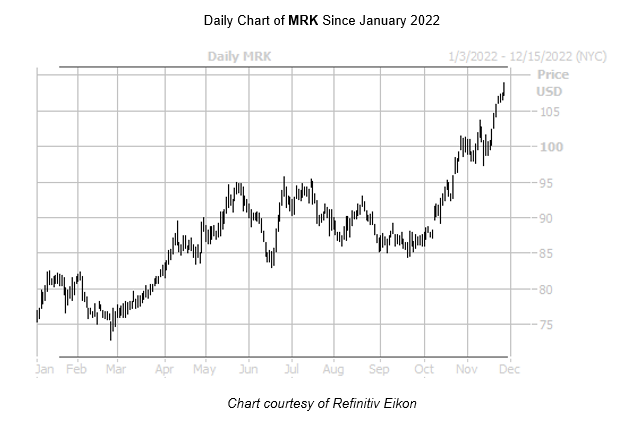

Per week after asserting its acquisition of Imago Biosciences (IMGO), issues are trying up for pharmaceutical concern Merck & Co Inc (NYSE:MRK). The shares simply secured their sixth-straight all-time excessive after surging to $108.90 earlier at present. Final seen up 1% to commerce at $108.56, MRK now boasts a 41.4% year-to-date lead. Bullish merchants ought to maintain their foot on the throttle, nonetheless, as historic proof means that the fairness has so much left within the tank.

Particularly, Merck inventory’s current highs come amid traditionally low implied volatility (IV) for the inventory — a bullish mixture up to now. Per information from Schaeffer’s Senior Quantitative Analyst Rocky White, there have been 4 comparable instances in the course of the previous three years when the fairness was inside 2% of a 52-week excessive whereas its Schaeffer’s Volatility Index (SVI) sat within the twentieth annual percentile or decrease. That is true of MRK, which sports activities an SVI of 19% that stands increased than simply 7% of readings from the previous 12 months.

Digging deeper, the safety averaged a 17% return after three of these alerts. From the place it at the moment sits, a transfer of comparable magnitude would put Merck inventory at roughly $110.40.

Analysts are typically constructive on the blue-chip title, although there’s nonetheless a bit of room for potential upgrades/price-target hikes. Particularly, 5 of the 16 following MRK fee it a “maintain.” Plus, the consensus 12-month value goal of $110.35 represents a slim 1.7% premium to present ranges.

It is also value noting the safety’s Schaeffer’s Volatility Scorecard (SVS) ranks at 88 out of 100, that means the fairness has exceeded choices merchants’ volatility expectations up to now 12 months.