The markets have been exhibiting some wobbly tendencies just lately, with the robust rally seen within the first half of the yr showing to have wilted a bit below the summer time solar.

Concern not, nonetheless, seems to be the recommendation of 1 outstanding inventory picker. With US inflation falling to three% just lately in comparison with final summer time’s 9%, and with GDP development within the final quarter coming in at 2.4%, well-known worth investor Invoice Miller, whose web price is valued at $1.4 billion, thinks the remainder of the yr seems to be fairly good for the inventory market.

“It’s completely attainable that we’re going to get again to a 2% inflation price by the tip of this yr,” says Miller. “If we accomplish that with out experiencing a recession and with earnings being okay, that will offer you a a lot, a lot increased justified valuation available in the market than we’re at proper now.”

With such a constructive outlook, then, it is smart to search out out which shares Miller believes will carry on delivering the products. On this regard, we took a more in-depth have a look at two dividend shares, providing yields of as much as 9%, that are at present held by Miller’s agency, Miller Worth Companions. Right here’s what we discovered.

CTO Realty Development (CTO)

We’ll begin with CTO Realty Development, an actual property funding belief (REIT) centered on shopping center and retail area of interest properties. The corporate’s portfolio options belongings in Southeast and Southwest of the US, and leans closely on high-quality, income-generating properties. CTO additionally holds a big stake in Alpine Earnings Property Belief, one other retail-oriented REIT.

CTO doesn’t select its property investments solely for his or her skill to generate present revenue; the corporate can be centered on future revenue potential. Greater than half of its portfolio investments – 13 out of 21 properties – are positioned in Florida, Georgia, or Texas, three of the fastest-growing US state economies. By GDP development, all three states rank within the high 10.

Persevering with on the momentum seen through the first quarter, the corporate delivered a robust set of ends in Q2. The highest line got here to $26.05 million, for a 34% improve year-over-year and beating the forecast by $1.82 million. The agency’s backside line quantity, a web revenue per diluted share of three cents, in contrast favorably to the year-ago quarter’s 0-EPS – and was 11 cents per share higher than anticipated.

Of explicit curiosity to dividend traders, CTO reported a Q2 funds from operations, or FFO, of 43 cents per diluted share. This was 6 cents higher than anticipated, and totally lined the 38-cent dividend cost. That widespread inventory dividend, final declared in Could and paid out on June 30, represented a 1.8% y/y improve. The annualized price, at $1.52 per widespread share, offers a yield of 9.2%.

Shifting our focus to Miller’s involvement with CTO, we discover that the billionaire’s agency is holding 436,900 shares, price $7.2 million.

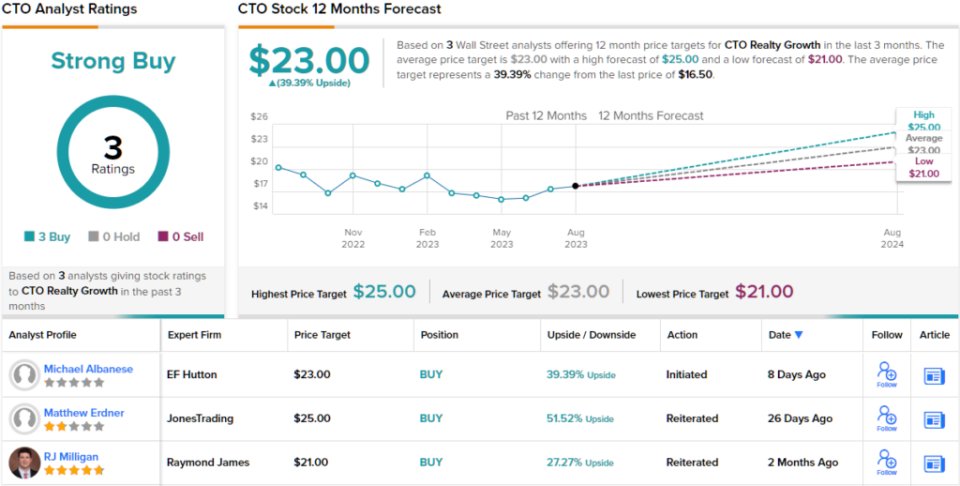

CTO’s engaging valuation and return potential have additionally caught the attention of analyst Matthew Erdner, from Jones Analysis, who writes of the inventory: “We stay constructive on the portfolio and imagine there’s vital upside to present buying and selling ranges. CTO shares stay considerably discounted relative to friends based mostly on conventional valuation metrics. CTO trades at a 29% low cost to our $24.95 2Q23 NAV estimate and a dividend yield of [9.2%].”

