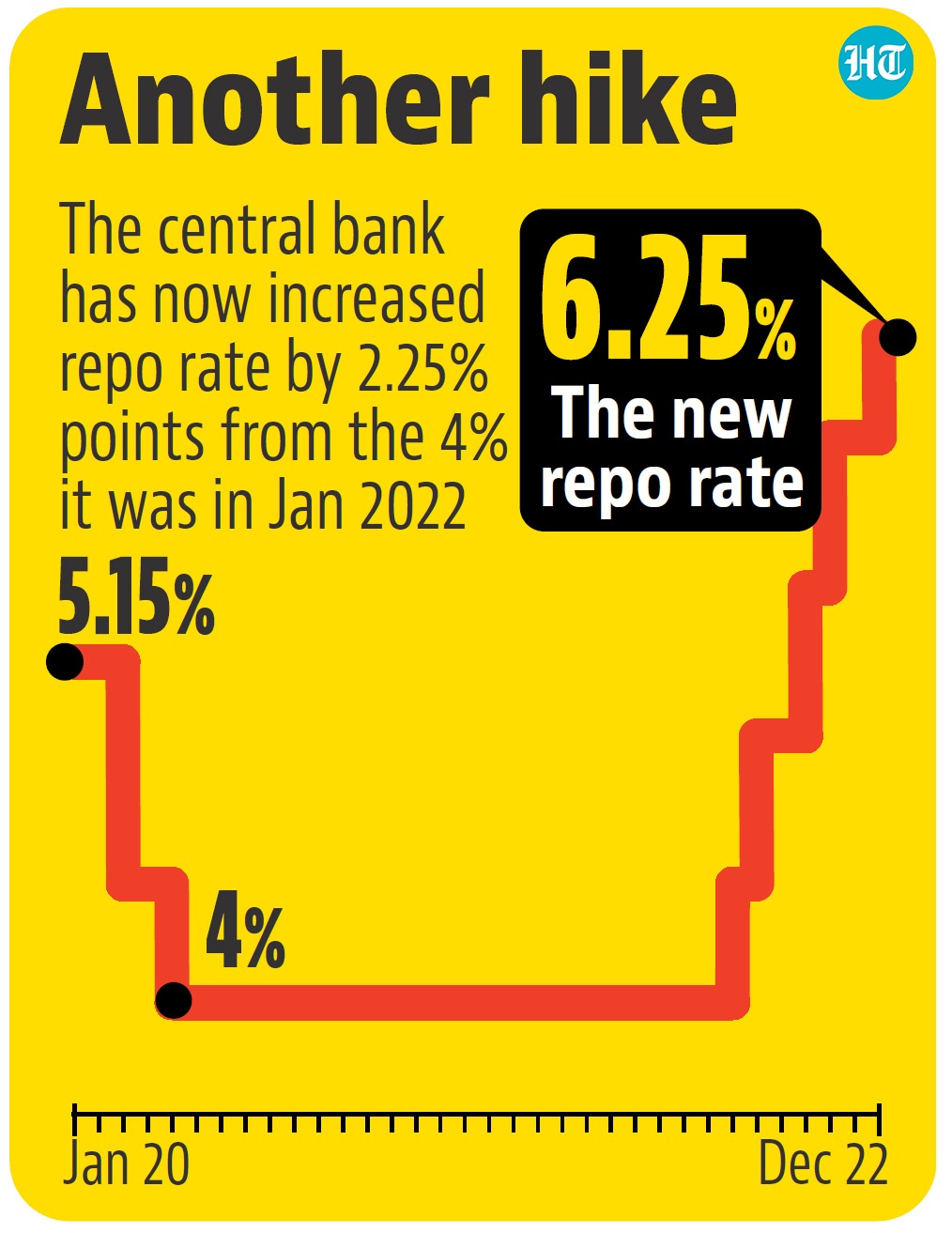

Loans and mortgages will get costlier with the Reserve Financial institution of India’s Financial Coverage Committee (MPC) asserting a fifth consecutive rate of interest hike on Wednesday, of 0.35 proportion factors, taking the coverage charge to six.25%, the best since March 2019.

RBI has taken up the coverage charge by 2.25 proportion factors since Might, and the tone and tenor of its assertion, as additionally the vote break-up – one of many six members of MPC voted towards a charge hike; and two voted towards the continued deal with “withdrawal of lodging to make sure that inflation stays inside the goal…” – recommend that there may very well be one other charge enhance in February.

