CrowdStrike Holdings (NASDAQ: CRWD) inventory was battered badly final month, dropping near 40% of its worth in July after it emerged that the cybersecurity specialist’s faulty software program replace induced an enormous outage. Whereas CrowdStrike moved speedily to appropriate its mistake, the detrimental press and threats of lawsuits appear to have largely saved buyers from shopping for the dip.

Nonetheless, the fast-growing cybersecurity firm is ready to launch its fiscal 2025 second-quarter earnings report (for the three months ended July 31) on Aug. 28. Will the report be stable sufficient to spark a turnaround in its fortunes? In different phrases, ought to buyers contemplate shopping for CrowdStrike inventory earlier than Aug. 28 within the hope of better-than-expected outcomes and steering?

CrowdStrike’s upcoming outcomes may reveal the extent of the injury it faces

The CrowdStrike incident that occurred on July 19 reportedly price $5.4 billion of losses for Fortune 500 corporations. Microsoft-based IT methods went down throughout the globe, whereas Delta Air Strains reportedly took a $500 million hit. Wall Avenue analysts imagine that CrowdStrike is more likely to undertake an extended damage-control train to win again buyer confidence.

In consequence, CrowdStrike could have to supply its options at reductions, present compensation to prospects who misplaced income due to the outage, and even supply credit to prospects. The small print of the actual extent of the injury that CrowdStrike could face ought to be evident within the earnings report.

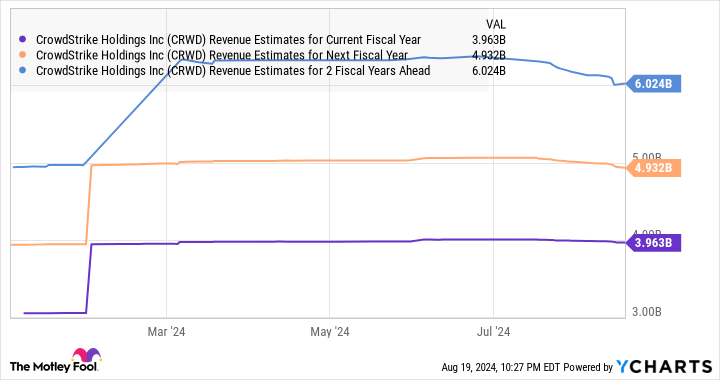

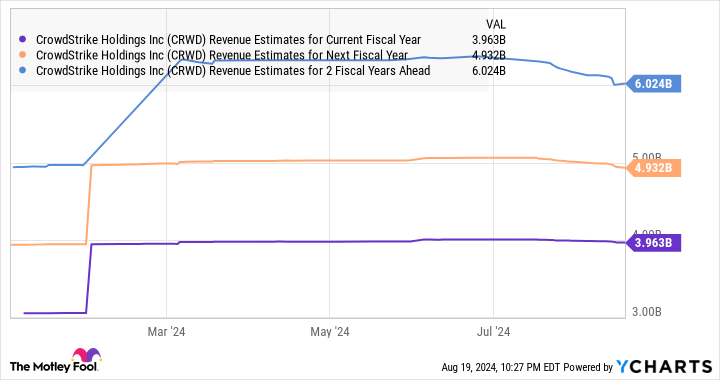

It is value noting that CrowdStrike beforehand guided for fiscal Q2 income of just about $960 million (on the midpoint), or a year-over-year improve of 31%. The corporate’s full-year income steering stands at $3.99 billion, up 30% from the earlier yr. Nonetheless, analysts have barely lowered their fiscal 2025 income estimates and count on CrowdStrike to fall in need of its full-year steering. Their income estimates for fiscal 2026 and 2027 fell even additional.

Including to this uncertainty, the inventory’s valuation is not precisely low cost.

The inventory stays richly valued regardless of the pullback

CrowdStrike inventory is at present buying and selling at 20.5 occasions gross sales. That is nicely above the U.S. know-how sector’s common price-to-sales ratio of seven.8. For a corporation that is coming off a serious incident that might negatively influence its steadiness sheet and progress for years, timing an funding in CrowdStrike earlier than the earnings report is simply too dangerous a transfer.

Buyers would do nicely to steer clear of this cybersecurity inventory till the actual extent of the injury it faces because of final month’s occasions emerges on Aug. 28.

Don’t miss this second likelihood at a probably profitable alternative

Ever really feel such as you missed the boat in shopping for essentially the most profitable shares? Then you definately’ll need to hear this.

On uncommon events, our knowledgeable group of analysts points a “Double Down” inventory suggestion for corporations that they assume are about to pop. When you’re apprehensive you’ve already missed your likelihood to take a position, now’s the perfect time to purchase earlier than it’s too late. And the numbers communicate for themselves:

-

Amazon: in case you invested $1,000 once we doubled down in 2010, you’d have $19,939!*

-

Apple: in case you invested $1,000 once we doubled down in 2008, you’d have $42,912!*

-

Netflix: in case you invested $1,000 once we doubled down in 2004, you’d have $370,348!*

Proper now, we’re issuing “Double Down” alerts for 3 unimaginable corporations, and there might not be one other likelihood like this anytime quickly.

See 3 “Double Down” shares »

*Inventory Advisor returns as of August 22, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends CrowdStrike and Microsoft. The Motley Idiot recommends Delta Air Strains and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Ought to You Purchase CrowdStrike Inventory Earlier than Aug. 28? was initially revealed by The Motley Idiot