Palantir inventory (NYSE:PLTR) dipped by about 16% after its Q1 earnings report, prompting me to ponder whether or not this downturn presents a shopping for alternative. Notably, Palantir showcased yet one more quarter of stable income development, promising consumer base growth, and powerful profitability metrics. That mentioned, issues persist relating to the inventory’s elevated valuation. Consequently, regardless of my perception in Palantir’s long-term prospects as a shareholder, I keep a impartial stance in direction of the inventory at current and don’t consider the dip is price shopping for.

Accelerating Development Pushed by Authorities and Business Shoppers

Palantir Q1’s marked a interval of accelerating development, pushed by stable efficiency in each the corporate’s Authorities and Business segments. Revenues landed at $634.4 million, up 20.8% year-over-year. This suggests an acceleration from final 12 months’s development of 17.7% and the third consecutive quarter of accelerating income development on a sequential foundation. Let’s take a deeper take a look at each Palantir’s segments in Q1 to raised perceive what exactly drove this consequence.

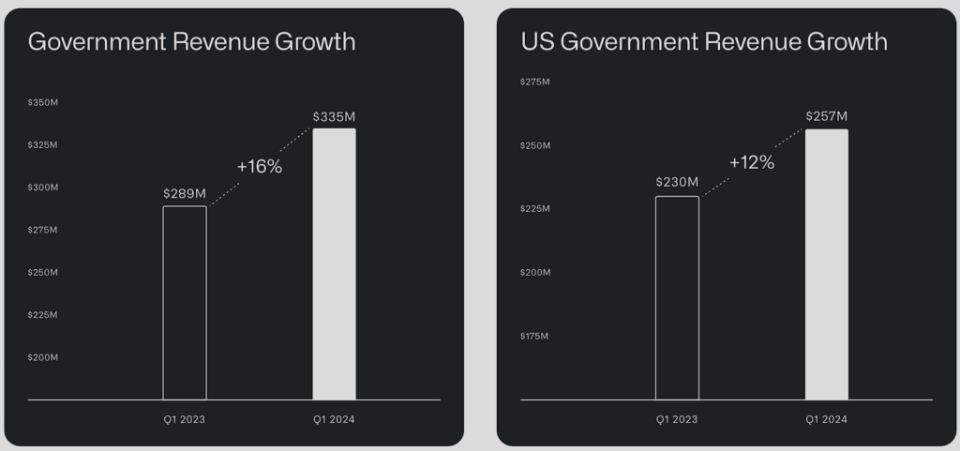

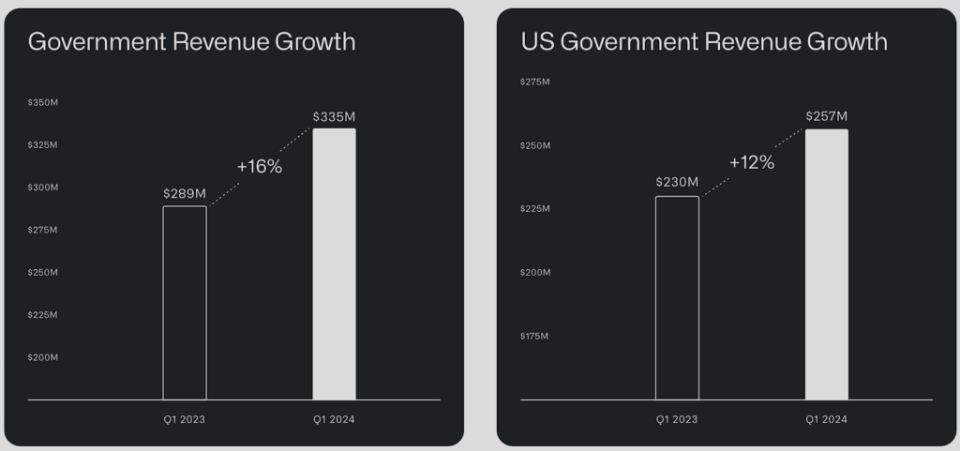

Authorities Income Fueled by Home Acceleration, Worldwide Enlargement

Beginning with Palantir’s Authorities phase, which accounted for about 53% of its Q1 income combine, complete income development on this phase was 16%, at $335 million. This development was primarily pushed by accelerating revenues within the home division and speedy worldwide growth.

