A decline within the buying energy of American paychecks helped put Donald Trump again within the Oval Workplace.

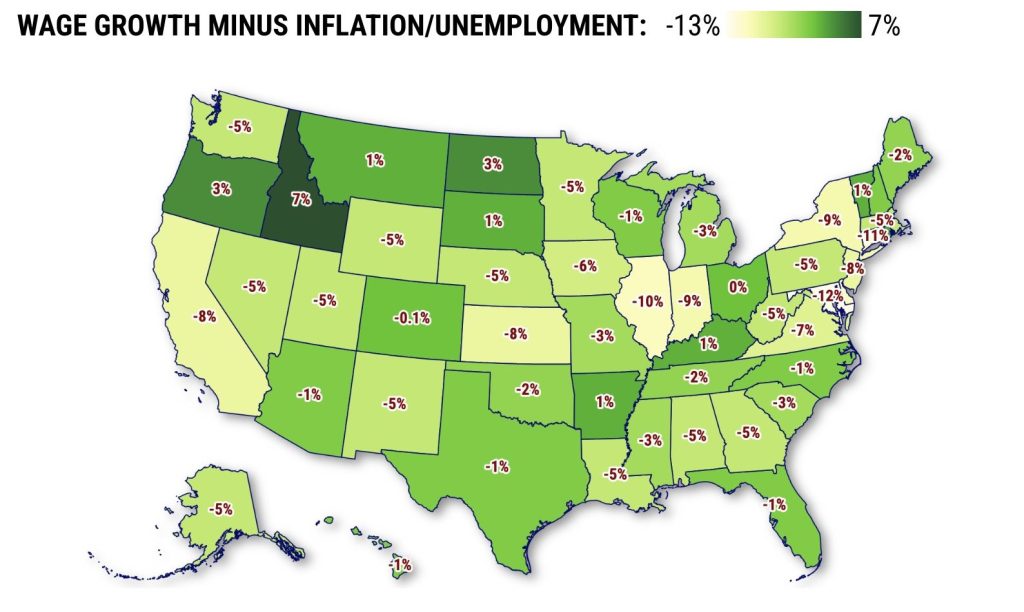

To gauge the financial slice of the Trump victory over Kamala Harris, my trusty spreadsheet crafted a paycheck energy index. It mixed three key enterprise yardsticks for the 50 states and the District of Columbia – eight years of common weekly wages paid by non-public business bosses, unemployment charges, and nationwide inflation as measured by the Shopper Value Index.

Pay hikes had been measured towards joblessness to approximate how many individuals obtained wage boosts. These raises had been then discounted by the rising value of dwelling.

Subsequent, to create a nationwide index with voting in thoughts, buying energy outcomes had been weighted by a state’s electoral faculty votes. That gave this yardstick, just like the presidential election, a contact of small-state favoritism. Right here is how this metric labored.

- REAL ESTATE NEWSLETTER: Get our free ‘Dwelling Stretch’ by e-mail. SUBSCRIBE HERE!

First, observe that within the 4 years ending in September – roughly measuring President Biden’s financial system, a monitor report politically tied to Harris, his vp – a typical US paycheck grew 17%. That was barely higher than the 14% enhance within the earlier 4 years of the Trump presidency.

Second, the Biden/Harris unemployment charge averaged 4.2% vs. 4.8% within the Trump years.

Lastly, and maybe the election-turning issue, shopper costs rose 21% through the previous 4 years vs. an 8% achieve within the earlier 4.

So if you mix these three measurements, adjusted for the Electoral Faculty’s oddities, the paycheck energy index declined 4% within the Biden/Harris period after rising 5% beneath Trump.

That’s no small hole. Exit polling reveals us that one-third of voters mentioned the financial system was their prime difficulty – with 80% of pocketbook-antsy of us voted for Trump.

Pay swing

Now, let’s take into account the index the place presidential elections are literally determined – on the state degree.

When evaluating these intervals, a typical paycheck’s shopping for energy grew in simply two states: Idaho and North Dakota. Regardless of the financial system, liberal Harris by no means had an opportunity in both conservative state.

But, take into account the drops on this wage benchmark for 2024’s seven swing states – all apparently received by Trump.

Nevada: Buying energy fell 5% over the last 4 years vs. a 9% achieve within the earlier 4. That’s the eighth-largest downswing among the many states.

Arizona : Off 1% final 4 years vs. earlier 8% achieve. The twenty sixth largest hole.

Georgia: Off 5% final 4 years vs. earlier 3% achieve – No. 27.

Michigan: Off 3% final 4 years vs. earlier 4% achieve – No. 32.

- INFLATION TRENDS: What’s up? What’s cheaper? What’s subsequent? CLICK HERE!

Pennsylvania: Off 5% final 4 years vs. earlier 2% achieve – No. 31.

Wisconsin: Off 1% final 4 years vs. earlier 4% achieve – No. 38.

North Carolina: Off 1% final 4 years vs. earlier 4% achieve – No. 40.

Caveat

Now, ponder shopping for energy’s shrinkage in three big economies with very differing political preferences. Pocketbooks clearly didn’t sway each voter.

In California, paycheck energy declined 8% within the final 4 years vs. a 9% achieve in the earlier 4. That fourth-largest hole didn’t cease Harris from simply profitable the state.

In the meantime, the Texas pay index was down 1% within the final 4 years vs. being up 1% beforehand, the fourth-mildest slide. And Florida’s latest 1% dip in contrast with a 6% enhance in 2016-20, the Seventeenth-best efficiency.

Nonetheless, this pair of states simply went for Trump.

Backside line

In a earlier column, I famous that inflation and the job market had been traditionally correct predictors of presidential elections. The one downside this 12 months was they pointed in reverse instructions: jobs favoring Harris whereas inflation favored Trump.

Harris and her supporters campaigned that the financial system was performing admirably. My paycheck index tends to agree.

- HIRING TRENDS: Who’s including staff? The place are the layoffs CLICK HERE!

Take into consideration the not too long ago accomplished third quarter. US weekly wages grew at a 3.2% annual charge, off barely from the three.6% common since 2016. In the meantime, unemployment ran 3.9% vs. at 4.5% norm.

And pesky inflation cooled, rising at a 2.6% annual charge vs. a 3.4% eight-year common.

That left my paycheck energy index up 0.4% for the quarter. That was the primary enhance in buying energy for American staff because the begin of 2021.

So was that upswing too little, too late? Was the financial system not a related difficulty for undecided voters?

Or had been many People unwilling to forgive the holes of their wallets created by what had been the worst inflationary spike in 4 a long time?

Jonathan Lansner is the enterprise columnist for the Southern California Information Group. He will be reached at jlansner@scng.com