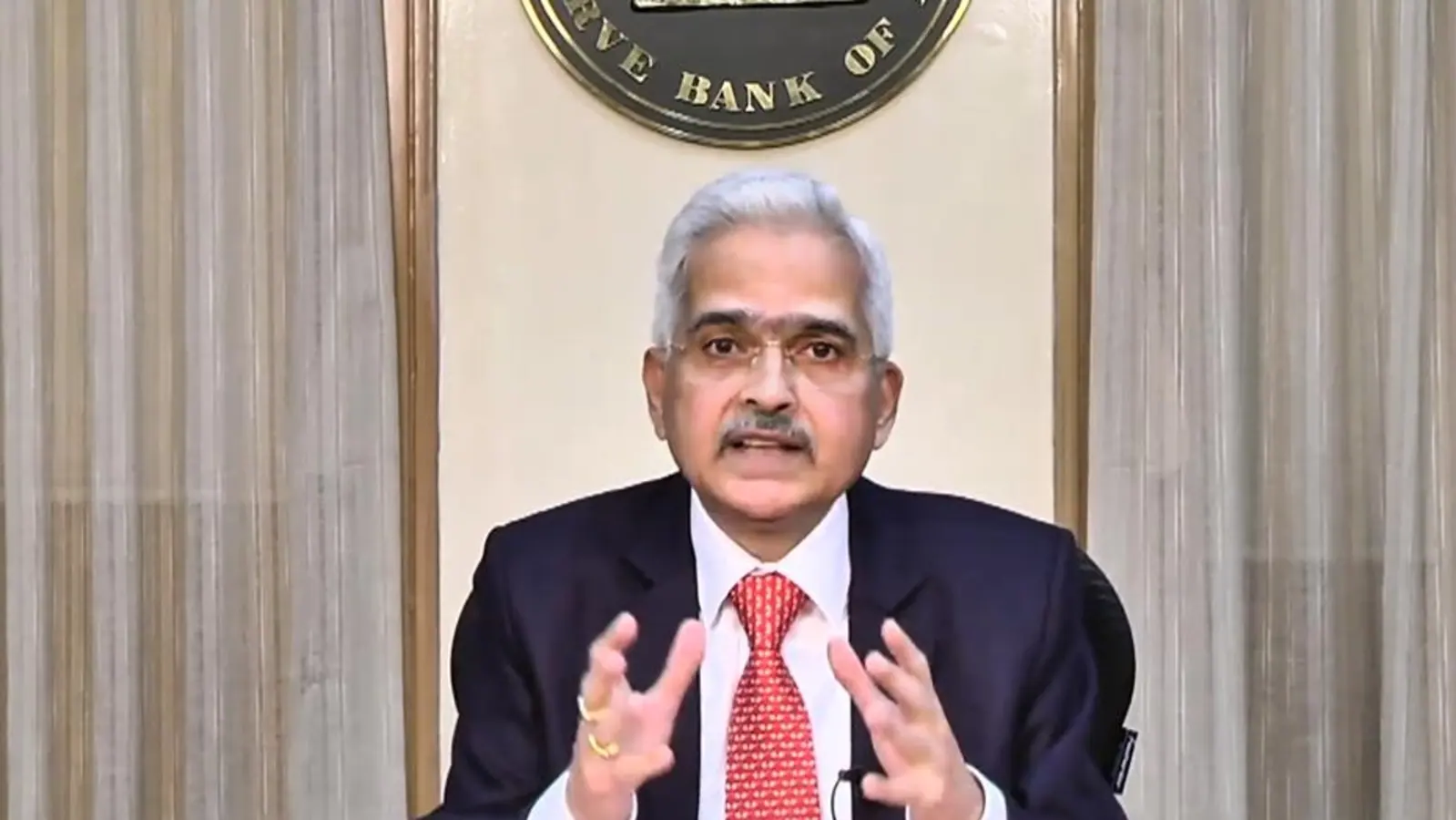

RBI Governor Shaktikanta Das on Friday introduced that the central financial institution’s Financial Coverage Committee (MPC) has hiked the repo fee – or the important thing lending fee – by 50 foundation factors (bps) to a three-year excessive of 5.9 per cent. The nation is anticipated to have an actual GDP of seven per cent, which has been lowered from 7.2 per cent predicted earlier. “We’re wakeful, ever vigilant, ever-striving,” the RBI Governor quoted Mahatma Gandhi throughout his tackle, whereas highlighting the measures taken to deal with the worldwide challenges, and underlining that the nationwide financial system stays resilient.

“The worldwide financial system is within the eye of storm however India has withstood shocks during the last two years,” RBI governor stated, including that the inflation is hovering round 7 per cent and is anticipated to stay round 6 per cent within the second half of the 12 months.

“Daunting challenges face us. A collection of measures have been taken since April 2022 within the backdrop of geopolitical tensions, which additionally hampered the worldwide provide,” he stated, referring to the Ukraine battle, which started in February. “The inflation fee is projected at 6.7 per cent,” he stated. “The MPC has to stay alert and nimble within the wake of present situations.”

The GDP grew by 13.5 per cent year-on-year within the first quarter, he highlighted. “Whereas the true GDP development within the first quarter of this 12 months turned out to be decrease than expectations, nonetheless it was 13.5 per cent, and maybe the best among the many main world economies,” he additional burdened.

Forward of the essential assertion, markets opened in purple with Sensex at 56,254. The Nationwide Inventory Trade (NSE) Nifty 50 index was down 0.3 per cent at 16,776. A Reuters ballot confirmed a slim majority of economists – forward of the assertion – had been anticipating a 50 foundation level hike and a few others anticipated a smaller 35 foundation level rise.

Final month, the MPC had introduced a rise of the repo fee by one other 50 foundation factors – one foundation level is one hundredth of a share level taking it to five.4%, a degree final seen in September 2019. It was the third consecutive fee hike by the MPC since its unscheduled Might 2022 assembly, HT had reported. The important thing committee had additionally retained its inflation and GDP development projection for the fiscal 12 months 2022-23 at 6.7 per cent and seven.2 per cent, respectively.

The MPC, since Might, has raised the important thing coverage fee by 190 foundation factors to chill off home retail inflation, which has stayed above the RBI’s higher tolerance restrict of 6 per cent since January, information company Reuters had highlighted in its report.

“The inflation trajectory stays clouded with uncertainties arising from persevering with geopolitical tensions and nervous world monetary market sentiments. On this backdrop, MPC was of the view that persistence of excessive inflation, necessitates additional calibrated withdrawal of financial lodging to restrain broadening of worth pressures, anchor inflation expectations and comprise the second spherical results. This motion will help the medium-term development prospects of our financial system,” Shaktikanta Das burdened on Friday.

(With inputs from Reuters, ANI)

Watch: Get set for greater EMIs as RBI hikes repo fee