Domestically, income development accelerated in Q1 within the U.S. Authorities enterprise, rising by 12% year-over-year and eight% quarter-over-quarter to $257 million. This compares in opposition to a 3% quarter-over-quarter enhance in This autumn, with Palantir’s software program turning into more and more important for the U.S. Authorities in at this time’s unstable geopolitical surroundings. Palantir’s Worldwide Authorities division additional compounded the phase’s development, with its revenues rising by 33% to $79 million.

An necessary milestone in Q1 was that the U.S. Military granted Palantir an unique prime contract price over $178.4 million to develop a next-generation focusing on node as a part of the TITAN program. This marks a historic second for Palantir, because it turned the primary software program firm ever to win a chief contract for a {hardware} system. This successfully positions Palantir to ascertain itself as a chief vendor akin to giants like Lockheed Martin (NYSE:LMT) or Northrop Grumman (NYSE:NOC) within the area of weapons and aerospace merchandise.

Business Income Surges Following Speedy Consumer Base Enlargement

Transitioning to Palantir’s Business phase, revenues skilled one other notable surge, pushed by the rising uptake of its synthetic intelligence platform (AIP) and the stable growth of the corporate’s clientele.

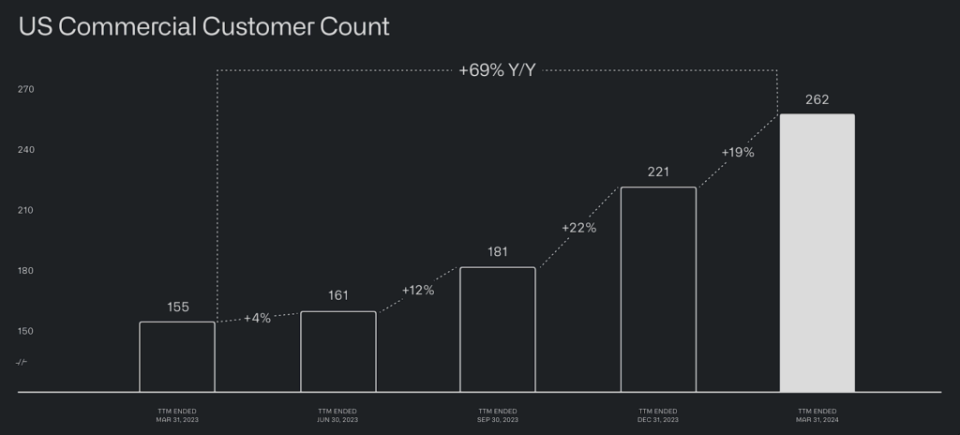

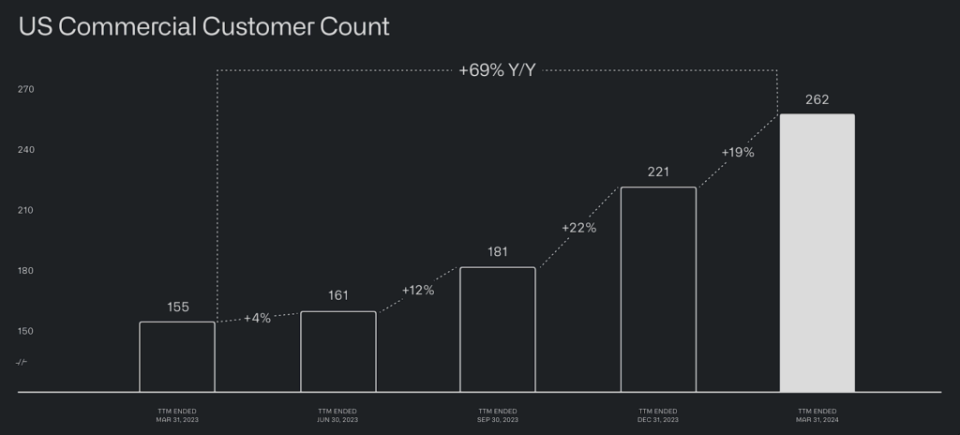

In a previous replace on Palantir, I emphasised the pivotal function of Bootcamps in bolstering Palantir’s company buyer base. Palantir organizes these hands-on workshops to showcase the capabilities of its software program, notably its AIP. Profitable demonstrations ought to enable potential shoppers to appreciate the worth proposition Palantir presents and probably decide to a contract.

This technique appears to be working extraordinarily properly for the corporate. In Q1, Palantir added 41 internet new clients in its U.S. Business phase (see the picture under). This marked a 69% enhance in Palantir’s buyer depend year-over-year and 19% quarter-over-quarter. Palantir additionally recorded a major acceleration right here, in comparison with the 8% quarter-over-quarter development of final 12 months’s Q1.

Quickly Enhancing Profitability, However Valuation Issues Stay

Palantir’s robust income development has progressively allowed the corporate to document bettering unit economics, thus bettering its profitability metrics. The corporate’s adjusted working margin landed at 36%, up from 34% within the earlier quarter and 24% final 12 months, marking the sixth consecutive quarter of growth. It led to an adjusted working earnings of $226.5 million, up 81% in comparison with final 12 months. Additional, Palantir’s adjusted free money stream got here in at $149 million, additionally reaching a noteworthy margin of 23%.

