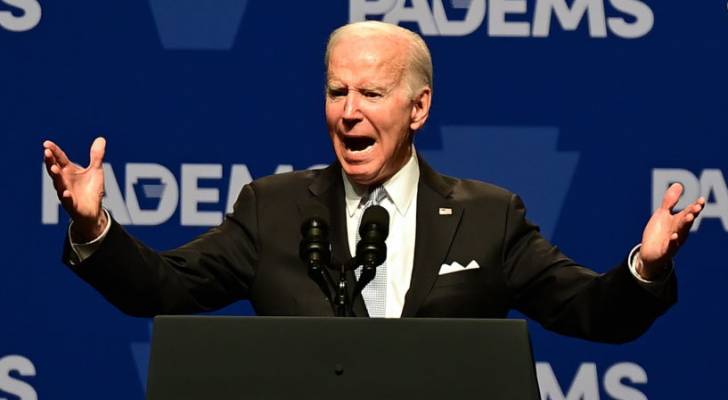

It might be a brand new 12 months, however President Joe Biden’s feud with the nation’s main gasoline corporations is raging on.

Biden has taken concern with oil juggernauts like Chevron and Exxon Mobil which have been raking in earnings this final 12 months — particularly within the wake of scorching inflation and Russia’s warfare in Ukraine.

Don’t miss

Now, the oil and gasoline trade is popping up the warmth on the state of affairs.

In his annual deal with in Washington on Jan. 11, American Petroleum Institute President Mike Sommers blamed the “barrage of detrimental rhetoric” from the White Home for slowing home oil and gasoline manufacturing.

With gasoline costs nonetheless elevated, and lots of households muddling by means of an costly winter, the strained relationship between Biden and the nation’s oil corporations might imply the state of affairs will solely worsen over the subsequent few months.

Biden hasn’t minced his phrases

Biden has been waging a battle with oil corporations since earlier than he even took workplace, however he escalated it final November when he known as their report earnings “a windfall of warfare,” not the results of something “new or progressive.”

He went on, exhorting them to “act past their slender self-interest,” and “spend money on America by rising manufacturing and refining capability” on behalf of “their shoppers, their group and their nation.”

And in the event that they don’t? Biden warns they’re going to face “a better tax on their extra earnings and … greater restrictions.”

Shortly after that, Amos Hochstein, a particular presidential coordinator for Biden, informed the Monetary Instances it was “un-American” and “unfair to the … public” that corporations didn’t use these report earnings to spend money on elevated manufacturing.

What Biden seems to be proposing is a “windfall” tax, which might redistribute earnings to American shoppers nonetheless paying out the nostril on the pump.

“It’s time for these corporations to cease warfare profiteering, meet their duties on this nation and provides the American folks a break,” Biden added.

Oil corporations hearth again

Whereas gasoline has dropped from a report excessive of over $5/gallon in June, it’s nonetheless at the moment hovering round $3.28. And that, together with a dangerously low oil provide and a dwindling diesel stockpile is clearly weighing on Biden.

However oil corporations argue they’re already contributing to the trigger. Exxon Mobil’s CEO Darren Woods took a second through the firm’s third-quarter earnings name on Oct. 28 to handle Biden.

“There was dialogue within the U.S. about our trade returning a few of our earnings on to the American folks,” Woods mentioned. “That’s precisely what we’re doing within the type of our quarterly dividend.”

The president didn’t take kindly to that, tweeting his response a number of hours later: “Can’t consider I’ve to say this however giving earnings to shareholders just isn’t the identical as bringing costs down for American households.”

Learn extra: [Over 65% of Americans don’t shop around for a better car insurance deal — and that could be costing you $500 a month

The issue has become political

But all this back-and-forth could only be aggravating the situation. A blog post from the Institute for Energy Research accused the Energy Department of asking them to “undersell their product” and accused Biden of using the country’s Strategic Petroleum Reserve “as a political tool to lower gasoline prices.”

And in an interview with Bloomberg, Sommers from the American Petroleum Institute said the signals Biden is sending discourage investment in the oil and gas industry “does harm to capital.”

“If the government signals support for American energy, it would boost investor confidence in future projects to unleash needed supplies and strengthen infrastructure,” Sommers says.

Biden does seem prepared to compromise, though. According to another report in Bloomberg, Energy Secretary Jennifer Granholm addressed oil and gas executives in Washington in mid-December at a meeting of the National Petroleum Council, an outside federal advisory group with members from Exxon Mobil Corp. and Royal Dutch Shell Plc.

“We are eager to work with you,” Granholm said, adding that fossil fuels are likely to be around for a while.

She also acknowledged the administration has “butted heads” with the industry, referring to it as the “elephant in the room.” And with growing demand and a shortage of diesel in the northeast, she says the administration is aware fossil fuel production will need to increase soon.

Don’t expect Biden to capitulate

Still, the president isn’t likely to cave entirely.

Just a few short months ago in November, Exxon and Chevron, two of the country’s biggest oil companies, reported hefty profits for the fourth consecutive quarter. That same day, in a briefing from the White House, Biden pointed out that six of the largest companies “made $70 billion in profit” in just 90 days.

Appalled that all that money was going back to their shareholders and executives, Biden issued a promise: “I’m going to keep harping on it. [These companies] speak about me selecting on them, they ain’t seen nothing but. I imply it. It outrages me.”

What to learn subsequent

This text offers data solely and shouldn’t be construed as recommendation. It’s offered with out guarantee of any type.