(Bloomberg) — Asia’s two tech-heavy economies South Korea and Taiwan are going through an uphill battle in making an attempt to stem losses in what are already among the many world’s worst-performing property this 12 months. They’re hit notably arduous by a worldwide development slowdown and US chip restrictions.

Most Learn from Bloomberg

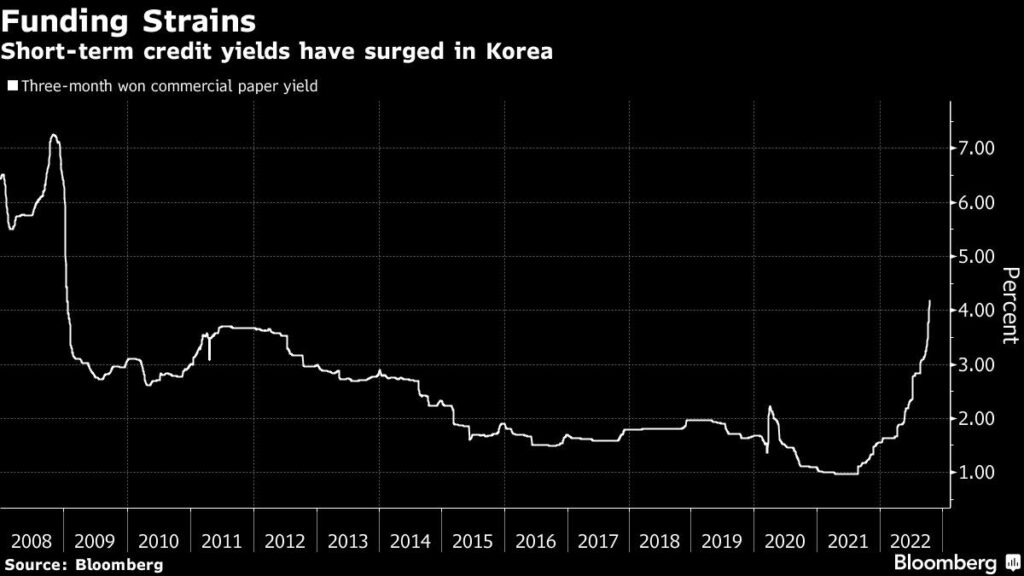

Authorities are stepping up actions, together with introducing curbs on quick promoting, readying market stabilization funds to purchase property and intervening in foreign money markets in strikes paying homage to the early days of the pandemic. Korea is resuming corporate-bond purchases as yields surge and default danger spreads.

Whereas markets in every single place have seen gut-wrenching strikes in response to accelerating inflation, aggressive central financial institution charge hikes and a hovering greenback, South Korea and Taiwan look particularly weak amongst main economies. Each are extremely depending on exports for development, and are swayed by world demand for chip. Including to their woes is the influence of latest US curbs on provide chains linked to China’s semiconductor trade.

The interventions haven’t stopped the declines. Taiwan’s fairness benchmark has dropped about 8% since a help fund was activated in mid-July and Korean shares have been down 11% previously two months, leaving inventory gauges in each markets greater than 25% decrease this 12 months. The Korean received and Taiwanese greenback are additionally among the many prime losers on the earth towards the buck 12 months up to now.

“These stabilization measures are meant to purchase sufficient time till the tech cycle bottoms out and overseas traders return,” mentioned Wai Ho Leong, strategist at Modular Asset Administration. “Turning markets round is a distinct matter.”

Chip Woes

Amid these headwinds, analysts have reduce their earnings estimates for Korea’s SK Hynix Inc. and Samsung Electronics Co. to the bottom in additional than two years.

Whereas the chipmakers have received approval from the US to maintain ordering American tools for his or her China vegetation for one 12 months, issues swirl round their enterprise fashions because the US seeks to curb China’s self sufficiency and development in navy capabilities.

A recessionary setting within the West and China’s Covid Zero coverage are additionally having knock-on results. The Taiwanese central financial institution warned of “extreme financial challenges” in 2023, whereas South Korea recorded its longest string of commerce deficits because the Asian monetary disaster.

“Within the close to time period we stay cautious on Asian shares -– specifically on shares or fairness markets which might be uncovered to exterior development — akin to Korea” and tech {hardware} corporations, Nomura Holdings Inc. strategists together with Chetan Seth wrote in a current word. Samsung and Taiwan Semiconductor Manufacturing Firm account for the largest weights on the Kospi and Taiex indexes, respectively.

Bond Gloom

Korea’s resumption of a $1.1 billion bond stabilization fund, which was introduced only a few weeks after a uncommon default on industrial paper by the developer of Legoland Korea theme park in Gangwon province, could have restricted influence as a result of the general market is a lot larger, and yields proceed to rise. Nonetheless, the fund could immediate others to observe go well with if credit score markets stay weak.

“Korea could solely be the primary of a string of credit score interventions in Asia amid larger dangers of monetary accidents,” DBS Group Holdings Ltd. strategists together with Chang Wei Liang and Philip Wee wrote in a word.

Korea and Taiwan aren’t alone in supporting markets. Japan has intervened within the foreign money market to stem the yen’s decline, nevertheless it failed to forestall the foreign money’s plunge to a 32-year low. China is easing restrictions on mutual funds’ purchases to again its plunging inventory market.

‘Lengthy Winter’

To make sure, slumping valuations in Korea and Taiwan are proving engaging for some, and will spark short-term reduction rallies. International traders snapped up Korean shares for 13 straight days this month, and Morgan Stanley is among the many outliers calling an finish to the underperformance of Asian know-how shares because it sees most dangers as priced in.

Others stay skeptical that the export-reliant economies will decide up anytime quickly, and a few favor Asian markets which might be backed by sturdy home demand and a revival in tourism akin to India and Indonesia.

“It’s going to be a protracted winter — these help measures will in all probability not be sufficient,” mentioned Ken Peng, head of Asia funding technique at Citigroup Inc.’s private-banking arm, referring to actions from Korean and Taiwan authorities. “A restoration will probably have to attend till the USD peaks and rolls over, probably when non-US development is anticipated to get well.”

–With help from Youkyung Lee, Hooyeon Kim, Betty Hou, Catherine Bosley and Abhishek Vishnoi.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.