Generally figuring out the perfect shares to purchase could be troublesome, however you possibly can do quite a bit worse than trying out the shares chosen by one of many world’s savviest hedge fund managers – Warren Buffett.

Buffett’s inventory picks are a preferred supply of inspiration for buyers, and for good cause. His formidable stock-picking capacity has given him the nickname ‘the Oracle of Omaha’ and a fortune of ~$117 billion, making him one of many richest folks on the planet. His agency, Berkshire Hathaway, can be counted among the many most profitable, boasting complete property of over $1 trillion.

So clearly when Buffett goes purchasing, buyers are eager to search out out what’s within the bag. Throughout Q2, Buffett opened new positions in just a few homebuilding shares, and as he’s identified for his worth investing fashion, he should suppose these names provide simply that proper now.

But it surely’s not simply Buffett who likes the look of those explicit equities. Raymond James analyst Buck Horne has additionally pinpointed a chance in these shares, believing they’re primed to ship double-digit progress over the subsequent 12 months.

For a fuller view of their prospects, we determined to run these tickers by the TipRanks database. Right here’s what we discovered.

D.R. Horton, Inc. (DHI)

The primary inventory Buffett is betting on is D.R. Horton, a Texas-based building agency and a pacesetter within the US homebuilding trade. The corporate has held the title of the ‘nation’s largest homebuilder’ for greater than 20 years and operates in 113 residential markets throughout 33 states. D.R. Horton works on tasks for each single-family properties and multi-family residence complexes.

D.R. Horton has been constructing properties for 45 years, and has closed over 1 million constructing contracts in that point. The corporate has a portfolio of designs, that includes properties in all value brackets, from underneath $200,000 to over $1 million, and might even implement good dwelling expertise from floor up throughout building.

Whereas the corporate holds a number one place in its trade, it has felt the consequences of actual property headwinds. Earnings are down year-over-year for the previous a number of quarters, whilst revenues have confirmed y/y positive aspects. This sample continued within the lately reported outcomes for Q3 of fiscal 2023. DHI had a prime line of $9.7 billion, up 11% from the year-ago quarter, however the backside line non-GAAP EPS of $3.90 was effectively under the 3Q22 determine of $4.67. That stated, of larger import for buyers, DHI beat the forecasts at each the highest and backside traces in Q3, with income coming in $1.31 billion above expectations and EPS beating by $1.07 per share.

Trying ahead, DHI reported two necessary metrics that bode effectively for future enterprise. First, it closed on 22,985 properties in Q3, a year-over-year improve of 8%, and the entire worth of these properties closures was up 4% y/y, to $8.7 billion. And, the corporate’s internet gross sales orders had been up a powerful 37% y/y, to 22,879 properties. The entire worth of the online gross sales orders was reported as $8.7 billion, for a 26% y/y improve. As such, the corporate raised its income outlook for the 12 months, with the top-line now anticipated to hit the vary between $34.7 billion to $35.1 billion in comparison with $31.5-$33 billion beforehand. Consensus had $32.34 billion.

As for Warren Buffett, his agency opened a brand new place in DHI in the course of the calendar second quarter. Berkshire Hathaway disclosed complete purchases of 5,969,714 shares of DHI, a significant inventory acquisition that’s now price about $700 million.

Turning to the Raymond James view, we discover that analyst Buck Horne is impressed with D.R. Horton’s prospects for the subsequent few quarters. He writes, “Because it stands, we now see DHI on a path towards double-digit EPS progress and 20%+ ROIC metrics in FY24, most notably supported by a surging rental housing platform – which we predict will considerably mitigate cyclical volatility related to mortgage charges. With its pristine stability sheet primed for progress and acquisition alternatives, we consider DHI’s earnings visibility and profitability have improved to the purpose that buyers shouldn’t be afraid of present valuations.”