Erdner’s feedback again up his Purchase ranking right here, and his $25 value goal implies a 51% return for the approaching yr. (To look at Erdner’s monitor report, click on right here)

Total, all three of the latest analyst opinions on CTO are constructive, for a unanimous Sturdy Purchase consensus ranking. The $23 common value goal suggests a 39% share appreciation from the present $16.5 buying and selling value. (See CTO inventory forecast)

Jackson Monetary (JXN)

For the following inventory, we’ll shift from REITs to the world of long-term finance. Jackson Monetary is a holding firm, based mostly in Lansing, Michigan, with subsidiaries in life insurance coverage and asset administration. The corporate is well-known as a supplier of RILAs, or registered index-linked annuities, insurance-based, tax-deferred, long-term financial savings choices that supply controlled-risk development choices for retail traders.

Jackson’s product traces are based mostly on variable annuities, permitting clients to learn from a variety of funding choices. Variable annuities convey increased danger than mounted or index annuity merchandise, together with the danger of principal loss, but in addition convey the prospect of better long-term rewards. Among the many added advantages that Jackson affords with its annuities are a diversified asset unfold, assured revenue for all times, and a legacy choice for the purchaser’s heirs.

Whereas there’s danger concerned in long-term annuity merchandise, these are mitigated by regulatory necessities stipulating the minimal reserves monetary establishments want to take care of to cowl claims. Jackson has ‘floored out’ its reserves within the state of Virginia, however has been engaged in discussions with regulators in its residence state of Michigan, with the purpose, amongst different issues, of accelerating transparency in its Virginia block. It is a viable resolution, as the corporate’s charges are more likely to outweigh claims long-term.

Close to-term, Jackson’s 2Q23 monetary report, the final reported, we discover that the corporate’s high and backside traces are down y/y – and under expectations. Income, at $410 million, was far under the $6.7 billion reported in 2Q22 and missed the forecast by $1.2 billion. On the underside line, the non-GAAP EPS variety of $3.34 per share got here in 15 cents under the estimates.

Regardless of the earnings misses, Jackson nonetheless returned $100 million in capital to traders throughout Q2. This included $53 million in dividend payouts. Within the firm’s final dividend declaration, made on August 8 for Q3, the cost was set at 62 cents per widespread share for a September 14 payout. This annualizes to $2.48 and provides a yield 7.3%, far above the market common.

Invoice Miller is clearly of a sanguine view on the subject of JXN, as he holds 215,050 shares of the inventory. This stake is at present valued at $7.13 million.

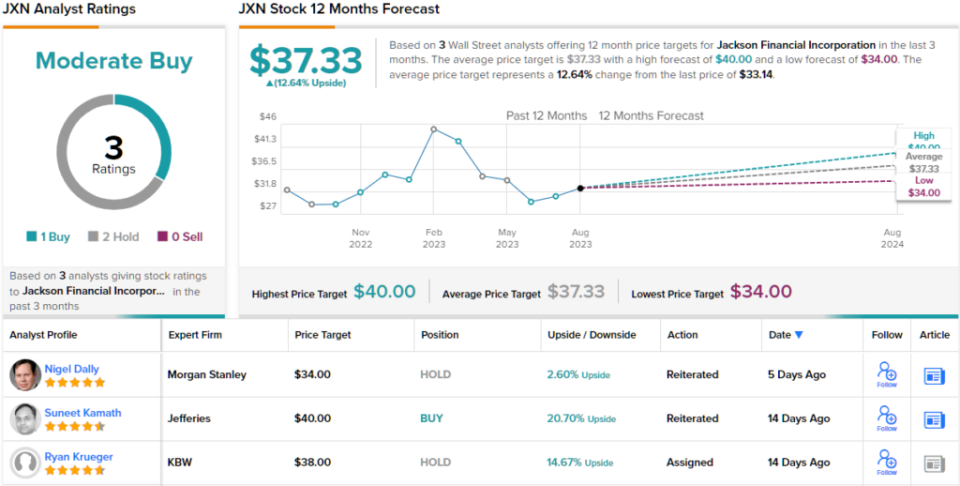

Miller shouldn’t be the one bull right here. Jefferies analyst Suneet Kamath has famous that the corporate is more likely to efficiently resolve its ‘VA e book’ points and is at present providing stable capital return. He writes of JXN, “Our Purchase-rating on JXN is largely because of our view that its high-quality VA e book shouldn’t be appropriately mirrored in its valuation. We’re optimistic that the Michigan resolution may appropriate this disconnect considerably. Within the meantime, we imagine the inventory affords one of the crucial engaging capital return yields within the house…”

Kamath’s Purchase ranking is complemented by a $40 value goal that signifies potential for ~21% upside within the yr forward. (To look at Kamath’s monitor report, click on right here)

Total, JXN shares have a Average Purchase from the analyst consensus, based mostly on 3 latest opinions that embody 1 Purchase and a pair of Holds. The shares are buying and selling for $33.14 and have a $37.33 common value goal, a mixture suggesting ~13% upside within the subsequent 12 months. (See JXN inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely vital to do your individual evaluation earlier than making any funding.