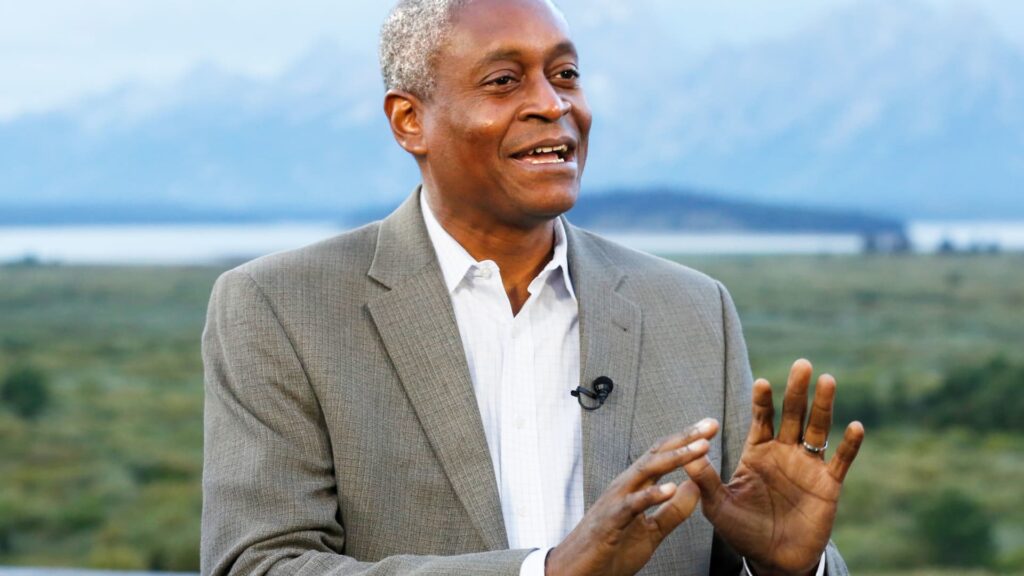

Atlanta Federal Reserve President Raphael Bostic mentioned Friday that December’s jobs report, with its slowdown in wage will increase and better-than-expected employment development, would not change his view on financial coverage.

The central financial institution official mentioned he nonetheless sees rates of interest rising, up previous 5% for the Fed’s benchmark funds fee, the place he sees it staying for a chronic interval.

“It would not actually change my outlook in any respect,” Bostic instructed CNBC’s Steve Liesman throughout a stay interview at a convention in New Orleans. “I have been in search of the financial system to repeatedly gradual from the sturdy place it was at within the summertime. That is simply the subsequent step in that.”

Nonfarm payrolls added 223,000 positions final month, and the unemployment fee fell to three.5%, the Labor Division reported. That was barely higher than respective estimates for 200,000 and three.7%.

Maybe extra importantly, common hourly earnings rose simply 0.3% for the month and 4.6% from a yr in the past, each under expectations and an indicator that the inflation spiral gripping the financial system for the previous yr and a half could also be easing.

Nonetheless, Bostic mentioned he expects one other fee enhance of both a quarter- or half-percentage level when the Fed releases its choice Feb. 1. The funds fee is at the moment focused between 4.25% and 4.5%. Bostic is a nonvoting member this yr of the rate-setting Federal Open Market Committee; he’ll vote once more in 2024.

Open jobs nonetheless outnumber accessible staff by almost 2 to 1, and wage development is nicely above the place it was earlier than the Covid pandemic. Bostic added that he would not suppose wages have been a key driver of the inflation that escalated in mid-2021 towards its highest stage in additional than 40 years.

“We have to remain the course,” he mentioned. “Inflation is just too excessive. We have to cut back these imbalances so it strikes extra quickly to our 2% [inflation] goal.”

Fed officers at their December assembly expressed concern that the general public would possibly misread the central financial institution’s transfer to a small fee hike — 0.5 proportion level from 4 straight 0.75 proportion level strikes — as an easing in coverage.

Bostic emphasised the Fed cannot “declare victory prematurely” and desires not solely to maintain pushing charges larger, however to maintain them there.

“What I believe is the essential [point] is simply to carry there and keep there and let that coverage stance actually grip the financial system and simply guarantee that the momentum is totally arrested, in order that we get to a spot the place demand and provide begin to turn out to be extra interbalanced and we begin to see these pressures on inflation actually begin to to return down,” he mentioned.

Bostic mentioned he doesn’t count on a recession to observe the Fed’s actions, and if there’s one he sees it as “brief and shallow.”