(Bloomberg) — Russia stated it should reduce oil output by 500,000 barrels a day subsequent month, following via on a risk to retaliate towards western sanctions and sending oil costs sharply greater.

Most Learn from Bloomberg

The output discount, which is the equal of about 5% of January output, has been hinted at repeatedly by the Kremlin for the reason that European Union and G-7 started discussing capping the worth of Russian exports. The transfer threatens renewed turmoil in an oil market that has in any other case taken in its stride the EU bans on most seaborne imports of Russian oil.

Crude costs jumped on the information, with Brent erasing earlier losses to rise as a lot as 2% to $86.50 a barrel as of 8:50 a.m. in London. Previous to this week, the worldwide benchmark had dropped 9% since mid-January, serving to to ease inflationary considerations.

“Russia believes that the mechanism of worth caps on Russian oil and petroleum merchandise is an intervention in market relations and an extension of damaging vitality insurance policies of the collective West,” Deputy Prime Minister Alexander Novak stated in a press release on Friday. His press service confirmed that crude output shall be affected by the cuts.

Moscow’s transfer deepens the two million barrel-a-day provide curbs introduced late final yr by OPEC+, which Russia leads together with Saudi Arabia. At a committee assembly earlier this month, ministers from the group noticed no want to vary their manufacturing restrict, which lasts till the tip of 2023.

For the reason that imposition of EU import bans and the worth cap “most observers anticipated some output loss, and Moscow may be trying to painting a obligatory reduce as a voluntary coverage selection,” stated Bob McNally, president of Rapidan Power Group and a former White Home official. “I doubt Russia’s OPEC+ companions had been taken without warning and don’t anticipate the availability discount will alter their ‘keep put’ coverage stance.”

Within the quick time period there may be no person to fill the availability hole created by the Russian cuts, stated Giovanni Staunovo, an analyst at UBS Group AG.

“OPEC+ would possibly enhance their group’s quota or unwind their cuts later this yr,” he stated. “There isn’t a strain to vary something production-wise at current.”

As of now, Russia is ready to promote its oil volumes to international markets, nevertheless it doesn’t need to adhere to the worth restrictions imposed by Western nations, Novak stated. “When making additional selections, we’ll act based mostly on how the market scenario is growing,” he stated.

Moscow’s oil income has taken successful in current months. The decline of about $40 a barrel in Brent crude since June has been the largest issue. The low cost at which Urals crude — Russia’s foremost export grade — trades to the worldwide benchmark has additionally widened because the EU import ban and G-7 worth cap pressured the nation to hunt out new markets and different strategies of cargo.

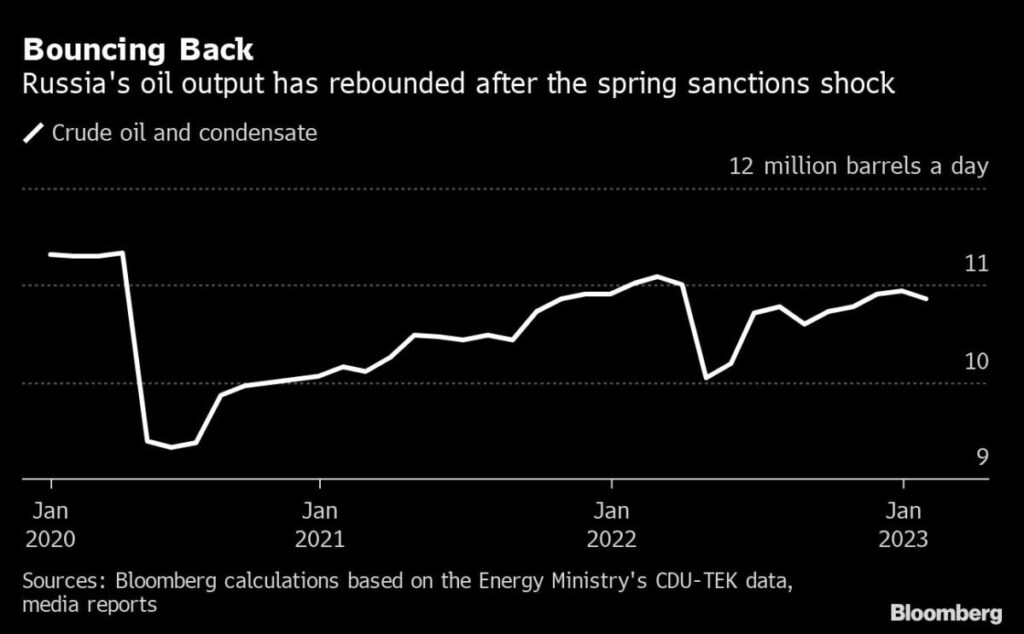

Even so, Russian manufacturing has been surprisingly resilient. Since hitting a post-invasion low of 10.05 million barrels a day in April, Russian oil manufacturing rebounded to round 10.9 million barrels a day on the finish of 2022. It stayed near that degree in January, regardless of the European Union’s ban on most seaborne imports of the nation’s crude on Dec. 5.

(Updates with analyst feedback in seventh paragraph.)

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.