AFTER LOSING $6.6 trillion in worth over two days final week, US shares have been extremely unstable Monday with the Dow Jones Industrial Common swinging wildly over 2,400 factors within the first hour of buying and selling, and down 2 per cent at 10.30 am (EST). The Nasdaq Composite additionally yo-yoed 1,125 factors, and was down 1 per cent at 10.30 am.

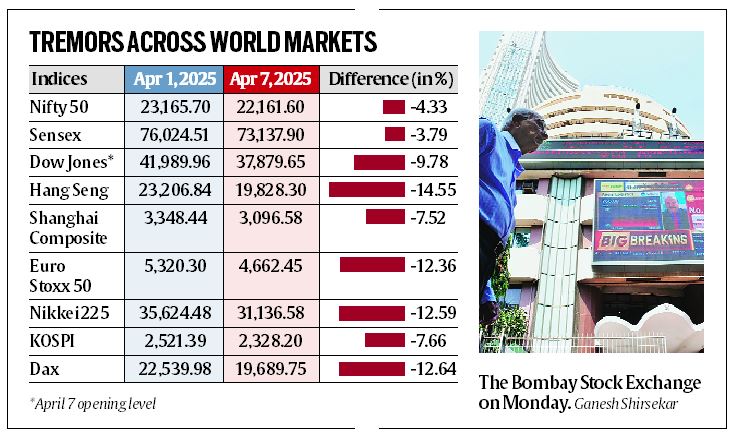

Globally, markets crashed, with Nifty and Sensex in India down nearly 5 per cent within the morning, however ending the day 3-3.25 per cent down. It was their greatest single day fall since June final 12 months, monitoring the nervousness and fall in fairness markets globally amid fears of escalation in commerce wars after US President Donald Trump introduced reciprocal tariffs final week.

In the course of the day, shares within the US rallied on expectations of a thaw on the tariff entrance. The administration, nonetheless, clarified there can be no delay in implementing new levies. In reality, in one other spherical of escalation, US President Donald Trump threatened extra tariffs of fifty per cent on US imports from China if the latter didn’t withdraw the 34 per cent tariff it had imposed on US merchandise final week.

In a put up on social media platform ‘Fact Social’ Trump mentioned, “If China doesn’t withdraw its 34% enhance above their already long run buying and selling abuses by tomorrow, April eighth, 2025, america will impose ADDITIONAL Tariffs on China of fifty%, efficient April ninth.” He additional mentioned, “All talks with China regarding their requested conferences with us shall be terminated!”

He, nonetheless, maintained that negotiations with different nations, which have additionally requested conferences, will start going down instantly.

The BSE Sensex tanked 2.95 per cent, or 2,226.79 factors, to shut at 73,137.9. The broader Nifty 50 plunged 3.24 per cent, or 742.85 factors, to finish at 22,161.6. On the opening, the Sensex tumbled 5.19 per cent, and Nifty nosedived 5 per cent. The markets, nonetheless, recovered over the past hour of the buying and selling session.

It was the largest single-day fall for the Sensex and Nifty in nearly 10 months. On June 4, 2024, the Sensex and the Nifty had plummeted 5.74 per cent and 5.93 per cent, respectively, following the Lok Sabha election outcomes announcement.

Story continues beneath this advert

The market capitalisation, or the whole worth of all listed shares, of the BSE-listed corporations declined by Rs 14.09 lakh crore to Rs 389.25 lakh crore. Overseas portfolio buyers (FPIs) bought Rs 9,041.01 crore of home shares, which was countered by home institutional buyers (DIIs) who bought Rs 12,122.45 crore of shares, in accordance with the BSE’s provisional knowledge.

The India VIX, an indicator of the market’s expectation of volatility over the close to time period, zoomed 65.7 per cent to shut at 22.79. On June 4, 2024, the volatility index had gained 27.75 per cent to settle at 26.75.

“After US markets plunged on Friday, it was writing on the wall for different world fairness indices which fell like a pack of playing cards amid fears that Trump’s insurance policies on reciprocal tariffs could result in recession and better inflation within the US going forward,” mentioned Prashanth Tapse, Senior VP (Analysis), Mehta Equities Ltd.

Already, commodity costs of crude oil and several other metals are seeing a downward slide, which is a sign of a slackening demand if the present development persists.

Story continues beneath this advert

Final week, US President Donald Trump introduced reciprocal tariffs on numerous buying and selling companions of the US, together with India. India faces a 26 per cent hike in tariffs. A ten per cent minimal tariff got here into impact from April 5 on all imports getting into the US.

“The market tumbled because the carnage over excessive US tariffs and the retaliation by different nations could kickstart a commerce struggle,” mentioned Vinod Nair, Head of Analysis, Geojit Investments Restricted.

On Friday, China introduced retaliatory tariffs, matching the US reciprocal tariff price of 34 per cent. The European Union can be within the strategy of approving imposing retaliatory tariffs on the US.

International indices witnessed heavy promoting. Euro Stoxx50 crashed 4.31 per cent, IBEX 35 fell 5.14 per cent, Grasp Seng tanked 13.22 per cent, Shanghai Composite fell 7.34 per cent, Nikkei 225 tumbled 7.83 per cent and KOSPI slumped 5.57 per cent.

Story continues beneath this advert

Within the home market, sectors like IT and metals underperformed relative to the broader market because of the danger of excessive inflation with slower progress that will lead to a possible recession within the US.

Nifty Smallcap 100 plunged 3.88 per cent and Nifty Midcap 100 declined 3.63 per cent.

Among the many sectoral indices, Nifty Metallic tanked 6.75 per cent, Nifty Oil & Fuel fell 2.79 per cent, Nifty IT nosedived 2.51 per cent, and Nifty Auto slumped 3.78 per cent.

NSE corporations that misplaced probably the most included Trent (14.7 per cent), JSW Metal (7.53 per cent), Tata Metal (7.26 per cent), Tata Motors (5.34 per cent), Hindalco Industries (5.92 per cent), Larsen & Toubro (5.31 per cent) and Reliance Industries (2.78 per cent).