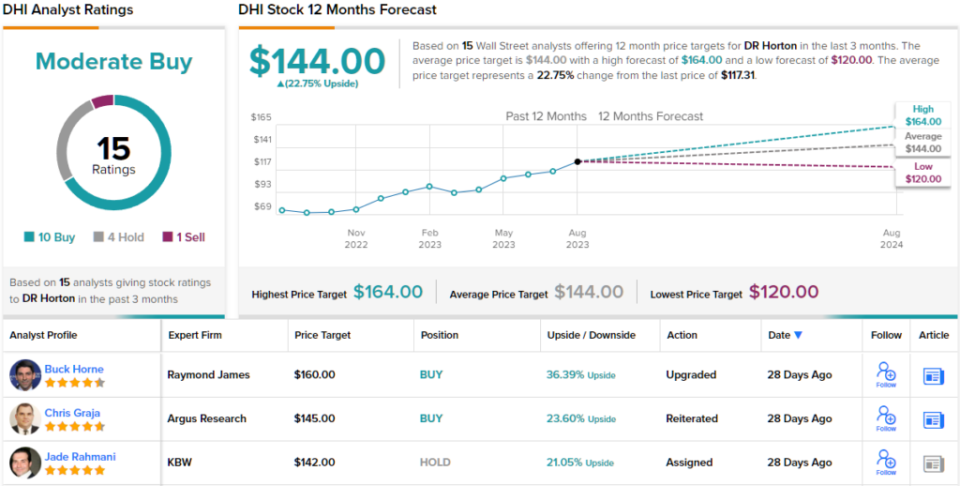

Alongside these feedback, Residence provides DHI shares an Outperform (i.e. Purchase) ranking, with a value goal of $160 that suggests a one-year upside potential of ~36%. (To observe Residence’s monitor report, click on right here)

Total, DHI has picked up 15 current Wall Road analyst critiques, and these embrace 10 Buys, 4 Holds, and 1 Promote to offer the inventory its Average Purchase consensus ranking. The shares are promoting for $117.31 and the $144 common value goal implies ~23% upside on the one-year horizon. (See DHI inventory forecast)

Lennar Company (LEN)

The subsequent Buffett alternative we’re is Florida-based Lennar Corp, one other of the key homebuilders within the US. Lennar operates on the East Coast and Southeast, within the Nice Lakes area, in Texas and Oklahoma, and within the West and West Coast areas. The corporate is perennially among the many prime 5 largest homebuilders within the nation, counting by complete dwelling gross sales. Since its founding in 1954, Lennar has constructed greater than 1 million properties.

The corporate controls quite a lot of manufacturers, that supply companies in all points of the new-home trade. There are 5 manufacturers working on the development aspect, whereas Lennar Mortgage, Lennar Title, and Lennar Insurance coverage Company present the required monetary companies to make the properties accessible to consumers. Lennar has a protracted historical past of increasing its operations by acquisition, and at the moment works in 26 states.

In 2022, Lennar reported greater than $33 billion in complete revenues, however the firm is just not fairly on monitor up to now this 12 months to fulfill that determine. In its 2Q23 report, Lennar confirmed a prime line of $8.05 billion, down 3.7% y/y, though it ought to be famous that was some $810 million above the estimates. The corporate’s Q2 earnings, an EPS of $2.94 by non-GAAP measures, additionally beat the forecast – by 62 cents per share.

Lennar delivered 17,074 properties in Q2, and completed the quarter with new orders for 17,885 properties – price a complete of $8.2 billion. The corporate’s work backlog, an necessary metric for future enterprise, was reported at 20,214 properties, valued at $9.5 billion.

Reflecting a brand new place for Buffett’s Berkshire Hathaway, the agency pulled the set off on 152,572 shares in Q2. This stake in Lennar is at the moment valued at $17.85 million.

Additionally bullish on this inventory, Raymond James’ Buck Horne is impressed by Lennar’s capacity to keep up manufacturing.

“Combining focused value reductions, incentives, and mortgage fee buydowns to maintain dwelling manufacturing flowing, regardless of mortgage fee volatility, Lennar has been capable of establish the exceptional reservoir of pent-up housing demand a lot ahead of most… We discover shares of LEN buying and selling at 1.7x trailing e-book worth and 9.5x our FY24 EPS, roughly consistent with peer averages. As such, we predict LEN shares stay worthy of a fabric valuation re-rating due to a 15%+ projected ROIC, double-digit EPS progress, and a internet debt free stability sheet,” Horne opined.

Quantifying his stance, Horne goes on to fee LEN an Outperform (i.e. Purchase), and he places a $150 value goal on the inventory to indicate his confidence in a 28% acquire on the 12-month horizon.

All in all, Lennar has picked up 16 current analyst critiques, and these embrace 10 Buys, 4 Holds, and a couple of Sells to offer the inventory its Average Purchase consensus ranking. The typical value goal of $134.40 and the present buying and selling value of $117 collectively level towards ~15% one-year upside potential. (See Lennar inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally necessary to do your individual evaluation earlier than making any funding.