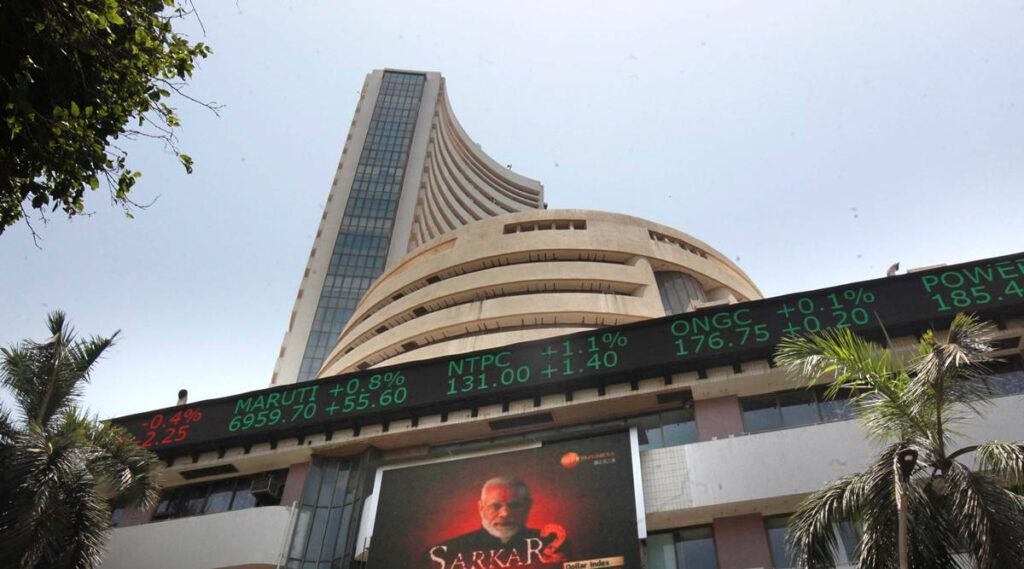

The benchmark Sensex at BSE jumped by over 600 factors or 1 per cent within the early buying and selling hours on Monday to hit a six-week excessive of 60,600 according to its Asian market friends because the market expects that the Federal Reserve might decrease the tempo of fee hike, set to be introduced on Wednesday. In India, the restoration on Monday was pushed by IT shares and energy within the banking scrips.

The sturdy opening on Monday got here according to world markets as Nikkei and Japan and Cling Seng in Hong Kong had been up by 1.6 per cent and 0.9 per cent respectively.

The rise in Asian markets comes on the again of rising hope that the Federal Reserve might go for a decrease fee hike. Whereas the Federal Reserve has raised charges by 300 foundation factors in its 5 conferences starting March 2022, within the final three conferences it raised charges by 75 foundation factors.

Because the market expects that the speed hike may very well be decrease, when the Fed publicizes its choice on Wednesday, the emotions have turned constructive lifting the inventory markets.

At the same time as the worldwide markets have been underneath stress over the previous couple of months on account of excessive inflation and the central banks elevating the rates of interest, the Indian markets have witnessed a sensible restoration over the past 4 months after having closed at a near-term low of 51,360 on June 17, 2022. Since then the Sensex has gained almost 18 per cent to commerce at ranges of 60,600 on Monday.

Analysts say that whereas Indian markets got here underneath stress within the first half of the calendar amid issues over excessive crude costs, inflation, rates of interest and geopolitical developments with regard to the Russia-Ukraine warfare, a secure crude oil value over the past couple of months has come as a giant aid to the Indian markets. Whereas Brent crude costs had hit ranges of $120 per barrel in June, they’ve softened and remained secure underneath $100 per barrel over the past couple of months. On Monday, it was buying and selling at $93 per barrel.