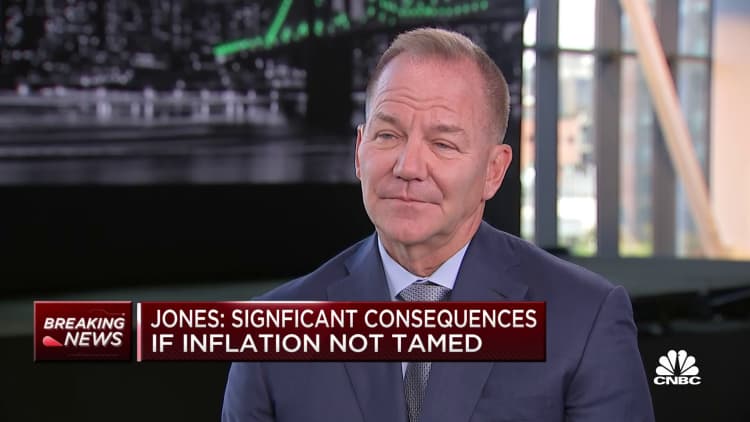

Billionaire hedge fund supervisor Paul Tudor Jones believes the U.S. financial system is both close to or already in the course of a recession because the Federal Reserve rushed to tamp down hovering inflation with aggressive fee hikes.

“I do not know whether or not it began now or it began two months in the past,” Jones mentioned Monday on CNBC’s “Squawk Field” when requested about recession dangers. “We at all times discover out and we’re at all times stunned at when recession formally begins, however I am assuming we’re going to go into one.”

The Nationwide Bureau of Financial Analysis is the official arbiter of recessions, and makes use of a number of elements in making its willpower. The NBER defines recession as “a major decline in financial exercise that’s unfold throughout the financial system and lasts quite a lot of months.” Nonetheless, the bureau’s economists profess not even to make use of gross home product as a main barometer.

GDP fell in each the primary and second quarters, and the primary studying for the Q3 is launched October 27.

The founder and chief funding officer of Tudor Funding mentioned there’s a particular recession playbook to comply with for traders navigating the treacherous waters, and historical past reveals that threat property have extra room to fall earlier than hitting a backside.

“Most recessions final about 300 days from the graduation of it,” Jones mentioned. “The inventory market is down, say, 10%. The very first thing that may occur is brief charges will cease going up and begin taking place earlier than the inventory market really bottoms.”

The famed investor mentioned it’s extremely difficult for the Fed to carry inflation again to its 2% goal, partly attributable to important wage will increase.

“Inflation is a bit like toothpaste. When you get it out of the tube, it is laborious to get it again in,” Jones mentioned. “The Fed is furiously attempting to clean that style out of their mouth … If we go into recession, that has actually detrimental penalties for quite a lot of property.”

To battle inflation, the Fed is tightening financial coverage at its most aggressive tempo for the reason that Eighties. The central financial institution final month raised charges by three-quarters of a share level for a 3rd straight time, vowing extra hikes to return. Jones mentioned the central financial institution ought to maintain tightening to keep away from long-term ache for the financial system.

“If they do not maintain going and we now have excessive and everlasting inflation, it simply creates I feel extra points down the highway,” Jones mentioned. “If we’re going to have long-term prosperity, you must have a secure foreign money and a secure technique to worth it. So sure you must have one thing 2% and beneath inflation within the very future to have a secure society. So there’s short-term ache related to long-term acquire.”

Jones shot to fame after he predicted and profited from the 1987 inventory market crash. He’s additionally the chairman of nonprofit Simply Capital, which ranks public U.S. firms based mostly on social and environmental metrics.