Now that we’ve had time to digest the April jobs numbers, some strategists are getting nervous in regards to the financial system’s mid-term outlook. The roles report confirmed 175,000 new jobs added within the month – however that was the bottom acquire prior to now six months, and was accompanied by an uptick in unemployment, from 3.8% to three.9%. Together with these topline numbers, the report confirmed declines in job openings and hires.

For Roukaya Ibrahim, watching the US financial system from BCA, this job report might point out a shift towards a recession by the tip of this 12 months or early in 2025.

“I believe that there’s nonetheless a runway for the delicate touchdown narrative to proceed over the approaching months. However finally, the unemployment charge goes to take greater and that’s going to result in considerations a few recession,” Ibrahim famous.

The strategist goes on to foretell that, within the occasion of a recession, the S&P 500 may drop to three,600, or a 31% decline from present ranges.

Which may be a depressing outlook, and it suggests a defensive stance for buyers – which is able to naturally flip our consideration to dividend shares. These shares are identified for offering actual safety to an funding portfolio throughout a downturn, by a dependable revenue stream through dividend funds.

In opposition to this backdrop, some Wall Avenue analysts have given the thumbs-up to 2 dividend shares yielding greater than 12%. Opening up the TipRanks database, we examined the main points behind these two to search out out what else makes them compelling buys.

Kimbell Royalty Companions (KRP)

For the primary inventory on our listing, we’ll head to Fort Value, Texas, the place Kimbell Royalty Companions has its headquarters. This firm has chosen the proper place to arrange store – Texas, in latest a long time, has develop into a serious participant on this planet vitality business, and Kimbell is within the mineral rights enterprise. The corporate buys land titles and related mineral rights in wealthy hydrocarbon basins throughout the US, and earns royalties on the oil and fuel manufacturing that takes place on its holdings. The corporate at the moment holds roughly 17 million gross acres in 28 states, with its largest single footprint within the well-known Permian Basin within the Texas-New Mexico boundary area.

Kimbell’s holdings host lively oil and fuel extraction actions. As of March 31 this 12 months, the tip of Q1, Kimbell’s main properties had 8.2 DUCs, or drilled however uncompleted wells. The corporate’s whole acreage had 98 lively rigs, which represented greater than a 16% market share of all lively land rigs within the decrease 48 states.

Royalties on oil, pure fuel, and pure fuel liquid manufacturing from Kimbell’s acreage type the bottom of the corporate’s income stream, and Kimbell realized a prime line of $82.2 million in 1Q24. This determine was up 22% year-over-year and beat the forecast by $1.1 million. The income was primarily based on a document quarterly run-rate each day manufacturing of 24,678 Boe, or barrels of oil equal, per day.

Of specific curiosity to dividend buyers, Kimbell completed Q1 with $48.9 million in money out there for distribution, up 59% year-over-year. The corporate declared its Q1 dividend at 49 cents per widespread share, for fee on Might 20. This dividend represents a payout of 75% of the money out there for distribution. Its annualized charge of $1.96 per widespread share provides a ahead yield of 12.2%, a excessive return by any measure and much above the present 3.5% charge of inflation.

For Truist analyst Neal Dingmann, an analyst ranked within the prime 1% of Avenue inventory professionals and an skilled on the vitality sector, a number of key elements inform the bull case. “We forecast Kimbell to proceed to generate manufacturing and FCF development with quite a few line-of-site wells guaranteeing ample upside,” stated the 5-star analyst. “The stable manufacturing profile together with what seems to be continued robust costs resulted within the firm boosting its distribution by 14% throughout the latest interval. We anticipate the corporate persevering with so as to add strategic belongings such because the personal deal late final 12 months given KRP’s relationships/skillset and the continued fragmented minerals market.”

These feedback assist Dingmann’s Purchase score on the shares, whereas his $21 worth goal implies a one-year upside potential of 31%. Add the ahead dividend yield, and that’s a doable return of 43%. (To look at Dingmann’s monitor document, click on right here)

