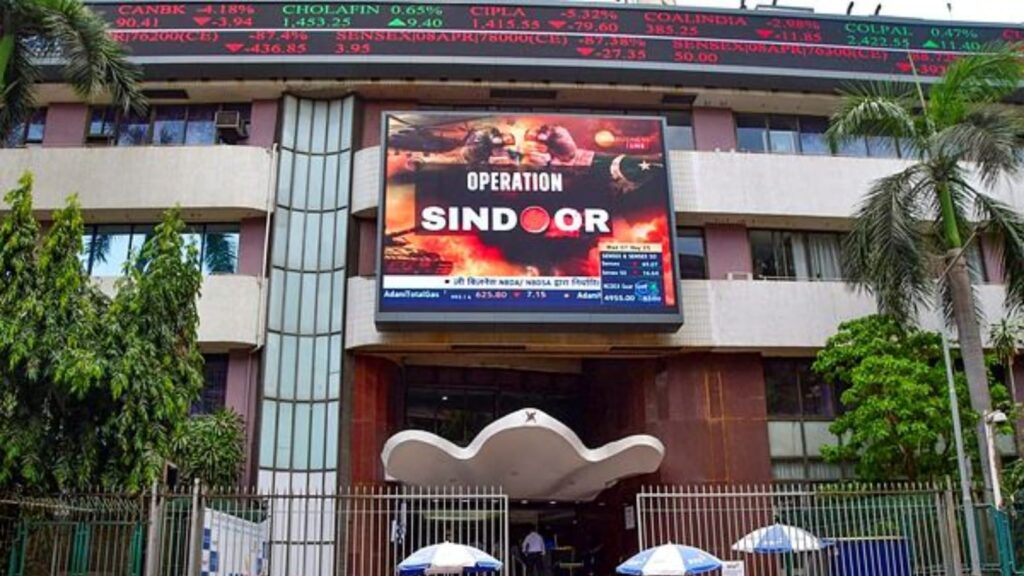

Home inventory market indices, Sensex and Nifty, declined 1 per cent on Friday as traders develop into danger averse as a result of ongoing India-Pakistan rigidity.

The BSE’s 30-share Sensex tanked 1.1 per cent, or 880.34 factors, to shut at 79,454.47. The index swung 1,065 factors through the day. The Nifty 50 slipped 1.1 per cent, or 265.8 factors, to settle at 24,008.

The India VIX, an indicator of the market’s expectation of volatility over the close to time period, rose 2.97 per cent to 21.63 per cent. The volatility index had surged by 10.21 per cent the day prior to this.

On Thursday night, India’s air defence techniques intercepted greater than 50 missiles fired by Pakistan towards key border areas and in addition shot down 4 Pakistani plane. This escalation has raised investor issues and is prone to result in heightened intraday volatility.

“A battle was anticipated however the market was not anticipating the scenario to accentuate, elevating issues about its period. Nonetheless, it’s nonetheless projected to be a short-lived confrontation, given the strategic benefit and the opponent’s weak financial standing,” mentioned Vinod Nair, Head of Analysis, Geojit Investments Ltd.

In regular circumstances, on a day like this, the market would have suffered deep cuts. However this didn’t occur as a result of two causes. One, the battle, up to now, has demonstrated India’s clear superiority in standard battle fare, and due to this fact, additional escalation of the battle will inflict enormous harm to Pakistan. Two, the market is inherently resilient supported by world and home macros. Weak greenback and probably weakening US and Chinese language economies are good for the Indian market, analysts mentioned.

“Merchants don’t need to get caught off guard by risking their investments as any escalation in battle through the weekends might set off main promoting beginning subsequent week,” mentioned Prashanth Tapse, Senior VP (Analysis), Mehta Equities Ltd.

Story continues under this advert

Nifty Midcap 100 fell 0.01 per cent and Nifty Smallcap 100 was down 0.61 per cent.

Among the many sectoral indices, Nifty Realty fell 2.38 per cent and Nifty Monetary Companies Ex-Financial institution declined 1.49 per cent.

The NSE corporations that fell probably the most included ICICI Financial institution fell (3.24 per cent), Energy Grid Company (2.74 per cent), Grasim Industries (2.22 per cent) and Ultratech Cement (2.22 per cent).

Specialists mentioned that traders shouldn’t panic and exit from the market now if the battle escalates or it continues for extra days.

Story continues under this advert

“Stay invested, monitor the developments and anticipate the mud to settle,” mentioned a veteran market analyst.

“As we have now been alerting our readers, it’s prudent to organize reasonably than panic. We advise merchants to maintain leveraged and speculative positions gentle and use derivatives to hedge short-term exposures,” mentioned Devarsh Vakil, Head of Prime Analysis, HDFC Securities.

On Friday, overseas portfolio traders (FPI) internet bought Rs 3,798.71 crore of equities, whereas home institutional traders (DIIs) bought Rs 7,277.74 crore of shares, in accordance with the BSE’s provisional knowledge.