To make certain, as analysts level out, a lot will depend upon world elements together with the actions of the US Federal Reserve (it has already signalled smaller charge hikes).

On development, despite the fact that the MPC has made a downward revision to its 2022-23 GDP forecast – it now stands at 6.8% in comparison with 7% within the September decision – Governor Shaktikanta Das reiterated that “even after this revision in our development projection for 2022-23, India will nonetheless be among the many quickest rising main economies on the earth”. It expects the financial system to broaden by 4.4% this quarter and 4.2% subsequent quarter, down from the 4.6% every it had beforehand projected for them.

However inflation, it’s clear, stays the central financial institution’s main concern. “On steadiness, the MPC was of the view that additional calibrated financial coverage motion is warranted to maintain inflation expectations anchored, break core inflation persistence and include second spherical results. These actions will strengthen the medium-term development prospects of the Indian financial system,” Governor Das stated in his assertion after the assembly. “The primary threat is that core inflation (CPI excluding meals and gasoline) stays sticky and elevated,” Das added, explicitly stating that “the battle towards inflation will not be over”.

MPC retained its inflation projection for the 12 months at 6.7%, and expects it to be 6.6% this quarter and 5.9% subsequent quarter. Inflation has been above the higher band of the central financial institution’s consolation stage, 6%, since January. It expects inflation to be at 5% within the first quarter of subsequent monetary 12 months, 2023-24.

Wednesday’s announcement marks the fifth consecutive charge hike by MPC, which began the present rate-hike cycle in an unscheduled MPC assembly in Might. Earlier than the newest hike, MPC elevated the coverage charge by 40 foundation factors in Might, and 50 foundation factors every in June, August and September. One foundation level is one hundredth of a proportion level. Whereas the newest coverage charge is the best it has been since March 2019, actual charges are prone to be decrease as present inflation is considerably greater than what it was again then. “Adjusted for inflation, the coverage charge nonetheless stays accommodative,” Das stated in his assertion.

MPC’s newest motion is in line with the forecast by a Bloomberg ballot of economists. Most analysts see MPC delivering yet one more charge hike in its February 2023 assembly, however count on it to be of a smaller magnitude. “Given the RBI’s emphasis on pushing in the direction of reducing core CPI inflation and pushing headline down in the direction of 4%, we now count on an extra 25bp hike in February taking the repo charge to six.50%”, Rahul Bajoria, MD and head of EM Asia (ex-China) Economics, Barclays, stated in a word. “We count on a 25bp charge hike in February 2023, taking the repo charge to six.5%. That is in step with the actual charge math. RBI has estimated India’s actual impartial charge at 1%. Combining it with our one-year forward inflation forecast of 5.25% provides a repo charge of 6.25%. With inflation trending greater than goal, repo charge needs to be greater than 6.25%,” Pranjul Bhandari, chief India and Indonesia Economist, HSBC World Analysis, stated in a word. The repo charge, at which RBI lends to business banks, is the coverage charge.

The logic of actual charges nonetheless being decrease however, charge hikes by the central financial institution are anticipated to have an opposed affect on credit score demand on account of greater borrowing prices. “For the reason that charge hike cycle in Might 2022, dwelling mortgage merchandise have change into costly by round 150bps earlier than in the present day’s hike. The lending charges have risen considerably, particularly for the loans linked to Exterior Benchmark primarily based Lending Fee (EBLR) the place there was a 100% transmission of repo charge,” Shishir Baijal, chairman & managing director, Knight Frank India, an actual property advisor agency, stated in a word. “This hike will additional affect EMIs and cut back dwelling affordability. Merely primarily based on the rate of interest affect on this charge cycle, the Knight Frank Affordability Index has recorded a cumulative deterioration of a mean of three% throughout the nation.”

Hours after the RBI announcement, the BSE Sensex dropped for the fourth session on the trot, ending the day’s buying and selling at 62,410.68 factors after a lack of 215.68 pts, or 0.34%. Equally, the broader Nifty 50 fell 82.25 factors, or 0.44%, to finish the day at 18,560.50. The benchmark 10-year yield, in the meantime, was at 7.301% on Wednesday as in comparison with 7.2486% the day earlier than. Bond yields had eased to 7.2113% earlier than the coverage resolution, monitoring a hunch in oil costs because the benchmark Brent crude futures declined beneath $80 a barrel. The Indian rupee nonetheless recovered to edge greater towards the US greenback – settling at 82.47 after an increase of three paise over its earlier shut of 82.50.