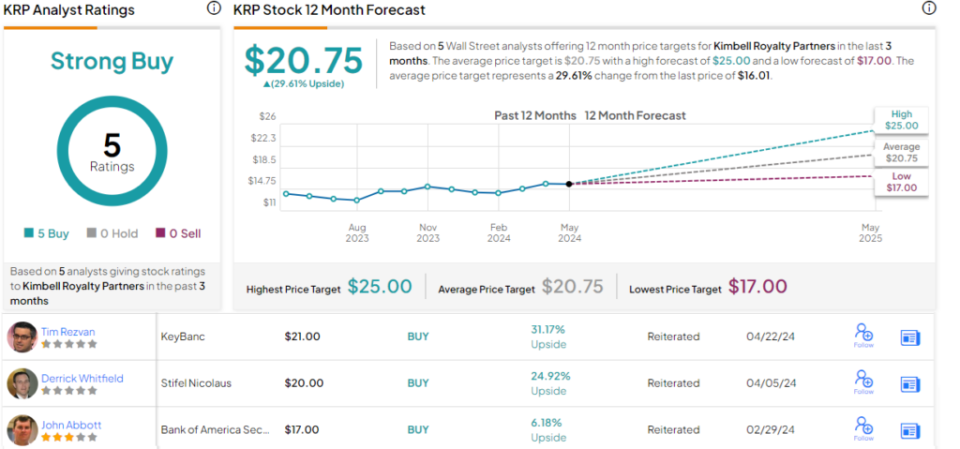

That bullish outlook isn’t any outlier, as Kimbell’s Sturdy Purchase consensus score is unanimous, primarily based on 5 optimistic analyst evaluations in latest weeks. The inventory is promoting for $16.01, and its $20.75 common worth goal means that the shares will acquire 29.5% over the approaching 12 months. (See KRP inventory forecast)

TXO Vitality Companions (TXO)

The second inventory on our listing is TXO Vitality Companions, a restricted grasp partnership agency working within the Southwest. The corporate owns productive hydrocarbon acreage positions in two of the area’s finest vitality basins – the Permian, of Southwest Texas and New Mexico, and the San Juan, straddling the New Mexico-Colorado state line. These basins are identified for his or her worthwhile oil and fuel performs, and TXO’s land holdings in each convey stable advantages to the corporate and its shareholders.

TXO’s administration takes nice care in its land acquisitions, specializing in constructing a profile primarily based on predictable manufacturing. The corporate achieves this by basing its properties on confirmed oil and fuel manufacturing, selecting places which have decades-long manufacturing histories. This offers TXO a set of holdings with clearly understood geology and reservoir traits, lowering the chance when in comparison with unconventional useful resource performs. TXO’s belongings have long-lived reserves and low manufacturing decline charges, together with excessive hydrocarbon restoration charges relative to the prices of finishing drilling actions.

Getting right down to brass tacks, because of this TXO has stable prospects for producing revenues and dividends from its property holdings. That stated, in its final SEC submitting, the corporate reported a 1Q24 prime line of $67.44 million, a determine that fell by 57.4% in comparison with the year-ago interval, though it beat the estimates by $2.2 million. The corporate adopted this up with a distribution declaration – that’s, a dividend – of 65 cents per widespread share. This represented a 7-cent improve from the earlier quarter. The newly raised dividend annualizes to $2.60 per widespread share and provides a ahead yield of 12.6%.

This inventory has caught the attention of Stifel analyst Derrick Whitfield, who stays bullish on the shares, writing, “In brief, we imagine TXO presents buyers a extremely skilled administration crew, publicity to low decline, low value manufacturing, a shareholder-friendly distribution framework, and a lovely valuation relative to friends. Based mostly on our estimates, TXO can return 100% of its enterprise worth by 2030, providing important worth now and potential upside sooner or later. Internet-net, TXO presents advantaged dividend yield and operational management relative to its Minerals friends, in our view.” (To look at Whitfield’s monitor document, click on right here)

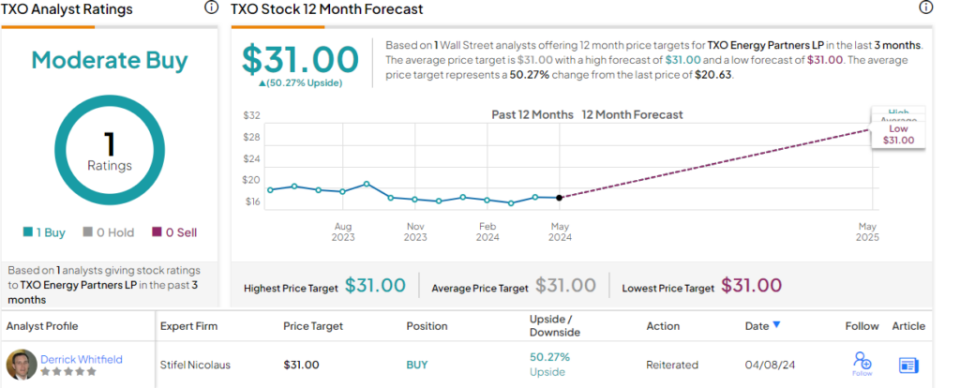

The Stifel take is the one analyst evaluate at the moment on file for TXO and features a Purchase score with a $31 worth goal that factors towards a 50% acquire on the one-year horizon. With the dividend yield, the entire return can attain almost 63%. (See TXO inventory forecast)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely essential to do your personal evaluation earlier than making any funding.