Reserve Financial institution Governor Shaktikanta Das on Friday flagged issues over mis-selling, lack of transparency and disproportionate service prices by varied lending entities and referred to as for assessment of working of their customer support and grievance redress mechanism.

He additionally cautioned in opposition to the mushrooming of digital lending apps, or DLAs, lots of which don’t abide by any laws.

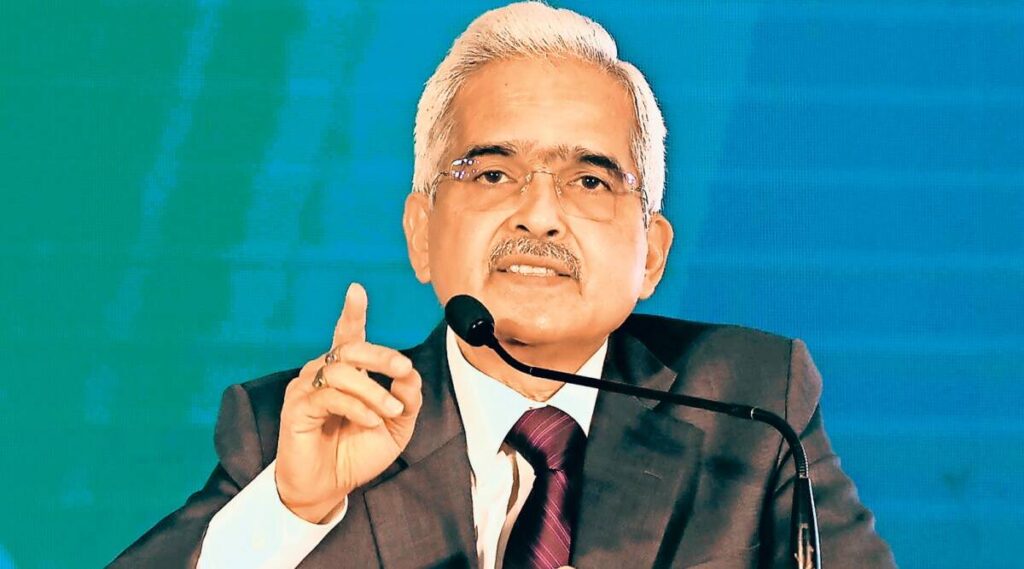

“In a big and vibrant monetary system like ours, some stage of complaints is comprehensible. What’s of concern is that also numerous complaints pertain to conventional banking. This requires critical assessment of the working of the customer support and grievance redress mechanism within the regulated entities,” Das mentioned whereas addressing the annual convention of RBI Ombudsmen in Jodhpur.

Tales in social-media about use of strong-arm techniques by some restoration brokers overshadow the great work that’s being finished for buyer safety, each by the regulated entities (banks, NBFCs, and so on.) and the Reserve Financial institution, he mentioned.

The assertion comes nearly a month after the RBI requested Mahindra & Mahindra Monetary Companies Ltd to stop finishing up any restoration or repossession exercise by outsourcing preparations after reviews of a 27-year previous pregnant girl in Jharkhand being allegedly crushed to demise underneath a tractor by an exterior mortgage restoration agent of the NBFC.

The Governor mentioned the position of the board and the highest administration of the regulated entities could be very essential in safeguarding clients’ curiosity and they need to have interaction and guarantee that there’s buyer centricity within the design of merchandise, supporting processes, supply mechanism of the merchandise and publish gross sales companies.

In keeping with him, business issues are essential, however they need to essentially be aligned with buyer orientation in each facet, together with technique and danger administration.

Final 12 months, the RBI changed the three erstwhile ombudsmen schemes and launched the Reserve Financial institution – Built-in Ombudsman Scheme (RB-IOS) 2021 on the imaginative and prescient of ‘One Nation, One Ombudsmen’.

Das mentioned the RBI Ombudsmen and the regulated entities should determine the foundation causes of persisting buyer complaints and take mandatory systemic measures to appropriate them. Additionally, the decision of buyer complaints should be truthful and fast.

Noting that expertise revolution has enhanced the effectivity of monetary entities and resulted in important enchancment in doing enterprise, the Governor mentioned that it has additionally posed new challenges.

“It has opened the backdoor for unregulated expertise gamers into the monetary house. There’s a mushrooming of digital lending apps or DLAs, lots of which don’t abide by any laws or truthful apply codes,” he mentioned, including that it results in a number of issues together with mis-selling, breach of buyer privateness, unfair enterprise conduct, usurious rates of interest and unethical mortgage restoration practices.

Initially, clients are tempted to borrow from these entities due to simplified or no documentation necessities adopted by immediate disbursals however it’s only later that the purchasers realise the intense downsides to such borrowings, Das added.

Final month, the RBI issued the rules on digital lending, which requires regulated entities to offer a key reality assertion, or KFS, to the borrower earlier than the execution of the contract.

The rules additionally said {that a} borrower will probably be given an express choice to exit digital mortgage by paying the principal and the proportionate curiosity with none penalty throughout a look-up interval. For debtors persevering with with the mortgage even after the look-up interval, pre-payment will proceed to be allowed as per the RBI pointers.