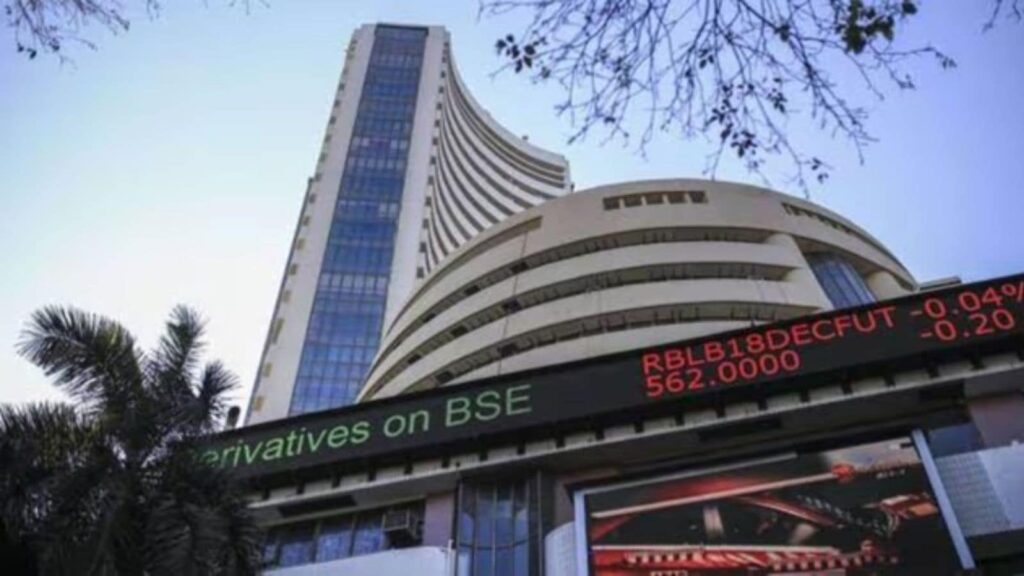

Mumbai, Might 7 The home inventory markets remained unstable on Wednesday after India’s strike on terror websites in Pakistan and concern of retaliation from the neighboring nation.

The markets additionally ignored the optimistic sentiment from the conclusion of the long-awaited India-UK Free Commerce settlement.

The Sensex was down 0.15 per cent, or 121.01 factors, 80,520.06 within the morning trades. The 30-share index opened at 79,948.8, in comparison with the earlier shut of 80,641.07. The Nifty 50 declined 0.6 per cent, or 15.6 factors, to 24,379.60. The index opened at 24,233.30, as towards Tuesday’s shut of 24,379.6.

“What stands out in “Operation Sindoor” from the market perspective is its targeted and non-escalatory nature. Now we have to attend and watch how the enemy reacts to this precision strikes by India. The market is unlikely to be impacted by the retaliatory strike by India since that was recognized and discounted by the market,” mentioned VK Vijayakumar, Chief Funding Strategist, Geojit Investments Restricted.

The Indian Armed Forces launched ‘Operation Sindoor’ on Wednesday, concentrating on 9 terror camps throughout Pakistan and Pakistan-occupied Jammu and Kashmir (PoJK). India’s actions have been targeted, measured and non-escalatory in nature, as per a press release from protection ministry.

India and the UK ironed out main variations in the course of the newest spherical of talks and introduced the conclusion of the long-awaited Free Commerce Settlement.

“As soon as the deal comes into impact, the UK tariffs on footwear, textiles, vehicle parts, electrical equipment, minerals, and base metals — at the moment within the 2-18 per cent vary — can be eradicated,” mentioned Devarsh Vakil, Head of Prime Analysis, HDFC Securities.

Story continues under this advert

In keeping with Vijayakumar, the principle catalyst of the market resilience in India is the sustained FII shopping for of the final 14 buying and selling days which has touched a cumulative determine of Rs 43,940 crores within the money market.

“FIIs are targeted on the worldwide macros like weak greenback, slower development in US and China in 2025 and India’s potential outperformance in development. This may maintain the market resilient. Nevertheless, buyers have to look at the developments within the border,” he mentioned.

The NSE corporations that have been buying and selling in inexperienced included Tata Motors (3.04 per cent), Energy Grid Company (1.28 per cent), SBI Life Insurance coverage (0.73 per cent) and Wipro (0.58 per cent).