(Bloomberg) — Palantir Applied sciences Inc., the info evaluation firm co-founded by Peter Thiel, stated it was worthwhile for the primary time within the fourth quarter, and expects 2023 to be its first-ever worthwhile 12 months.

Most Learn from Bloomberg

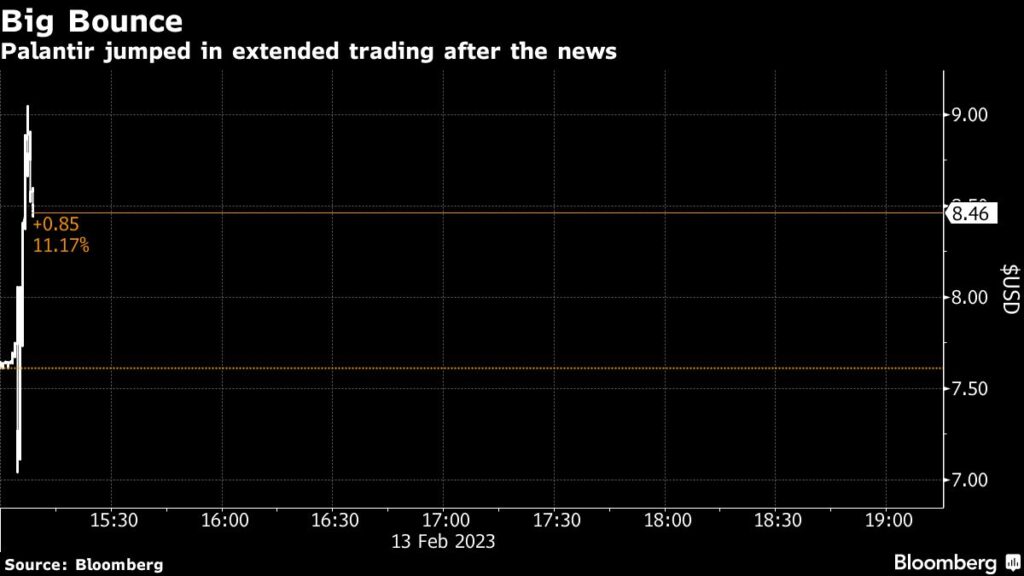

The inventory surged as a lot as 23% in prolonged buying and selling after the outcomes had been launched.

The corporate stated on Monday it earned 1 cent per share in the course of the fourth quarter utilizing typically accepted accounting ideas, exceeding analyst expectations for a 3-cent loss. Profitability was helped alongside by higher-than-anticipated income, fueled by progress in gross sales to governments, and decrease prices associated to inventory compensation.

“A threshold has been crossed, and that is the beginning of our subsequent chapter,” Palantir Chief Govt Officer Alex Karp wrote in a letter to shareholders. “We count on to generate a revenue for the present fiscal 12 months, our first worthwhile 12 months within the historical past of our firm.”

RBC Capital Markets analyst Rishi Jaluria stated Palantir is delivering annual revenue two years sooner than anticipated, however some issues stay over progress. “The numbers aren’t significantly sturdy,” he stated, including that Palantir’s industrial enterprise is particularly weak given the broader pattern towards declining IT budgets. “The factor that stunned individuals is the revenue” for 2023, he stated.

Palantir reported $508.6 million in gross sales within the fourth quarter. Analysts had been anticipating income of $505.1 million, in accordance with knowledge compiled by Bloomberg.

For 20 years, the Denver-based firm has been offering knowledge evaluation software program to the US authorities and its allies, famously eschewing doing enterprise with China and different nations thought of American rivals. In recent times, it’s additionally made a concerted effort to push into industrial enterprise, working with firms like Airbus SE, Merck & Co. and Ferrari.

Palantir’s income from its industrial shoppers, a carefully watched metric, elevated 11% to $215 million, consistent with analyst estimates. In a convention name on Monday, Karp stated that firms exterior the US had been a weak spot. “You simply have an absence of receptivity to new expertise in components of Europe,” he stated.

In his letter to shareholders Karp described the two-year-old industrial gross sales group as “fledgling,” and stated that the surge in firms in search of to make use of synthetic intelligence will assist drive progress at Palantir over the long run.

“The more and more widespread adoption of synthetic intelligence in civilian functions will come quickly,” he wrote. “Within the army context, it has already arrived.”

On the decision, Palantir Chief Expertise Officer Shyam Sankar stated that the corporate had an eventful 2022. “Our software program foiled a plot to overthrow the German authorities, delivered $200 million in worth to Tyson Meals and powered (individuals) by means of the power disaster,” he stated.

The corporate’s gross sales to governments elevated 23% to $293 million in the course of the fourth quarter, with $225 million of that coming from offers with the US.

The corporate is coming off a tough 2022, when shares misplaced virtually two-thirds of their worth. After recouping a few of these declines in 2023, Palantir at this time has a market capitalization of about $16 billion.

The corporate’s adjusted working margin was 22% within the fourth quarter, greater than analyst estimates of 15.75%.

(Updates with government feedback in eighth paragraph.)

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.