Buyers are all the time on the lookout for excessive returns, and proper now the indicators are lining up in favor of the high-yield dividend phase. Dividend funds guarantee an everyday revenue stream, no matter market situations, whereas excessive yields provide the potential for strong returns on funding.

The dividend shares are additionally favorites of defensive buyers, tending to be much less risky throughout market ups and downs. That’s an essential level proper now – though the consensus knowledge is suggesting that we’ll see an financial comfortable touchdown, there’s nonetheless an opportunity of an financial downturn.

This background has knowledgeable a current observe from Desh Peramunetilleke, head of Microstrategy at funding financial institution Jefferies, who factors towards high-yield dividend shares as sound decisions given at present’s situations.

“After a difficult 2023,” the Jefferies staff says, “the outlook for dividend methods has improved. Fed is more and more leaning in the direction of June being the primary reduce, indicating that development will develop into an even bigger problem than inflation. Nevertheless, given {that a} hard-landing is unlikely, ultra-defensive bond-proxies may proceed to wrestle. As a substitute, we discover high-quality yield as best-placed to seize the cycle.”

Jefferies’ Omar Nokta, a 5-star analyst rated within the high 4% of the Road’s inventory professionals, has adopted this line of thought with a number of particular picks – tagging 2 high-yielding dividend shares as buys, decisions that ought to return as much as 8% dividend yield. We’ve used the TipRanks database to get the broader view of those shares, and located that they’ve earned Robust Purchase consensus rankings. Listed here are the main points

DHT Holdings (DHT)

We’ll begin with a tanker firm, DHT Holdings. This agency is among the unbiased operators within the world oceanic transport sector, specializing within the carriage of crude oil. DHT’s title is the acronym for ‘double hull tankers,’ a contemporary mode of tanker development designed to advertise security and stop leaks. The corporate is a pure-play operator of VLCC’s, or ‘very massive crude carriers,’ huge tankers with rated within the vary of 299,000 to 320,000 dry weight tonnage (DWT). These are the most important of the crude tankers plying the oceans at present.

DHT’s fleet of 28 VLCCs is wholly owned by the corporate and operated totally on a constitution foundation. The prevalence of long-term constitution contracts within the firm’s operations mannequin offers DHT a excessive stage of dependable fastened revenue.

Fleet high quality is an important issue for oceanic tanker firms, and DHT has a comparatively younger fleet. All however 4 of its vessels have been in-built 2011 or later, with the 5 youngest vessels afloat having been in-built 2018. The corporate’s fleet includes a complete of 28 VLCCs, together with 4 tankers for which the corporate has lately entered into constructing agreements. These 4 vessels are to be constructed at South Korean shipyards and can gross 320,000 DWT every. Every ship has a mean value of $128,500,000 and might be delivered in 2026.

In its final quarterly monetary outcomes, from 4Q23, DHT reported a complete of $94.5 million in adjusted web revenues, a complete that was down 19% year-over-year however was $1 million higher than had been anticipated. The corporate’s EPS, by GAAP measures, got here to 22 cents per share. This was 1 cent above the forecast – and it totally coated the corporate’s most up-to-date dividend declaration.

The dividend, amounting to 22 cents per widespread share, was declared together with the This fall outcomes. This dividend cost represented a 15.7% improve from the earlier cost and was despatched out to widespread shareholders on February 28. The annualized cost of $0.88 per widespread share yields an 8% return.

Jefferies analyst Omar Nokta is impressed by the standard of DHT’s ships and operations, writing: “DHT is a pure-play VLCC shipowner with publicity to the spot market, with its eco-design and scrubber-equipped vessels positioned for outsized earnings potential. We see stronger dynamics forward for tankers, particularly with rising non-OPEC manufacturing volumes and the potential for extra OPEC+ exports. We count on shareholders to learn from its dividend payout ratio of 100% of quarterly earnings.”

