(Bloomberg) — One after the other, quick sellers are being pressured to capitulate as market expectations develop for a slower tempo of central financial institution tightening.

Most Learn from Bloomberg

Whether or not in shares or bonds, bearish bets are being dealt a blow as US knowledge start to replicate the fallout from the Federal Reserve’s aggressive charge hikes. A dovish pivot by the Reserve Financial institution of Australia on Tuesday can be fanning hypothesis that coverage makers could also be about to melt their hawkish stance.

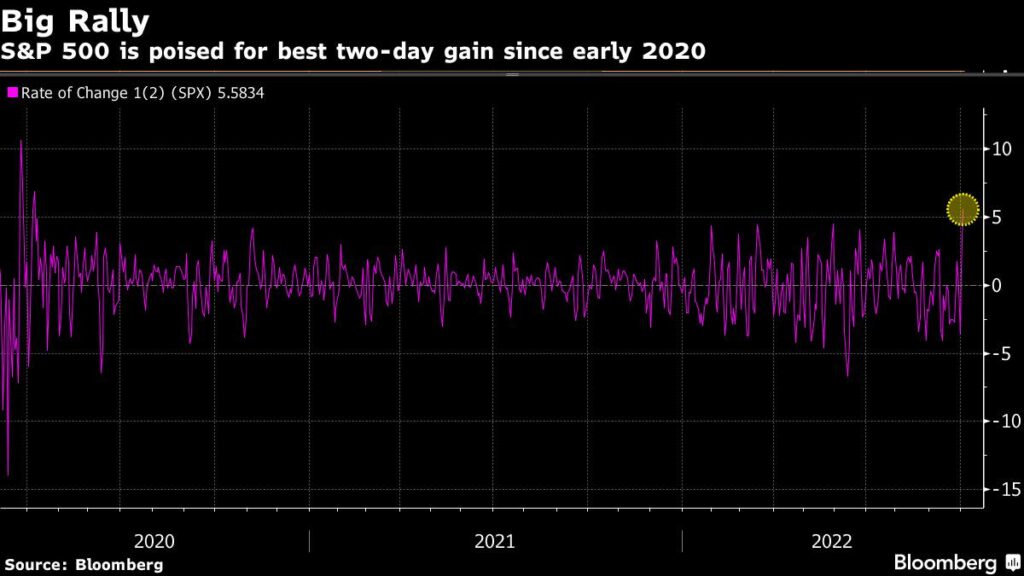

Brief sellers are being pressured to fold throughout one of the best two-day fairness rally within the US since April 2020, after elevating bearish wagers in one of many longest stretches in years. Whereas the newest revival in danger urge for food has improper footed the naysayers, some analysts, together with Goldman Sachs Group Inc. and Financial institution of America Corp., say that the rout has but to run its course.

“Buyers are searching for any signal they’ll discover that central banks will ease up on their tightening cycles,” mentioned Lauren Goodwin, economist and portfolio strategist at New York Life Investments.

This comes after the S&P 500 climbed greater than 2.5% for a second straight session. On the middle of the rally are most-shorted shares, as tracked by Goldman Sachs Group Inc., which jumped nearly 6% as a bunch on Tuesday, handing losses for many who had positioned guess towards them.

The surge is dealing acute ache for skilled speculators, who raised shorts final month because the S&P 500 plunged to contemporary bear-market lows. For 11 straight classes by Thursday, hedge funds tracked by Morgan Stanley boosted quick positions towards exchange-traded funds, sending their total fairness publicity to a 13-year low.

The comeback in shares, after the S&P 500 suffered its worst September in 20 years, can be a headache for rules-based funds that had boosted bearish fairness bets as volatility spiked and the market misplaced momentum. Development followers like commodity buying and selling advisors, as an illustration, final week noticed their fairness positioning approaching the trough noticed on the peak of the 2008-2009 world monetary disaster, JPMorgan Chase & Co.’s knowledge present.

“Shorts stay excessive from the CTAs to the hedge funds,” mentioned Andrew Brenner, the pinnacle of worldwide fixed-income at NatAlliance Securities.

Whereas quick gross sales have helped skeptics similar to hedge funds fare higher throughout 2022’s bear market, they at occasions turned a supply of stress when a sudden share rally pressured a squeeze.

It isn’t simply inventory buyers who’ve been caught out.

Hedge funds elevated already elevated web quick positions on US Treasuries final week, fueling a rout that despatched 10-year yields to 4% for the primary time in additional than a decade.

The shift fueled a brief squeeze value motion, with US authorities bonds already below strain amid thinning liquidity and fears of extra outsized Fed charge hikes. The ten-year yield surged to the best since 2008 final week, earlier than tumbling again after the Financial institution of England resumed shopping for long-dated bonds.

Yields then fell additional on Monday following a weaker-than-expected studying on a US manufacturing facility gauge, and have been down for a 3rd day to three.62% on Wednesday in Asia buying and selling.

Retail Buyers

The fairness bounce can be penalizing retail buyers, who, primarily based on JPMorgan estimates, final month dumped probably the most in single shares in knowledge going again to 2015.

Towards this backdrop, companies from HSBC Holdings Plc to Credit score Suisse Group AG are holding to the view that the S&P 500 Index might have but to succeed in its final low as US fairness costs nonetheless don’t absolutely replicate the dangers of upper rates of interest on earnings and valuations.

Valuation dangers for the benchmark index “will persist properly into 2023, and most draw back within the coming months will come from slowing profitability,” which threatens to push the S&P 500 as little as 3,200 within the fourth quarter, in response to Max Kettner, HSBC’s chief multi-asset strategist.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.