With extra money flowing into Palantir’s steadiness sheet, the corporate ended the quarter with a document money place of $3.87 billion, all whereas sustaining a debt-free standing. Nonetheless, traders ought to nonetheless take into consideration the underlying dangers concerned in Palantir’s present valuation, regardless of how spectacular its profitability metrics and sturdy monetary standing are.

On the finish of the day, Palantir continues to be buying and selling at roughly 65 occasions this 12 months’s anticipated earnings per share (EPS) and 54 occasions subsequent 12 months’s anticipated EPS. Its income development acceleration and ongoing margin growth might enable the corporate to develop into these multiples sooner quite than later. Nonetheless, Palantir’s funding case presents a notably decrease margin of security in comparison with final 12 months’s ranges, even after the post-earnings dip—and that is coming from a shareholder with excessive hopes.

Is PLTR Inventory a Purchase, In keeping with Analysts?

The current sentiment on Wall Road appears bearish, even after Palantir’s post-earnings share value decline. In keeping with Wall Road, Palantir Applied sciences encompasses a Reasonable Promote consensus score based mostly on two Buys, 5 Holds, and 6 Sells previously three months. At $19.67, the common PLTR inventory value goal suggests 4.5% draw back potential.

When you’re questioning which analyst it is best to comply with if you wish to purchase and promote PLTR inventory, essentially the most worthwhile analyst overlaying the inventory (on a one-year timeframe) is Mariana Perez from Financial institution of America (NYSE:BAC) Securities, with a mean return of 61.42% per score and a 92% success charge. Click on on the picture under to be taught extra.

The Takeaway

To sum up, Palantir’s Q1 report displays an ongoing acceleration in income development, evident in each its Authorities and Business segments. With Governments relying more and more on Palantir’s software program throughout an unstable geopolitical surroundings and company shoppers progressively realizing the capabilities of AIP, Palantir’s long-term prospects seem extra promising than ever.

Nevertheless, the persistent concern over the inventory’s valuation can’t be neglected. Whereas Palantir reveals promise for long-term traders, and I’m one in every of them, a impartial stance on the inventory appears affordable, given its elevated valuation multiples. Accordingly, I wouldn’t purchase the inventory on this dip if I have been seeking to provoke a place in Palantir. I’d quite look forward to a probably extra enticing entry level.

Disclosure