Philadelphia Federal Reserve President Patrick Harker on Thursday offered a robust endorsement to an rate of interest minimize on the best way September.

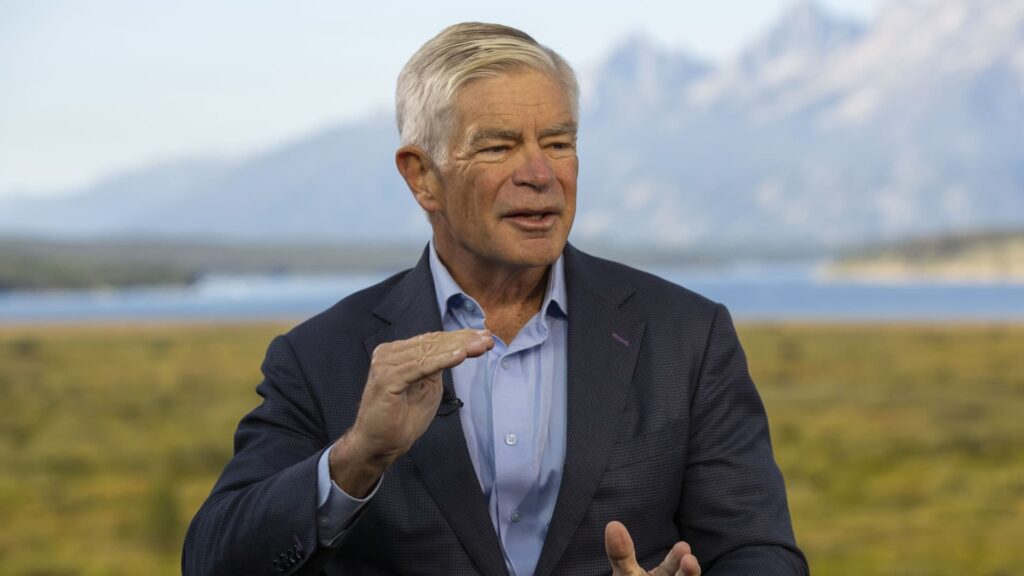

Talking to CNBC from the Fed’s annual retreat in Jackson Gap, Wyoming, Harker gave essentially the most direct assertion but from a central financial institution official that financial coverage easing is nearly a certainty when officers assembly once more in lower than a month.

The place comes a day after minutes from the final Fed coverage assembly gave a strong indication of a minimize forward, as officers achieve extra confidence in the place inflation is headed and look to move off any potential weak point within the labor market.

“I feel it means this September we have to begin a technique of transferring charges down,” Harker advised CNBC’s Steve Liesman throughout a “Squawk on the Road” interview. Harker stated the Fed ought to ease “methodically and sign nicely prematurely.”

With markets pricing in a 100% certainty of 1 / 4 proportion level, or 25 foundation level, minimize, and a few 1-in-4 likelihood of a 50 foundation level discount, Harker stated it is nonetheless a toss-up in his thoughts.

“Proper now, I am not within the camp of 25 or 50. I have to see a pair extra weeks of information,” he stated.

The Fed has held its benchmark in a single day borrowing fee in a spread between 5.25%-5.5% since July 2023 because it tackles a lingering inflation drawback. Markets briefly rebelled after the July Fed assembly when officers signaled they nonetheless had not seen sufficient proof to start out bringing down charges.

Nonetheless, since then policymakers have acknowledged that it quickly will probably be applicable to ease. Harker stated coverage will probably be made independently of political considerations because the presidential election looms within the background.

“I’m very happy with being on the Fed, the place we’re proud technocrats,” he stated. “That is our job. Our job is to have a look at the info and reply appropriately. Once I have a look at the info as a proud technocrat, it is time to begin bringing charges down.”

Harker doesn’t get a vote this 12 months on the rate-setting Federal Open Market Committee however nonetheless has enter at conferences. One other nonvoter, Kansas Metropolis Fed President Jeffrey Schmid, additionally spoke to CNBC on Thursday, providing a much less direct tackle the way forward for coverage. Nonetheless, he leaned towards a minimize forward.

Schmid famous the rising unemployment fee as a consider the place issues are going. A extreme supply-demand mismatch within the labor market had helped gasoline the run in inflation, pushing wages up and driving inflation expectations. In current months, although, jobs indicators have cooled and the unemployment fee has climbed slowly however steadily.

“Having the labor market cool some helps, however there’s work to do,” Schmid stated. “I actually do imagine you have to begin it a little bit bit tougher relative to the place this 3.5% [unemployment] quantity was and the place it’s right this moment within the low 4s.”

Nonetheless, Schmid stated he believes banks have held up nicely below the high-rate setting and stated he doesn’t imagine financial coverage is “over-restrictive.”

Harker subsequent votes in 2026, whereas Schmid will get a vote subsequent 12 months.