Noting that overseas trade reserves must be used judiciously, Chief Financial Advisor V Anantha Nageswaran on Monday stated that rupee must be allowed to depreciate step by step. India’s development charge is seen to be average at 6.5-7 per cent in 2022-23, he stated, including that financing India’s commerce deficit can be an ‘essential’ problem for the 12 months.

“We have now not confronted such a scenario like this in a really very very long time because the finish of World Conflict II…in recent times, now we have confronted one aspect or the opposite…however geopolitics was not a difficulty, commodity costs, solely vitality was a difficulty, meals costs was not a difficulty at the moment…what we face now could be a number of disaster in any respect ranges.”

“…in 2022-23, in comparison with what we anticipated initially of the 12 months, sure we’re going to have low development of 6.5-7 per cent. However this in comparison with many different international locations is an excellent quantity and solely Saudi Arabia goes to develop at a charge quicker than India this 12 months. Inflation is excessive however it isn’t excessive in comparison with different international locations. Different international locations had a goal of two per cent however they’ve inflation of 8-10 per cent. We have now a goal of 4 per cent however now we have about 7.4 per cent inflation charge now. So the hole between the goal and actuality is far decrease for India than it’s for superior international locations,” Nageswaran stated at an occasion organised by trade physique Indian Chamber of Commerce.

Most companies have been decreasing their development forecasts for India in current weeks. The Reserve Financial institution of India additionally lower its development projection to 7 per cent from 7.2 per cent and seven.8 per cent earlier.

Nageswaran stated that the nation has satisfactory reserves to cope with capital outflows. “We must always within the brief run permit the rupee to depreciate step by step and we must always use overseas trade reserves judiciously, protecting the fire-power for 2023 as nicely…we must always increase overseas trade reserves simply to maintain ourselves nicely ready for any contingencies in 2023 as a result of the worldwide setting could be very dangerous in the intervening time,” he stated.

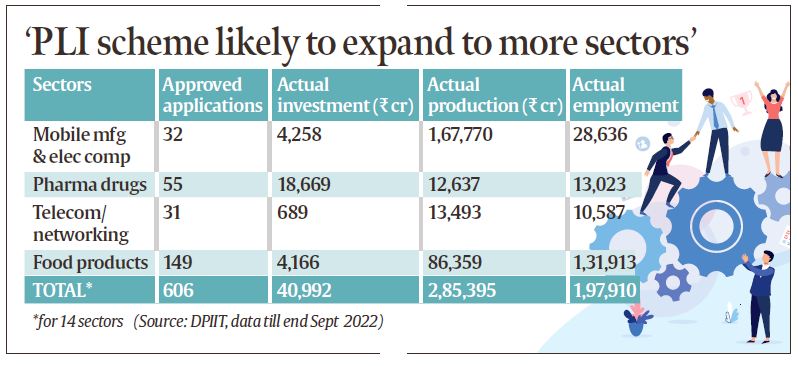

On the production-linked incentive scheme, the Chief Financial Advisor stated that it’s prone to achieve extra momentum and broaden to extra sectors. “PLI is for the medium and long run; it’s about creating capability inside India to grow to be a worldwide chief, to draw provide chains into India and to facilitate China-plus-one to occur. The PLI scheme is prone to achieve momentum. Proper now it’s taking place in two or three areas – cell phones, prescribed drugs and chemical compounds however it has to choose up steam in different areas as nicely and hopefully within the subsequent two years it should occur,” he stated.

As per the info shared by the CEA in a presentation within the on-line occasion, Rs 40,992 crore of precise funding is there for PLI schemes throughout 14 sectors together with mobiles, pharma, medical units, telecom and networking merchandise amongst others. 606 purposes have been accredited that are anticipated to yield funding value Rs 2.71 lakh crore and in addition anticipated to lead to employment of 59 lakh folks. The precise employment stands at 1.97 lakh.

For the medium time period, India’s economic system ought to develop on the charge of 6.5-7 per cent in view of deleveraging of company stability sheets and the federal government’s reform measures, he stated. “Medium-term outlook is nice… due to stability sheet power, as corporates are keen to take a position, manufacturing exercise continues to broaden and digital infrastructure (is) turning into increasingly more essential in bettering entry to finance and formalisation,” he stated.

Whereas the world is going through a polycrisis, which is a number of crises of excessive inflation, tightening of financial coverage, excessive rates of interest, slowdown in China which affected international provide chain, and the Russia-Ukraine battle, India is doing higher on each development and inflation fronts and can reap the rewards of the arduous work finished during the last a number of years, Nageswaran stated. The CEA stated that India wants to take care of macroeconomic stability, proceed direct tax reforms, full ongoing capex tasks within the authorities and proceed to deal with the challenges confronted by MSMEs.

He stated the federal government is predicted to fulfill its fiscal targets for this 12 months. “For the time being our expectation is the fiscal deficit goal will probably be met,” he stated. The central authorities’s fiscal deficit goal for this monetary 12 months is 6.4 p.c of the gross home product. In April-September, the federal government’s fiscal deficit widened to Rs 6.20 lakh crore, accounting for 37.3 p.c of the full-year goal.