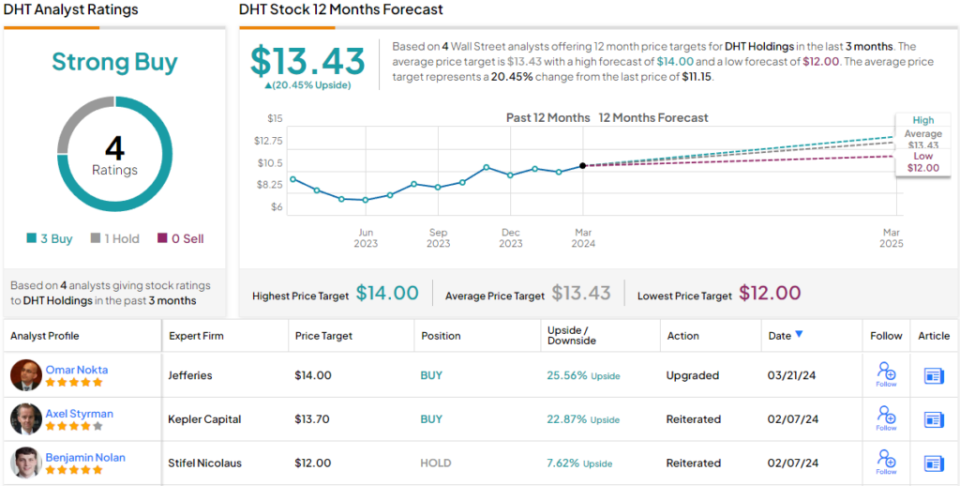

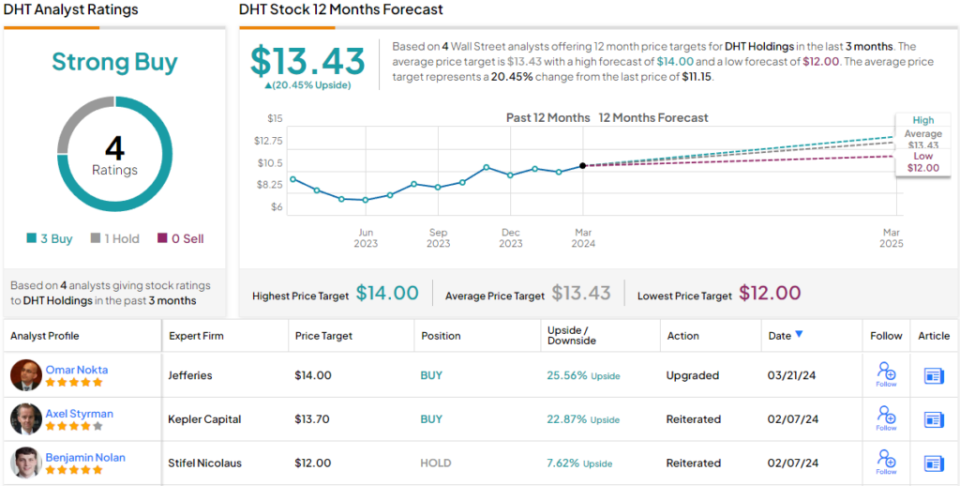

Taking this ahead, Nokta offers DHT a ranking of Purchase, an improve from Maintain, and a value goal of $14 that factors towards a one-year upside potential of ~26%. (To observe Nokta’s monitor report, click on right here)

General, this inventory’s Robust Purchase consensus ranking relies on 4 current analyst critiques, that break down to three Buys and 1 Maintain. The shares are buying and selling for $11.15, and the $13.43 common goal value implies the shares will acquire ~20% within the subsequent 12 months. (See DHT inventory forecast)

Frontline (FRO)

The subsequent inventory on Jefferies’ listing is Frontline, one of many world’s largest tanker firms. Frontline carries each crude oil and refined merchandise and operates one of many business’s largest and most fashionable fleets. The corporate has 86 vessels afloat, with the oldest in-built 2009 and 20 in-built 2020 or later. The fleet consists of 43 VLCCs, the most important class of ocean-going tanker, and likewise consists of 25 Suezmax vessels, rated at 157,000 DWT and the most important that may transit the Suez canal, in addition to 18 LR2/Aframax tankers, rated at 110,000 DWT.

Frontline has been in operation since 1985 and has seen strong successes in current quarters. Revenues have been up final 12 months in comparison with the prior 12 months, rising 27% from $1.44 billion in 2022 to $1.83 billion in 2023. The corporate’s inventory additionally noticed robust positive aspects, greater than 60% within the final 12 months and almost 17% for the year-to-date.

With the fourth quarter of 2023 behind us, we are able to have a look at Frontline’s income for that quarter. The corporate had $415 million on the high line, down 21% year-over-year and greater than $5 million beneath the forecast. On a greater observe, the corporate’s adjusted revenue for the quarter, at $102.2 million, got here to 46 cents per share.

