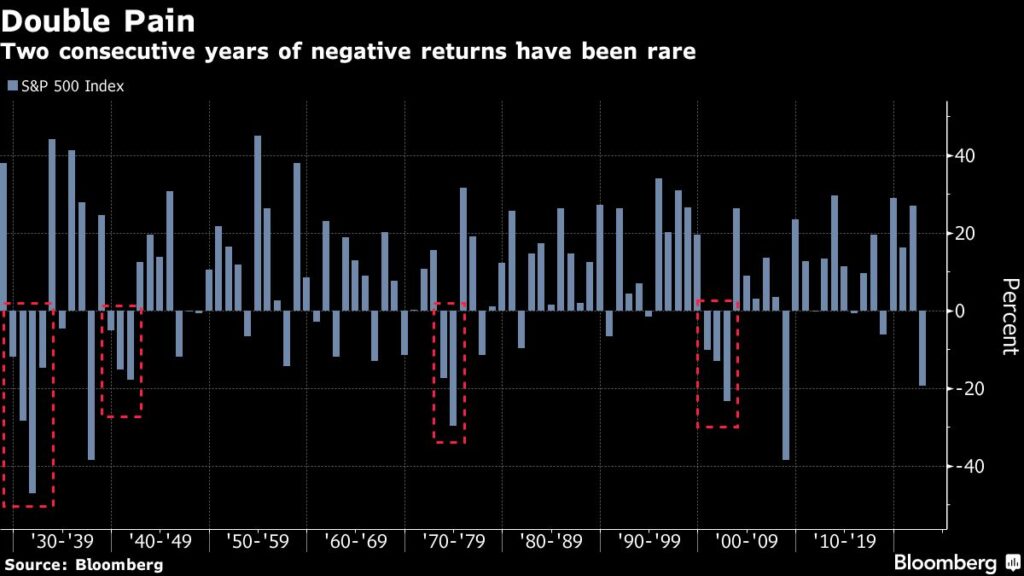

Consecutive down years are very uncommon for the S&P 500, having taken place on simply 4 events since 1928. But after they have occurred, drops within the second 12 months have at all times been deeper than within the first, with a mean decline of 24%. The typical year-end goal for the S&P 500 amongst strategists surveyed by Bloomberg in December was 4,078, which might suggest a 6% achieve for the index, although that largely displays the massive hunch that passed off on the finish of the 12 months. In November, the common forecast was for a decline.

Analysis from Bespoke Funding Group suggests year-end targets are often about 5 share factors off in both course anyway. “We don’t typically do targets, simply because we expect they need to be taken with a grain of salt,” stated Bespoke cofounder Paul Hickey. “If there’s one factor I’ve discovered by expertise, it’s that when there’s such widespread settlement on something, issues don’t often play out as deliberate.”

Recession odds are ebbing within the credit score market, the place the hole between default swap spreads of high-grade corporations and their junk counterparts has fallen greater than 100 foundation factors since September. Referred to as “compression” in market parlance, it factors to much less worry {that a} sharp financial downturn will go away the weakest credit weak to default. Even so, the measure stays above pre-pandemic ranges.

A Financial institution of America measure of strategists’ sentiment appears to again up Kelly’s view that market consensus is just too pessimistic. It has tumbled a lot that it’s now signaling a return of round 16% within the subsequent 12 months. An important change that’s taken place since final 12 months, he says, is that costs have fallen, creating alternatives “in every single place.” Index members within the S&P are buying and selling at about 17 instances projected 12-month income, consistent with its common studying this century.

“One decision I’ve made initially of 2023 is to keep away from unreasonable gloom,” Kelly wrote in a observe. “A brand new 12 months, like a brand new child, deserves to be greeted with optimism.”

–With help from Jan-Patrick Barnert and Vildana Hajric.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.