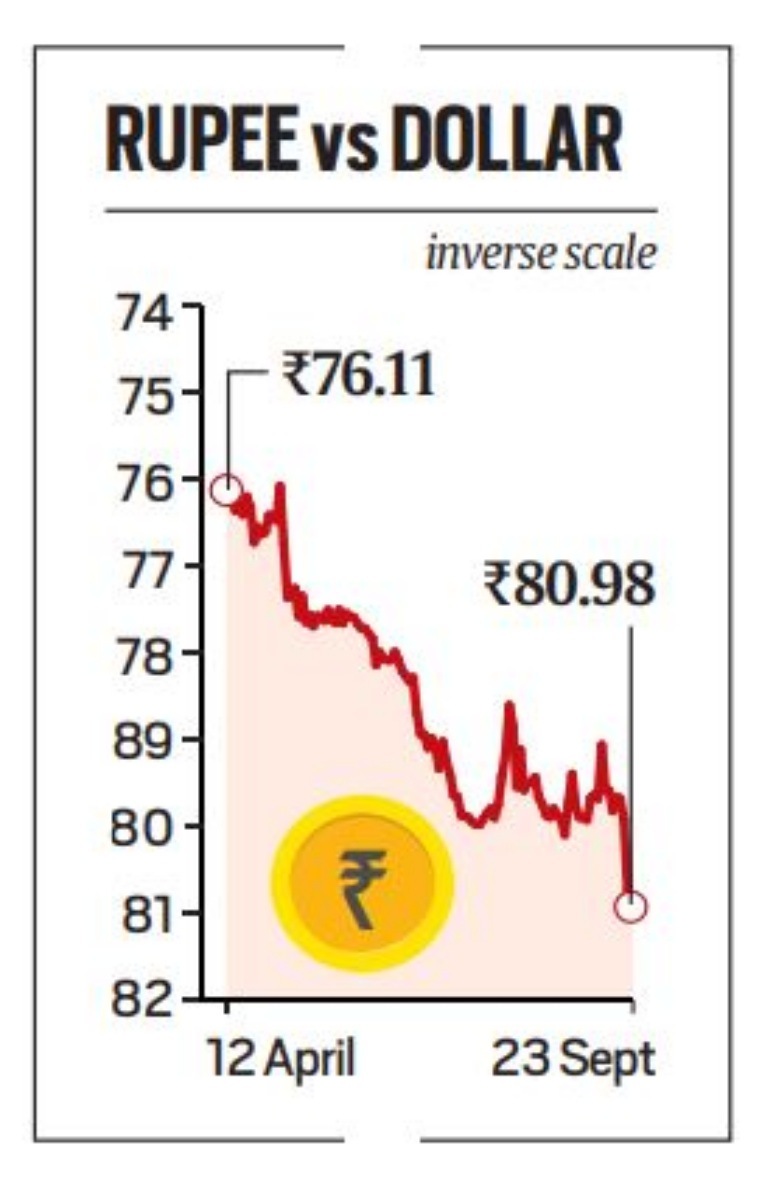

Because the rupee breached the 81-mark to the US greenback intra-day Friday, coverage makers in New Delhi are in a dilemma with the Reserve Financial institution of India (RBI) having burnt foreign exchange reserves at a dramatic tempo this calendar yr to forestall change charge volatility – an intervention which many available in the market imagine is to defend the foreign money at a selected stage.

In simply eight months between mid-January and mid-September this yr, foreign exchange reserves have depleted by virtually $90 billion, or roughly a mean of $11 billion a month. For the week-ended September 16, India’s foreign exchange reserves stood at $545.65 billion in contrast with $634.97 billion within the week-ended January 14.

“How lengthy?” requested the CEO of a overseas institutional investor (FII), who didn’t want to be named. Whereas sustained excessive inflation of seven per cent plus has prompted the RBI to hike coverage charges, the federal government is eager to protect GDP progress and create extra jobs as a number of large states head for polls over the following 12-18 months.

With a number of businesses chopping the GDP progress forecast to 7 per cent and decrease, the Union finance ministry is in a dilemma whether or not an aggressive tightening of the financial coverage is the suitable technique for India, which faces challenges that mayrequire a distinct response than the western international locations. On this context, Finance Minister Nirmala Sitharaman has already mentioned that “RBI will not be as a lot synchronised because the western international locations would do” – in different phrases, mountain climbing coverage charges will not be one of the best factor for India.

Bumpy street forward

GROWTH imperatives and must create jobs weigh heavy on the federal government’s thoughts with elections in over a dozen states within the subsequent 12-18 months. As a substitute of sharp charge hikes to include inflation, policymakers would somewhat let the rupee depreciate.

Coverage makers within the authorities in addition to the RBI are satisfied that a big a part of inflation is “imported”. They’re discussing relative benefits and downsides of an “overt” motion similar to an rate of interest hike versus “covert” gradual depreciation of the rupee. “In contrast to financial tightening by means of charge hikes, which is akin to using a sledgehammer, letting the rupee discover its stage, is a greater instrument to rein in demand,” mentioned an official, who didn’t want to be named. A depreciating rupee makes imports dearer, and curbs demand.

A depreciating rupee makes imports dearer, and curbs demand.

A depreciating rupee makes imports dearer, and curbs demand.

In accordance with RBI’s financial coverage report of April 2022, a 5 per cent depreciation in rupee may lead to inflation edging up by 20 foundation factors whereas the GDP progress might be larger by 15 foundation factors. In 2022 thus far, the rupee has depreciated by 8.2 per cent in 2022 in opposition to the US greenback. Coverage makers in New Delhi appear to be veering across the view that the RBI shouldn’t maintain any explicit stage sacrosanct. “This (gradual weakening of rupee) covert measure is healthier than an overt financial coverage motion of mountain climbing charges,” mentioned a coverage maker who didn’t want to be named.

“Even as we speak, the rupee closed above 81,” mentioned a senior government in an FII, pointing to the central financial institution’s aversion to let the rupee slip. The Indian rupee breached the 81-mark in opposition to the US greenback for the primary time on Friday, earlier than settling at 80.98, because the buck continued to strengthen in opposition to all different main currencies following an aggressive charge hike announcement by the Federal Reserve.

In two days, for the reason that Fed announcement Wednesday, the rupee has misplaced 1.5 per cent.

It opened at a document low of 81.03 in opposition to the US greenback, in comparison with the earlier shut of 80.86. The home foreign money fell to an intra-day low of 81.22 per US greenback. The weak point in rupee additionally dampened fairness market investor sentiments and the benchmark Sensex at BSE fell sharply by 1020 factors or 1.7 per cent to shut at 58,098.9. The broader Nifty at NSE misplaced by 302.45 factors or 1.7 on Friday to shut at 17,327.3. Over the past two buying and selling periods the 2 indices have misplaced over 2.2 per cent.

The home is already divided over the quantum and tempo of charge hikes by the RBI. There are early however discernible indicators of a divergence of views between the federal government and the central financial institution on the latter’s financial motion to examine inflation versus the previous’s crucial to rekindle progress. The three-day RBI financial coverage committee is scheduled to start September 28, with the motion to be introduced on September 30.

North Block is learnt to be leaning in favour of a benign tempo of charge hikes by the RBI somewhat than the aggressive stand taken by central banks of developed international locations since inflation is being seen pushed primarily by international components and different considerations about employment and sluggish funding taking priority over inflation.