This was greater than sufficient to cowl the common share dividend, which was declared on February 28 for a cost on March 27, at a charge of 37 cents per share. This declaration represents a 23% improve from the earlier quarter, and the annualized dividend, of $1.48, offers a yield of 6.4%. Frontline has a historical past of adjusting its dividend cost to maintain it consistent with present earnings.

In his protection for Jefferies, analyst Nokta is impressed by the corporate’s capacity to constantly keep a excessive dividend payout ratio. He says of the inventory, “Frontline is among the largest crude tanker operators on the earth with a younger fleet and excessive scrubber publicity. We see stronger dynamics forward for tankers, particularly with rising non-OPEC manufacturing volumes and the potential for extra OPEC+ exports. We count on dividends to stay a central a part of the Frontline story and count on shareholders to learn from its unofficial dividend payout ratio of 80% of quarterly earnings.”

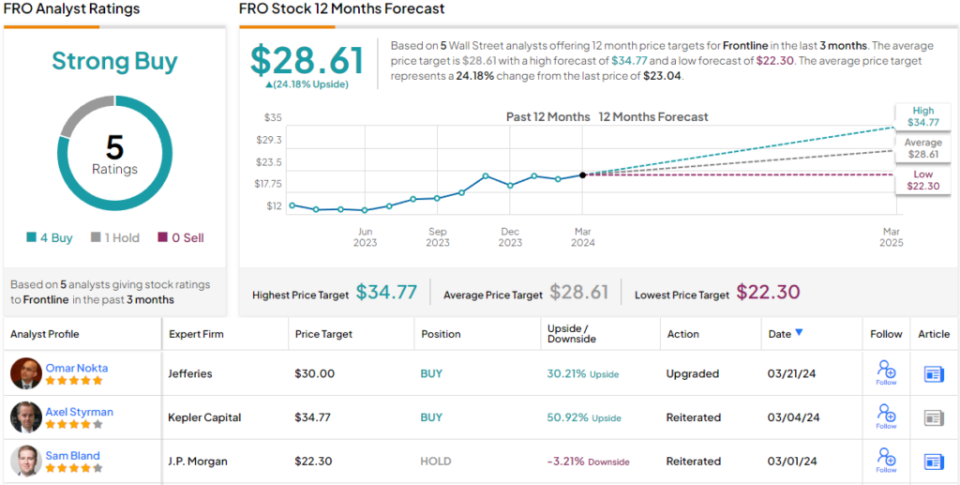

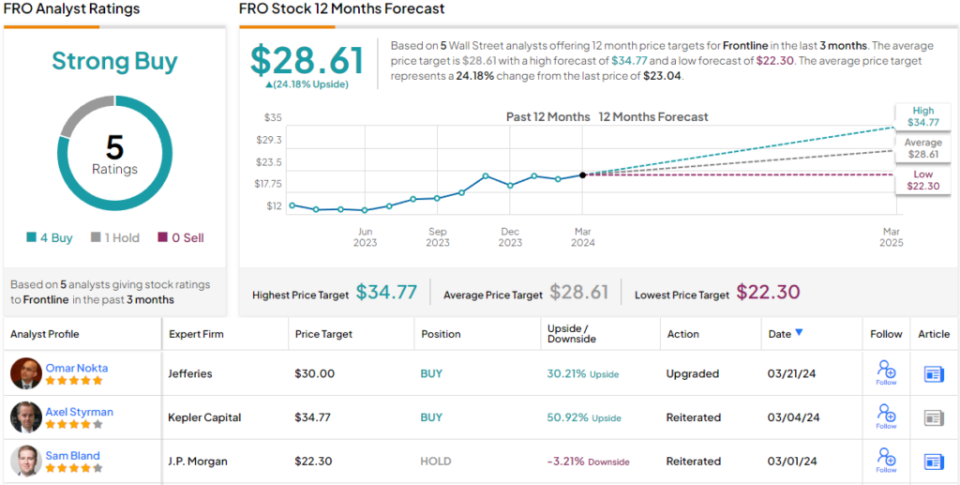

Trying forward, Nokta offers this inventory, like DHT above, an upgraded ranking, from Maintain to Purchase. His value goal right here, set at $30, suggests a possible one-year upside of 30%.

All in all, Frontline has 5 current analyst critiques, together with 4 Buys to 1 Maintain, for a Robust Purchase consensus ranking from the Road’s analysts. The inventory’s common goal value of $28.61 and its present buying and selling value of $23.04 collectively suggest a one-year acquire of 24%. (See FRO inventory forecast)

To search out good concepts for dividend shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is rather essential to do your personal evaluation earlier than making any funding.