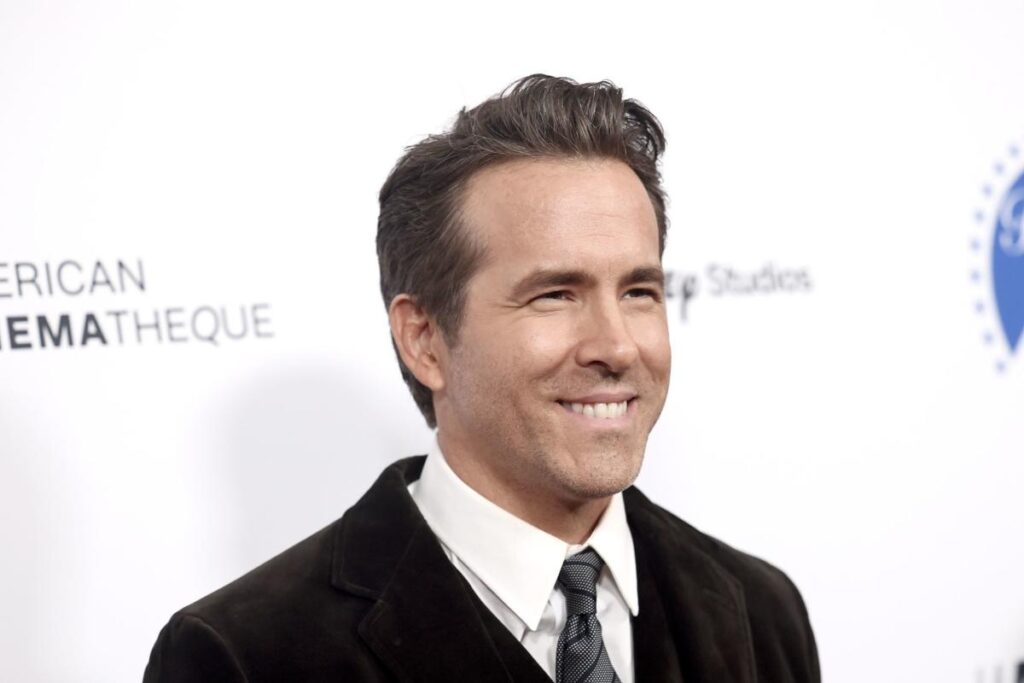

(Bloomberg) — T-Cell US Inc. is shopping for Mint Cell, the finances wi-fi supplier partly owned by actor Ryan Reynolds, for as a lot as $1.35 billion in an effort to bolster its pay as you go telephone enterprise and attain extra lower-income prospects.

Most Learn from Bloomberg

The second-largest US wi-fi supplier is buying Mint’s intently held guardian firm, Ka’ena Corp., with a mixture of 39% money and 61% inventory, in line with an announcement Wednesday. The last word buy worth shall be based mostly on Mint reaching sure efficiency objectives, each earlier than and after the transaction closes. The sale talks have been first reported by Bloomberg Information in January.

Reynolds, who owns an undisclosed however “important” stake in Mint, will proceed to make industrial appearances on the corporate’s behalf, co-founder David Glickman mentioned in an interview, including the actor has incentives to “proceed for years.” Glickman and his associate Rizwan Kassim will be part of T-Cell and handle the enterprise, which incorporates Extremely Cell, a world telephone service.

Mint affords among the nation’s lowest priced cellular plans, beginning at $15 a month for 4 gigabytes of wi-fi knowledge. The businesses didn’t disclose Mint’s subscriber depend. Its annual subscriber progress over the previous 4 years has been 50%, and income progress has been 70% or extra a 12 months, Glickman mentioned.

Bloomberg Intelligence analysts John Butler and Hunter Sacco estimate the deal could enhance T-Cell’s buyer depend by 2 million customers. The enterprise has no shops, and sells telephones and cellular plans totally on-line. The service is supplied by T-Cell already as a part of a wholesale network-sharing settlement.

“Mint’s formulation works, the model is rising quick and we are able to pour extra gas onto that by leveraging shopping for energy for telephones and advertising and marketing,” mentioned Mike Katz, president of selling for T-Cell. The Bellevue, Washington-based service additionally operates its personal pay as you go model referred to as Metro.

The pay-as-you-go market is seen as a supply of total subscriber progress as credit-challenged prospects are ultimately pulled into common month-to-month billings. Mint competes with different pay as you go telephone manufacturers, together with Cricket from AT&T Inc., Whole from Verizon Communications Inc. and Increase Cell from Dish Community Corp.

T-Cell expects the deal to shut later this 12 months and doesn’t anticipate any modifications to its 2023 monetary outlook. Mint shall be “barely accretive” to adjusted earnings earlier than curiosity, taxes, depreciation and amortization. The shares rose 1% to $144.42 on the shut on Wednesday.

Reynolds, a pitchman and co-owner of Aviation American Gin, offered that model to Diageo Plc in 2020 for $610 million, with almost half that potential cost based mostly on gross sales efficiency over 10 years. The actor, identified for his work within the superhero sequence Deadpool, met Glickman by way of their joint work with the Michael J. Fox Basis for Parkinson’s Analysis. Reynolds additionally co-owns the Welsh soccer workforce Wrexham AFC, which has been featured in a documentary sequence on the FX community.

“We’re so blissful T-Cell beat out an aggressive last-minute bid from my mother Tammy Reynolds as we consider the excellence of their 5G community will present a greater strategic match than my mother’s slightly-above-average mahjong expertise,” Reynolds joked within the assertion.

(Provides buyer estimate in fifth paragraph.)

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.