Inflation made the headlines by most of final yr, for all of the worst causes: it ran far too excessive, peaked above 9% in June, and the inflationary pressures pushed down onerous on inventory markets. The Fed jacked rates of interest up their highest stage in over a decade, risking recession to struggle the rise in costs.

Immediately, inflation continues to be within the headlines, though the tone has shifted. The annualized price is trending downward; the December quantity got here in at 6.5% year-over-year. Whereas that is excellent news, some doubts stay.

“To the upside, inflation of sticky costs like violin classes, veterinarian charges, automobile repairs, and different companies supplied by small companies and sole proprietors was nonetheless accelerating in late 2022—and that stickiness may make inflation rebound later this yr or in 2024 as development will get again on observe,” mentioned Comerica Financial institution chief economist Invoice Adams in a current word.

A potential rebound within the tempo of inflation instantly suggests defensive portfolio strikes for retail traders, particularly into dividend shares. These income-generating equities supply some extent of safety in opposition to each inflation and share depreciation by offering a gentle earnings stream.

In opposition to this backdrop, some Wall Avenue analysts have given the thumbs-up to 2 dividend shares yielding of seven%, and even higher. Opening up the TipRanks database, we examined the small print behind these two to seek out out what else makes them compelling buys.

Enterprise Merchandise Companions (EPD)

We’ll begin with a midstream vitality firm, Enterprise Merchandise Companions. Enterprise’s community of transport and storage belongings connects the wellheads with the purchasers within the hydrocarbon sector; the corporate’s main work is transferring crude oil, refined merchandise, pure gasoline, and pure gasoline liquids to the place they’re wanted. Enterprise has a community of belongings, together with pipelines, rail and highway tankers, and barges, in addition to refineries, processing vegetation, terminal factors, and tank farms. These networks are centered on the Texas and Louisiana coasts, however extent up the Mississippi Valley and into the Rocky Mountains, into the Southeast, and into Appalachia and the Nice Lakes areas.

The hydrocarbon sector has gotten a lift from rising costs over the previous 18 months, supported by the truth that our trendy world merely can not do with out gasoline – and so customers can not make vital cuts in utilization. Because of this, whereas the S&P 500 has proven a 11% decline within the final 12 months, EPD shares are up by roughly 14% in that very same interval. This acquire has come alongside the same development of rising revenues and earnings.

The corporate will report quarterly outcomes on February 1, for This fall and full-year 2022; however we are able to look again at Q3 to get a concept of the image. The third quarter high line was $15.5 billion, up from $10.8 billion within the prior yr quarter. Of explicit curiosity to dividend traders, the online earnings attributable to shareholders got here to $1.4 billion, up from $1.2 billion one yr earlier. In EPS phrases, this was 62 cents per diluted share, a acquire of 19% y/y.

The corporate declared its subsequent dividend fee, for 4Q22, on January 5, at 49 cents per frequent share. This fee will exit on February 14. The annualized fee, of $1.96, provides a yield of seven.7%, greater than 3x the common dividend yield discovered on the broader markets – and extra importantly, beating present inflation by greater than a full level. Enterprise is dedicated to conserving the dividend dependable, and has a 24 yr historical past of normal dividend will increase.

This firm has caught the attention of analyst Linda Ezergailis from TD Securities, who writes, “We consider EPD’s items supply a mixture of worth and distribution development at a reasonable danger profile, given the corporate’s well-positioned built-in system of belongings, connectivity, scale, incumbency, and experience. Our thesis incorporates expectations of some valuation enlargement as traders acknowledge the long-term development potentialities that EPD has related to its hydrocarbon-related exports to rising markets, transition to a lower-carbon vitality future, and value-chain extension to midstream petrochemicals alternatives.”

Wanting ahead from her place, Ezergailis charges EPD shares a Purchase, and her worth goal of $31 implies a one-year upside potential of 21%. Primarily based on the present dividend yield and the anticipated worth appreciation, the inventory has ~29% potential complete return profile. (To observe Ezergailis’ observe report, click on right here)

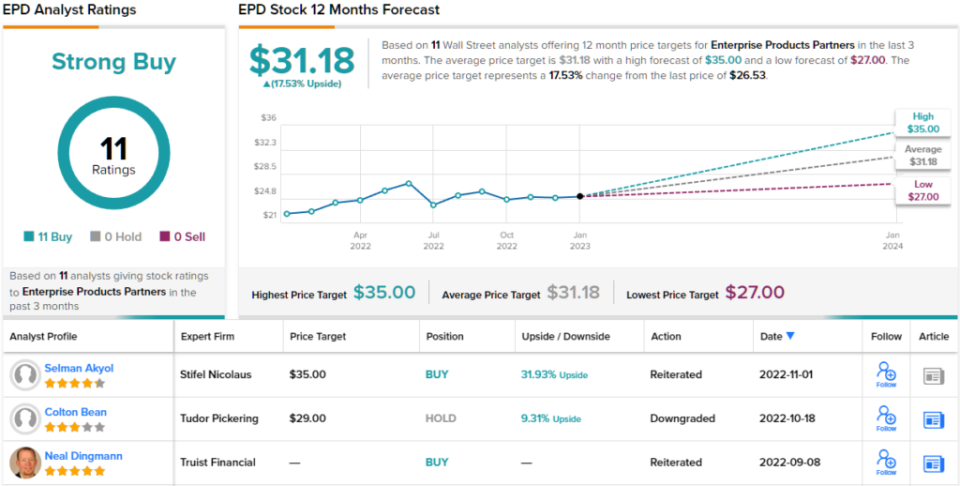

Some shares earn their love from Wall Avenue – and EPD, with 11 optimistic evaluations supporting a unanimous Robust Purchase consensus score, has clearly performed so. The shares are buying and selling for $25.59, and their common worth goal of $31.18 signifies room for 17.5% appreciation over the following 12 months. (See EPD inventory forecast)

