The S&P 500 fell 4.2% in worth final month. Based on S&P World, “Geopolitics, rising authorities bond yields, inflation and financial coverage issues are behind the latest drops, but shares should have room to rise once more.”

After the drop, three iconic dividend shares now pay large yields between 6.5% and 9%. In case you’re on the lookout for massive dividends, that is your likelihood.

This 9% dividend has at all times been dependable

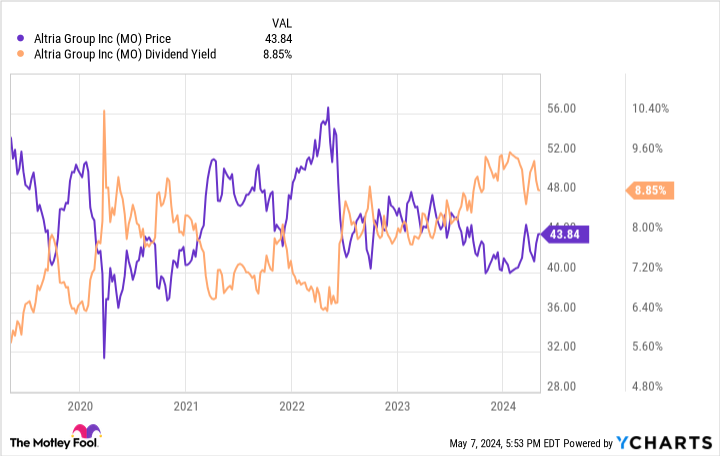

Altria Group (NYSE: MO) has lengthy been a high-paying dividend inventory. During the last 5 years, the dividend yield has at all times remained above 6%. Resulting from some latest share worth weak point, the dividend yield is now round 9%. This can be a nice alternative to purchase right into a recession-resistant enterprise with excessive ranges of free money circulation.

At its core, Altria is a tobacco enterprise. It owns a portfolio of recognizable manufacturers together with Marlboro, Copenhagen, Skoal, Purple Seal, Benson & Hedges, Chesterfield, NJOY, and Black & Delicate. This can be a market that varies little yr to yr, even throughout recessions. The combination of merchandise could shift — combustibles, for instance, have slowly ceded share to vaporized nicotine — however total nicotine use has remained steady. Altria’s status, market entry, and capital benefits have allowed it to compete wherever its core market heads.

Simply because the nicotine market is steady doesn’t suggest it is rising. From 2018 to 2023, for example, nicotine utilization rose by simply 1%. That is the rationale Altria pays such a big dividend. This inventory won’t ever make you wealthy in a single day, nevertheless it’s confirmed a dependable strategy to generate constant dividend revenue over the long run. That equation will not change a lot within the years to come back.

These 2 shares have turn out to be dividend all-stars

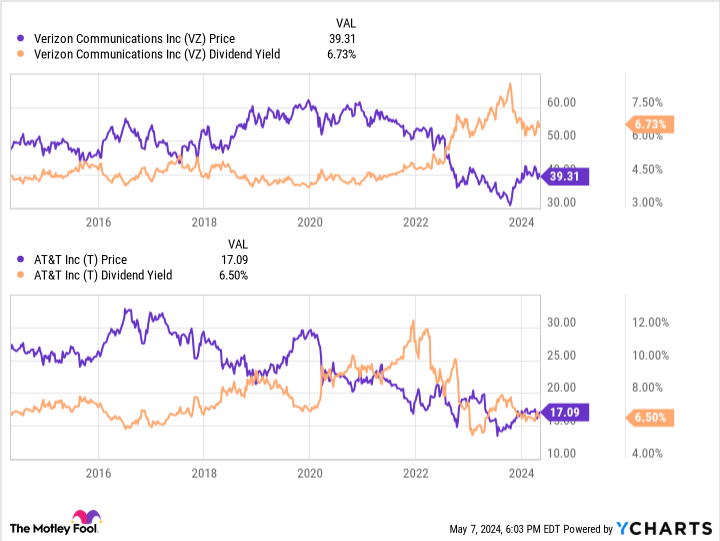

The telecom trade has lengthy paid above-average dividends. These companies will be costly to determine at first, however as soon as up and working, they usually generate excessive ranges of free money circulation. AT&T (NYSE: T) and Verizon (NYSE: VZ), for instance, now pay dividends of 6.5% and 6.7% respectively. Earlier than you leap in, nevertheless, there are some things you must know.

As you possibly can see within the charts above, each AT&T and Verizon have persistently paid excessive dividends, though Verizon’s yield particularly has picked up strongly lately. The impetus behind these excessive yields, nevertheless, wasn’t a dramatically greater payout. What’s modified is that the share costs for each firms has steadily fallen, artificially inflating the dividend yield.

You’ll be able to see this dynamic in motion by every firms complete return over the previous decade. These returns consider each share worth motion and dividends. Since 2014, Verizon and AT&T have each posted complete returns of round 35%. The S&P 500, for comparability, rose in worth by 234%.

AT&T and Verizon each face their very own difficulties, however the root problem has been competitors, which has eroded pricing energy and elevated operational prices. AT&T truly needed to lower its dividend in 2022 after the spinoff of its media division, WarnerMedia. Verizon has been capable of steadily elevate its payout, however not by a lot. Final quarter, the corporate carried out a 2% enhance to the payout.

Must you purchase Altria, Verizon, or AT&T inventory?

In case you’re on the lookout for a dependable, high-yield dividend inventory, Altria Group is the higher decide versus AT&T or Verizon. It is not that the latter two are poor companies, however rising telecom competitors will not abate anytime quickly. And whereas Altria has confronted competitors of its personal, its established supremacy within the combustibles market buys it time to innovate and management new market classes as they emerge.

Must you make investments $1,000 in Altria Group proper now?

Before you purchase inventory in Altria Group, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Altria Group wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $550,688!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Might 6, 2024

Ryan Vanzo has no place in any of the shares talked about. The Motley Idiot recommends Verizon Communications. The Motley Idiot has a disclosure coverage.

Ought to You Purchase the three Highest-Paying Dividend Shares within the S&P 500? was initially revealed by The Motley Idiot