-

Buyers have been piling into riskier, leveraged stock-market bets in current weeks, Vanda Analysis mentioned.

-

These elevated inflows come because the inventory market has made new information.

-

Strategists mentioned traders could also be making an attempt to make their capital work tougher by way of leverage.

The inventory market has soared to information within the first three months of the yr, and retail merchants have been more and more leaning into that momentum with riskier bets.

In keeping with Vanda Analysis, particular person traders’ use of leverage has steadily ramped up over current weeks.

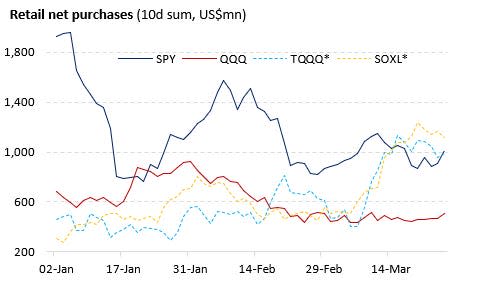

Because the chart under illustrates, retail traders have dialed again purchases of broader market ETFs like SPY and QQQ — which observe the S&P 500 and Nasdaq — whereas rising publicity to triple-leveraged funds proper as shares are hitting all-time highs.

The development comes as main averages have loved robust first-quarter beneficial properties, with the Dow Jones Industrial Common, up 4.91% year-to-date and the S&P 500, and the Nasdaq Composite up 10.1% and 10.59%.

Danger-on bets throughout markets together with crypto and meme shares are on the rise once more, this time bucking the development of excessive rates of interest that took the air out of these trades two years in the past when the Federal Reserve began tightening financial coverage.

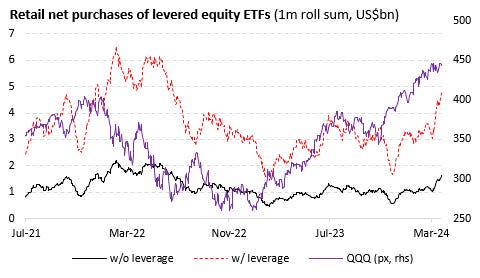

“If we then develop the levered ETF pool to a couple extra heavily-traded funds, we see that retail inflows (adjusted for leverage) have now simply cleared highs seen over the last AI-fuelled rally in Could-July ’23,” Vanda strategists wrote this week.

The chart under depicts how retail web purchases of levered ETFs have ramped up in February and March 2024. The information is predicated on the most important 22 levered ETFs within the US, as of March 26.

One other potential driver, in the meantime, is that after about two years, the typical retail portfolio is lastly out of the crimson following the brutal bear market of 2022. Now that the main focus is on driving beneficial properties slightly than recouping losses, merchants could really feel extra assured taking up greater threat, Vanda mentioned.

The analysts went on to notice that they anticipate retail traders to lean into contrarian bets, shopping for dips or promoting into rallies. Additionally they say that retail is diversifying away from the highest gainers just like the Magnificent Seven and into different shares, with knowledge suggesting the cohort is trying to get in early on any elevated breadth in stock-market beneficial properties.

Learn the unique article on Enterprise Insider