Coterra Power, Inc. (CTRA)

The second inventory on our record, Coterra Power, exists within the exploration and manufacturing realm of the hydrocarbon trade – particularly, within the North American oil and gasoline fields. Coterra’s community of operations is in a few of North America’s best and worthwhile formations, equivalent to Pennsylvania’s Marcellus shale, Texas’ Permian basin, and Oklahoma’s Anadarko basin. Total, Coterra has a 600,000 acre footprint, and nicely over 2,891 million barrels of oil equal in confirmed reserves.

Coterra’s strong place within the exploration and manufacturing world is mirrored within the firm’s steadily rising revenues and earnings. Coterra will report its 4Q22 and full-year 2022 outcomes on February 23, however for now we are able to take a look at the revealed 3Q22 outcomes for an image of how the corporate is doing.

That image is considered one of income positive factors. Revenues got here to $2.52 billion, in comparison with simply $440 million one yr prior. These revenues introduced in internet earnings of $1.196 billion, up from $64 million in 3Q21. Earnings per share rose from 16 cents to $1.51 y/y. Money from operations reached $1.77 billion within the quarter, with free money movement of $1.06 billion. These sound outcomes rested on excessive manufacturing numbers, which exceeded the beforehand revealed steerage. Oil manufacturing in 3Q22 got here in at 87.9 MBopd, above the steerage mid-point, and pure gasoline manufacturing for the quarter averaged 2.807 billion cubic feed each day, beating the steerage high-end.

On the dividend entrance, Coterra has introduced plans to return as much as 74% of Q3 free money movement to shareholders, with two-thirds of that return made by dividend funds. The present dividend, of the 15-cent base plus the 53-cent variable, equals 68 cents per frequent share; this dividend provides a strong yield of 11%, far above each the common yields amongst peer firms – and the speed of inflation.

Stifel analyst Derrick Whitfield has been protecting Coterra, and he’s upbeat concerning the firm’s confirmed reliability – and future plans – in returning capital to shareholders.

“Coterra has dedicated to a +50% return to shareholders, excluding share buybacks. Over the previous two quarters, the corporate has returned 81% and 74% of FCF by money dividends and share repurchases. Throughout a current assembly with the corporate, the CEO famous that he desires to differentiate the corporate in 2023, which we consider might be within the type of a wholesome improve within the base dividend and elevated share buybacks,” Whitfield famous.

These feedback, and the implication for the inventory’s worth to dividend traders, again up Whitfield’s Purchase score on CTRA, and his worth goal, now at $38, suggests a acquire of 54% on the one-year horizon. (To observe Whitfield’s observe report, click on right here)

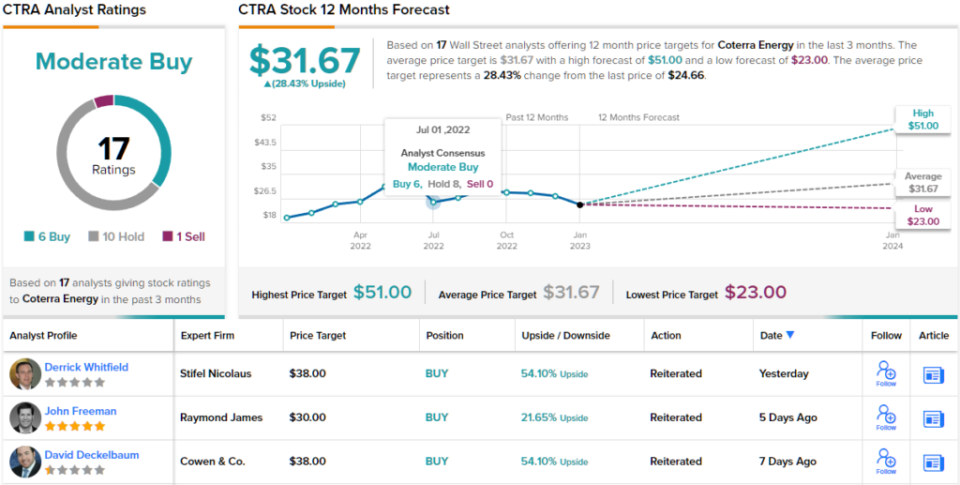

Wanting on the consensus breakdown, 6 Buys, 10 Holds, and a single Promote have been revealed within the final three months. Due to this fact, CTRA will get a Reasonable Purchase consensus score. Primarily based on the $31.67 common worth goal, shares may surge ~28% within the subsequent yr. (See CTRA inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally essential to do your individual evaluation earlier than making any funding.